Trump’s new tax law introduces significant changes set to reshape both personal and business finances. With updated tax brackets and deductions, these key provisions take effect next tax year, revolutionizing how Americans approach their taxes

Browsing: taxation

The latest UK tax update unveils crucial changes to Capital Gains Tax rules that everyone should know. These significant revisions transform reporting requirements and reliefs, impacting both individuals and businesses alike. Stay informed with Mondaq’s expert, in-depth analysis!

The tax and spending bill proposed by former President Trump is set to take effect in early 2025, pending Congressional approval. This bold legislation aims to reshape fiscal policy dramatically, just in time for the crucial midterm elections

Spain and Brazil have joined forces to urge the UN to implement global taxes on the super-rich, aiming to tackle skyrocketing inequality and unlock vital funding for sustainable development projects worldwide, officials announced at a recent UN summit

One of the UK’s richest billionaires has made a striking move from London to the UAE, fueled by soaring taxes, economic uncertainty, and growing regulatory challenges. This bold relocation highlights the rising concerns among wealthy investors about the future landscape of Britain’s business climate

Brazil’s President Lula has boldly taken Congress to the Supreme Court amid a fierce tax revolt, directly challenging lawmakers who resist his ambitious fiscal reforms. This dramatic showdown underscores the escalating battle between the executive and legislative branches

Treasury warns that taxing actual instead of unrealised superannuation gains could burden millions of Australians with steep costs, sparking a fierce debate over the fairness and financial consequences of the proposed tax reforms

Spain is rolling out a bold new tax policy that could significantly impact British buyers looking to purchase holiday homes. With plans to impose a staggering 100% tax on foreign-owned properties, the government is stirring up quite a buzz and raising eyebrows among potential investors. Will this move deter dreamers from owning a slice of Spanish paradise?

In a bold move, Brazil has scrapped its contentious offshore tax on investment funds after facing intense pushback from investors. This pivotal decision is set to rejuvenate confidence in the financial sector and draw in foreign capital, signaling a transformative shift in the government’s fiscal strategy.

An exciting new ruling from an Australian court has paved the way for a staggering $640 million in potential Bitcoin tax refunds! This landmark decision signals a major transformation in how cryptocurrencies are taxed, sparking intriguing discussions about future regulations and what this means for investors moving forward.

Germany has made a significant revision to its tax revenue forecasts, dramatically cutting estimates for 2029 by more than 80 billion euros. This substantial downward adjustment highlights the persistent economic challenges the country faces, including escalating costs and uncertainty in global markets, which are all taking a toll on fiscal planning

Samsung is challenging a hefty $520 million tax demand from Indian authorities, asserting that its business practices are in line with those of its competitor, Reliance Industries. This case underscores the escalating tensions between multinational corporations and India’s tax regulations.

In a bold move, a recent proposal in France aims to scrap the 10% tax allowance for retirees, a change that could significantly affect the financial well-being of countless seniors. Supporters of the measure argue that it promotes fairness within the tax system, but critics warn it could add further strain on retirees who are already grappling with escalating living expenses.

Brazil has taken a significant step by raising its income tax exemption threshold, now in sync with the recent hike in the minimum wage. This strategic move is designed to ease the financial burden on lower-income households, showcasing the government’s commitment to enhancing economic support for its citizens.

In a recent meeting with Spain’s economy minister, the U.S. passionately urged Spain to ramp up its defense spending and take a fresh look at the contentious ‘Google tax’. This appeal highlights the pressing issues surrounding global security and the evolving landscape of digital economy policies

In a significant escalation of trade tensions, China has announced retaliatory tariffs on U.S. goods, raising duties to 125%. This move comes amid a declining dollar, signaling increased economic friction between the two nations. Continue following for live updates.

Germany has officially formed a new government, unveiling plans to reduce corporate taxes as part of its economic strategy. The move aims to boost investment and competitiveness amid global economic challenges, signaling a shift in fiscal policy.

France has identified digital services as a key target in the EU’s tariff response to U.S. trade policies. This move reflects rising tensions over tax structures and digital market regulations, signaling a strategic shift in Europe’s trade negotiations.

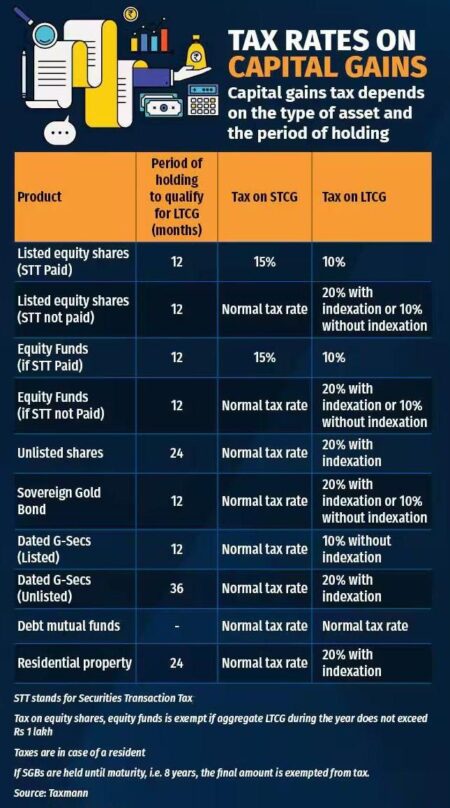

Canada has officially canceled its proposed increase in the capital gains tax, a decision met with mixed reactions. Critics argued it could stifle investment, while supporters claimed it was necessary for equitable taxation. The government aims to focus on economic stability.

Germany has reached a landmark agreement on a fiscal package that includes significant changes to its debt brake policy. This reform aims to enhance budget flexibility while ensuring fiscal stability, addressing both economic challenges and future investments.