Australia has voiced strong opposition after former President Trump proposed tariffs on Australian goods. Officials caution that these measures could seriously damage the trusted trade relationship between the two countries

Browsing: tariffs

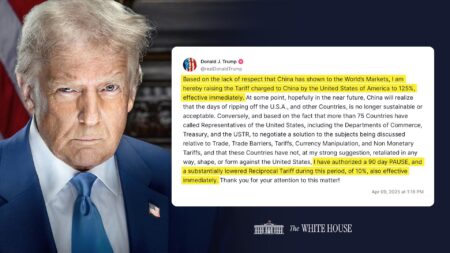

Former President Trump slammed China for “totally violating” the US-China tariff agreement, reigniting tensions between the two economic giants, according to a report by Yahoo. Trade relations continue to face challenges amid ongoing disputes

The appeals court has upheld crucial Trump-era tariffs on China, sending ripples through Apple and global markets alike. This ruling brought a wave of relief to investors, propelling the S&P 500 higher as trade tensions begin to ease

In a bold move to safeguard its domestic steel industry, Brazil has reintroduced tariffs and quotas on steel products. This strategic decision comes in response to the ever-changing global market landscape, aiming to empower local manufacturers. As trade tensions simmer and challenges persist within the sector, Brazil is taking decisive steps to ensure its steel industry remains resilient and competitive.

Spain’s hatmakers are navigating turbulent waters as Trump-era tariffs cast a shadow over their trade with the U.S. This situation is especially challenging for Orthodox Jewish consumers who cherish traditional styles. The rising costs could jeopardize a cherished cultural bond, leaving both artisans and enthusiasts in a precarious position.

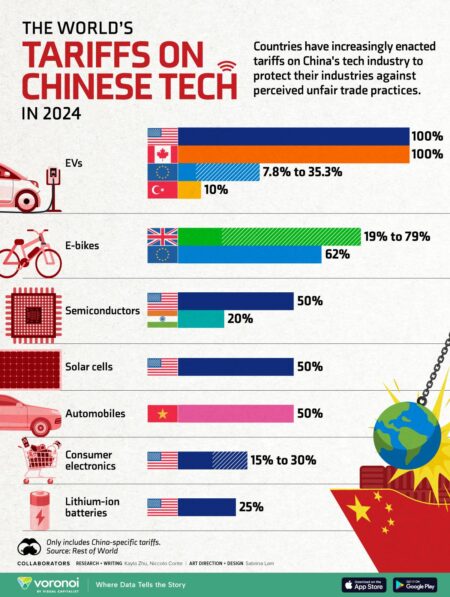

As tariffs transform the global marketplace, Chinese consumers are embracing domestic brands over international giants like Apple. This exciting shift underscores a powerful trend in China, fueled by a spirit of nationalism and a surge in innovation that champions homegrown products

In a dramatic turn of events, former President Trump has intensified his threats against tech titans such as Apple and Samsung, along with the European Union. This bold maneuver marks a significant escalation in the ongoing trade war, raising concerns about its potential ripple effects on global markets

In a pivotal gathering in Canada, G7 finance leaders came together to tackle the pressing issue of non-tariff barriers, seeking a cohesive strategy amidst escalating global trade tensions. Yet, the path forward may be fraught with challenges, as U.S. officials are likely to prioritize their own domestic interests, potentially complicating these crucial discussions.

A federal judge has delivered a pivotal ruling, affirming that former President Donald Trump was well within his legal rights to impose tariffs on Chinese goods. This decision not only represents a major win for the White House but also has the potential to shape the ongoing discussions surrounding trade policies.

In a bold move driven by soaring tariffs and mounting financial challenges, a cherished rubber duck museum is making its way to Canada! This exciting relocation not only seeks to ensure the museum’s sustainability in the face of increasing operational costs in the U.S., but also sheds light on how trade policies are shaping the future of small businesses everywhere.

Beijing is basking in the glow of a strategic triumph with the recent truce on U.S. tariffs, signaling a hopeful thaw in trade tensions. As both nations take a moment to reevaluate their economic strategies, China is poised to bolster its standing in global markets while nurturing robust domestic growth.

BYD’s bold vision for expansion in Brazil is hitting some serious roadblocks, as local car manufacturers rally for higher tariffs on imported electric vehicles. These rising trade tensions could put a damper on BYD’s growth ambitions in the fiercely competitive Brazilian market.

Japan is ramping up its efforts to persuade the United States to lift tariffs, highlighting growing worries about trade barriers that impact their relationship. This push comes during crucial negotiations, as Japan aims to boost economic collaboration and forge even stronger connections.

Even with tariffs slashed from a staggering 145%, small businesses caught in the whirlwind of US-China trade tensions are still grappling with formidable challenges. Experts caution that the persistent uncertainty and rising costs are putting immense pressure on their operations and pricing strategies.

Former President Trump’s recent tariff truce with China has sparked a wave of concern regarding the United States’ credibility in trade negotiations. Critics warn that by easing pressure on Beijing, the U.S. may be jeopardizing its commitment to fair trade practices and its role as a leader in the global economy.

Even with tools proudly stamped “Made in USA,” they aren’t shielded from the effects of tariffs. The surge in material costs and ongoing supply chain hiccups can still drive prices up. However, savvy consumers can navigate this tricky landscape by hunting for local alternatives and taking advantage of discounts, ensuring they get the best bang for their buck!

The European Union has updated its growth forecasts for Italy for 2025 and 2026, highlighting worries about falling productivity and the effects of tariffs. This revision sheds light on the persistent economic hurdles the nation is grappling with as global trade dynamics continue to shift.

North Dakota farmers are witnessing a dynamic transformation in the soybean market, fueled by changing demand and innovative production trends. However, the shadow of looming tariffs and China’s import policies casts a cloud of uncertainty, affecting both profitability and future planting choices.

China has taken a bold step by imposing tariffs on plastic imports from the US, EU, Taiwan, and Japan, citing concerns over dumping practices. This move signals a dramatic escalation in trade tensions as Beijing seeks to safeguard its domestic industry amidst the backdrop of ongoing global trade disputes

France has revealed that talks with China regarding a long-standing cognac dispute have hit a roadblock, marking a significant setback in the quest to ease trade tensions. This impasse raises alarm bells for the French spirits industry and could impact exports, leaving many wondering what the future holds for this iconic beverage.