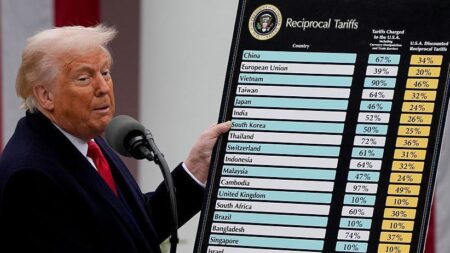

Former President Trump has unleashed a powerful 50% tariff on Indian goods, hitting back at India’s continued purchase of Russian oil despite worldwide sanctions. This daring move escalates the trade battle between the two nations to a whole new level

Browsing: trade policy

The steel union warns that removing counter-tariffs at this moment would be a risky gamble, especially amid rising fears that President Trump is weakening CUSMA. They stress that these protective measures are crucial to safeguarding the North American steel industry

Brazil eagerly looked to the U.S. for support in developing rare earth mining to meet soaring demand for these vital materials. However, escalating tariff tensions have cast a shadow over this partnership, slowing progress in strengthening supply chains essential for cutting-edge technologies

The US has officially informed India that new tariffs, originating from former President Trump’s trade penalties, will take effect starting tomorrow. This move directly impacts key Indian exports and intensifies the already heated trade tensions between the two countries

Canadian banks have posted impressive earnings, deftly sidestepping the toughest blows from tariff challenges, Reuters reports. Strong consumer spending and well-diversified portfolios were crucial in cushioning the impact

India will continue to secure oil from the most competitive suppliers, stressed the Indian envoy, who strongly criticized US tariffs as “unfair” and “unjustified.” This powerful declaration underscores India’s steadfast determination to meet its energy demands despite escalating global tensions

Canada has announced it will lift most retaliatory tariffs on U.S. goods, marking a significant breakthrough in easing trade tensions between the two neighbors. This move follows encouraging progress in bilateral talks aimed at resolving ongoing disputes, Al Jazeera reports

Former U.S. President Donald Trump has delivered a bold warning of “massive sanctions or tariffs” targeting Russia within the next two weeks, signaling a tough and unwavering stance amid rising tensions, Anadolu Ajansı reports. The specific details of these possible actions remain under wraps for now

Major Japanese automakers are committed to maintaining stable vehicle prices in the U.S., boldly defying tariffs to stay competitive and keep cars affordable for consumers, CNBC reports

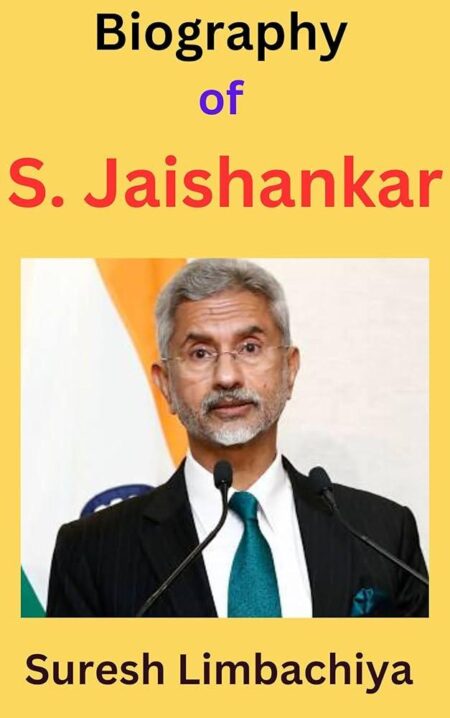

External Affairs Minister S. Jaishankar vehemently condemned the U.S. tariffs, affirming that India remains resolute in safeguarding its farmers’ rights. He emphasized the nation’s steadfast dedication to protecting the agricultural sector amid rising trade tensions

Trump’s tariff war sent shockwaves through global trade, compelling India and China to reconsider their age-old rivalry. Recent diplomatic talks show these two Asian giants are now seeking new ways to deepen cooperation and join forces against growing economic challenges

Several advocacy groups are urging the U.S. Trade Representative (USTR) to take bold and immediate action against Brazil’s concerning trade practices. They warn that these unfair tactics are seriously harming American industries and insist on a swift, strong response

U.S.-UK trade relations are heating up as both nations eagerly explore fresh opportunities in the post-Brexit landscape. Congress.gov offers an inside look at the intense negotiations, tariff battles, and regulatory challenges driving the evolution of this crucial alliance

Trump-era tariffs on Chinese goods have ignited a remarkable surge in trade between China and the Global South, reshaping the global economic landscape like never before. Experts emphasize that this shift is challenging the long-standing dominance of Western-led trade dynamics

India is facing mounting challenges as US tariffs, imposed during the Trump administration, continue to hinder its exports. Although talks for relief are underway, progress has been sluggish, leaving key industries under intense strain

A global powerhouse that once boldly challenged Trump’s tariff policies is now deepening its ties with China, igniting curiosity about shifting alliances and evolving trade strategies in the face of escalating global economic tensions

India and the US have yet to finalize a tariff agreement, prolonging trade tensions that affect key industries on both sides. This ongoing standoff underscores the intricate challenges in their bilateral relationship and threatens to unsettle global economic stability

The White House has unveiled bold new plans to adjust reciprocal tariff rates, aiming to find the perfect balance between economic interests as trade talks with the People’s Republic of China move forward-paving the way for stronger bilateral cooperation

President Trump has just extended the tariff truce with China by another three months, hitting the pause button on new levies as trade talks gain momentum. This strategic move aims to ease tensions and open the door for meaningful progress between these two economic powerhouses

Former President Trump’s Nvidia deal has intensified U.S.-China tech tensions, with China fiercely condemning the agreement and signaling potential disruptions to semiconductor trade and global supply chains