Brazil is gearing up to revolutionize out-of-court tax settlements in 2026, speeding up dispute resolutions and tackling the growing court backlogs head-on. This ambitious move is set to transform tax collection and ignite a new wave of investor confidence across the nation

Browsing: taxation

Latam Insights: Venezuelan ties emerge in Trump’s ‘Gasolina’ case, as Brazil faces intense debates over stablecoin taxation-showcasing the vibrant and ever-changing regulatory landscape across Latin America

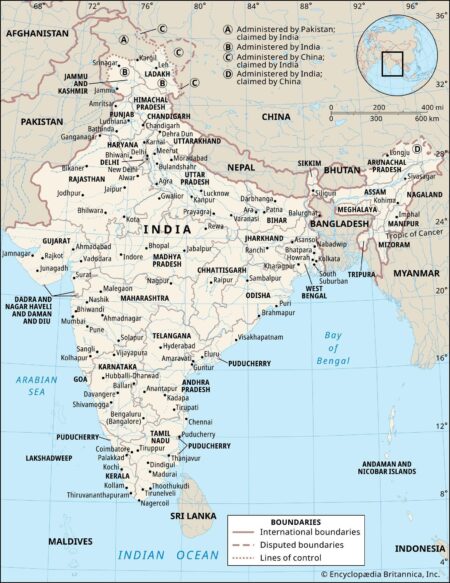

India surged ahead with an impressive 7.4% GDP growth, yet tax revenues are lagging behind expectations. Experts warn that this shortfall could limit public spending and put fiscal stability at risk amid mounting economic pressures. Bloomberg.com reports

Brazil’s tax revenue for November skyrocketed 3.75% year-on-year, reaching an unprecedented all-time high fueled by strong economic momentum and improved tax collection efforts, according to TradingView data. This impressive surge points to a bright and promising fiscal future ahead

The UK government is gearing up to dramatically cut the tax-free savings allowance in the upcoming November budget, Reuters reports, citing The Telegraph. This bold strategy aims to increase revenue amid mounting economic challenges

UK Finance Minister unveils bold plans for tax reform designed to ignite growth in small businesses, Reuters reports. These proposed changes aim to lighten financial pressures and fuel a new wave of economic expansion throughout the sector

Angela Rayner, the UK’s Deputy Prime Minister, has admitted to underpaying tax, igniting new questions about her financial conduct. This revelation comes amid growing scrutiny of government officials’ tax affairs

Italy is considering a bold new tax on banks to strengthen its budget, Bloomberg reports. This strategic move aims to boost government revenues amid economic challenges and rising fiscal pressures

Spain has introduced wealth taxes targeting the ultra-rich – and, surprisingly, it hasn’t sparked a mass billionaire exodus. Thanks to thoughtful policy design and well-balanced rates, the country has not only retained its wealthy residents but also seen a significant boost in public revenue

India is gearing up for major cuts to consumption taxes by October, aiming to ignite economic growth, Reuters reports. This bold step is designed to spark consumer spending and drive recovery in the face of global uncertainties

Prime Minister Albanese is striking a calm and confident tone as the upcoming economic summit approaches, focusing on steady progress rather than drastic tax overhauls. His careful strategy underscores the government’s dedication to maintaining economic stability through thoughtful, gradual policy advancements

Trump’s new tax law introduces significant changes set to reshape both personal and business finances. With updated tax brackets and deductions, these key provisions take effect next tax year, revolutionizing how Americans approach their taxes

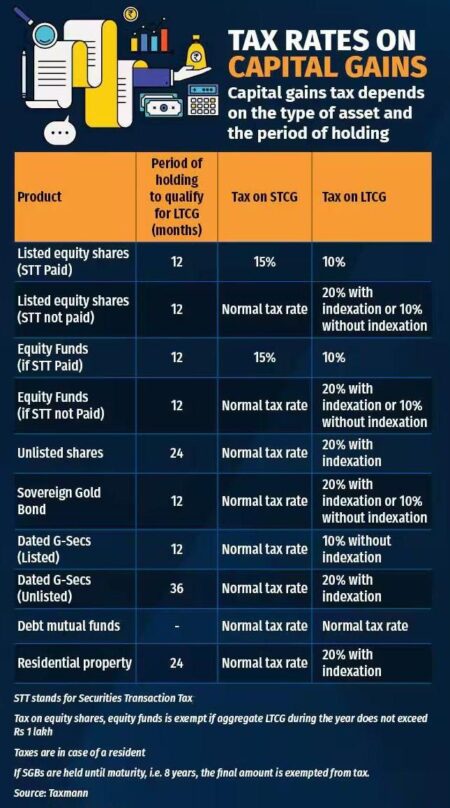

The latest UK tax update unveils crucial changes to Capital Gains Tax rules that everyone should know. These significant revisions transform reporting requirements and reliefs, impacting both individuals and businesses alike. Stay informed with Mondaq’s expert, in-depth analysis!

The tax and spending bill proposed by former President Trump is set to take effect in early 2025, pending Congressional approval. This bold legislation aims to reshape fiscal policy dramatically, just in time for the crucial midterm elections

Spain and Brazil have joined forces to urge the UN to implement global taxes on the super-rich, aiming to tackle skyrocketing inequality and unlock vital funding for sustainable development projects worldwide, officials announced at a recent UN summit

One of the UK’s richest billionaires has made a striking move from London to the UAE, fueled by soaring taxes, economic uncertainty, and growing regulatory challenges. This bold relocation highlights the rising concerns among wealthy investors about the future landscape of Britain’s business climate

Brazil’s President Lula has boldly taken Congress to the Supreme Court amid a fierce tax revolt, directly challenging lawmakers who resist his ambitious fiscal reforms. This dramatic showdown underscores the escalating battle between the executive and legislative branches

Treasury warns that taxing actual instead of unrealised superannuation gains could burden millions of Australians with steep costs, sparking a fierce debate over the fairness and financial consequences of the proposed tax reforms

Spain is rolling out a bold new tax policy that could significantly impact British buyers looking to purchase holiday homes. With plans to impose a staggering 100% tax on foreign-owned properties, the government is stirring up quite a buzz and raising eyebrows among potential investors. Will this move deter dreamers from owning a slice of Spanish paradise?

In a bold move, Brazil has scrapped its contentious offshore tax on investment funds after facing intense pushback from investors. This pivotal decision is set to rejuvenate confidence in the financial sector and draw in foreign capital, signaling a transformative shift in the government’s fiscal strategy.