Trump and Starmer have struck a landmark trade deal that dramatically cuts tariffs on U.K. cars, steel, and more-paving the way for a booming surge in transatlantic trade and stronger economic ties between the U.S. and the United Kingdom

Browsing: tariffs

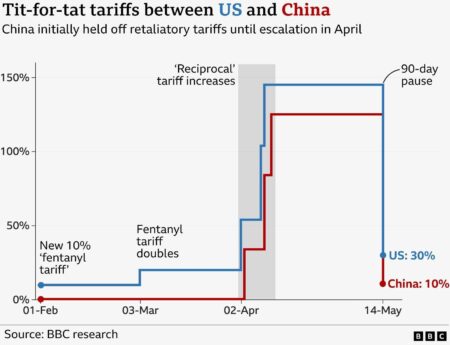

In the ongoing U.S.-China trade talks, Beijing masterfully balances boldness with diplomacy, aiming to secure favorable terms while carefully managing tensions. This strategic approach highlights China’s commitment to maintaining the delicate economic partnership without sparking disruption

In a recent WSJ opinion piece, experts argue that former President Trump’s trade strategy with China is riddled with confusion and inconsistency. Critics caution that such unpredictable policies risk undermining the U.S. economy and diminishing its influence worldwide

China has announced it will eliminate tariffs on almost all goods from Africa, strengthening trade ties as both parties push back against US policies. This bold step seeks to ignite economic cooperation in the face of escalating global tensions

A U.S. trade negotiator has unveiled exciting progress on a deal aimed at shielding Japan from increased car tariffs, seeking to ease tensions and supercharge automotive trade between the two nations, sources told Automotive News

Japanese Finance Minister Akira Amari has hinted at a potential breakthrough with the US that could shield Japan from higher car tariffs, Bloomberg reports. This promising development could ease trade tensions and provide a significant boost to the auto industry. Negotiations are ongoing

Trump’s latest trade deal with China throws a spotlight on a persistent U.S. challenge: limited leverage in negotiations. Despite new agreements, experts caution that the fundamental structural issues in the trade relationship remain stubbornly unresolved

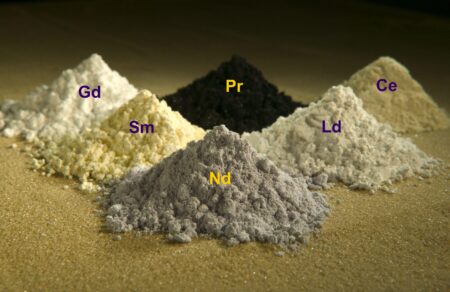

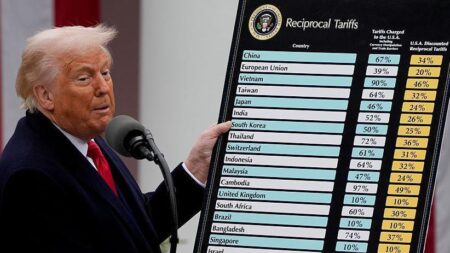

Former President Trump spotlighted America’s heavy reliance on China for rare earth minerals and announced plans to skyrocket tariffs on Chinese goods to 55%, intensifying the trade battle, according to AP News

Former President Donald Trump enthusiastically hailed a breakthrough “deal” with China, highlighting major progress on tariffs and promising ongoing talks. Yet, skeptics remain doubtful about the real impact and long-term value of the agreement

Former President Trump unveiled a bold new strategy: securing magnets and rare earth minerals from China while simultaneously slapping tariffs on Chinese goods at a staggering 55%. This move signals a daring and complex shift in the US trade policy and supply chain approach

US-China trade talks reignited on Monday, sparking fresh hopes for easing the ongoing tensions. After the first day, both sides expressed cautious optimism, even as significant disagreements over tariffs and technology transfers continue to cast a shadow

China’s exports to the US have plunged dramatically just before critical trade talks, spotlighting rising tensions and uncertainty in this crucial economic relationship. This steep drop exposes growing challenges within the world’s largest trade partnership

Former President Donald Trump described Chinese President Xi Jinping as “hard to make a deal with,” highlighting the ongoing challenges in U.S.-China trade negotiations, Al Jazeera reports

The UK has just scored a major victory, narrowly escaping Donald Trump’s proposed 50% tariffs on imported metals. This much-needed relief gives British industries a vital breathing space, securing steady steel and aluminum supplies despite escalating trade tensions

President Trump intensifies his drive for fresh trade agreements amid rising concerns that tariffs could disrupt the global economy. Stay with Yahoo Finance for the latest updates on unfolding negotiations and market reactions

TACO trade” is a memorable Trump-era term for tariffs aimed at turbocharging American manufacturing and protecting domestic jobs. This bold trade strategy sparked spirited debates about its impact on the economy and global relations throughout his administration

The Trump administration has chosen to postpone the implementation of a 25% tariff on Chinese-made graphics cards. This strategic decision aims to ease supply chain pressures amid soaring demand for semiconductor components

Former President Donald Trump has accused China of breaking their trade agreement and announced a bold plan to double tariffs on steel and aluminum imports, intensifying the trade war between these two economic powerhouses

Former President Donald Trump claims that China has “totally violated” the tariff pause agreement, accusing Beijing of breaking its trade commitments. This bold accusation intensifies the already heated US-China trade negotiations, Axios reports

Japan calls President Trump’s tariffs a “national crisis,” highlighting their devastating impact on its export-driven economy. These measures put critical industries at risk, intensifying tensions in U.S.-Japan trade relations during crucial negotiations