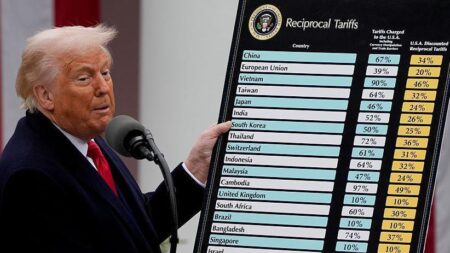

Former President Trump is turning up the heat on trade by threatening an additional 10% tariff on BRICS nations, labeling them as “anti-American,” Fox Business reports. This daring move escalates the already fierce trade battles amid ongoing geopolitical turmoil

Browsing: trade war

Japan navigates economic uncertainty as US tariffs climb under Trump, expertly balancing the looming threat of recession with savvy trade strategies. The government is resolute in protecting exports while avoiding a deeper market crisis

President Trump’s bold threat to slap a staggering 35% tariff on Japanese imports has sent shockwaves through Tokyo, igniting fears of economic upheaval and escalating trade tensions between the U.S. and Japan, sources reveal

Former President Donald Trump has announced he is “terminating” all trade talks with Canada, escalating tensions between the two neighboring countries, Politico reports. This striking decision signals a dramatic shift in U.S.-Canada trade relations

Canada has fired back boldly at Trump’s tariff ultimatum, imposing a steep hike on US goods. This striking move threatens key American industries, escalating the high-stakes trade battle between the two neighbors

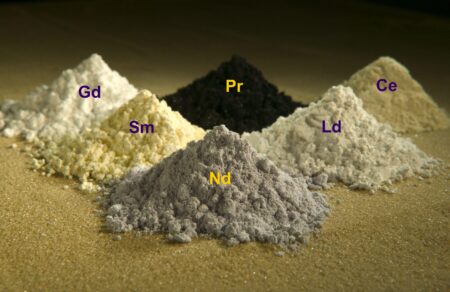

Former President Trump spotlighted America’s heavy reliance on China for rare earth minerals and announced plans to skyrocket tariffs on Chinese goods to 55%, intensifying the trade battle, according to AP News

China has uncovered a critical vulnerability in global trade networks and plans to leverage this insight to expand its strategic influence, signaling potential major shifts in the future of international commerce, Bloomberg reports

Former President Trump unveiled a bold new strategy: securing magnets and rare earth minerals from China while simultaneously slapping tariffs on Chinese goods at a staggering 55%. This move signals a daring and complex shift in the US trade policy and supply chain approach

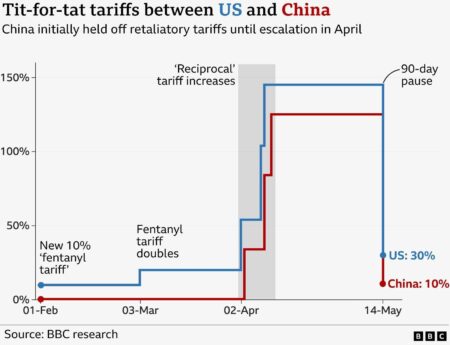

US-China trade talks reignited on Monday, sparking fresh hopes for easing the ongoing tensions. After the first day, both sides expressed cautious optimism, even as significant disagreements over tariffs and technology transfers continue to cast a shadow

Former President Donald Trump’s escalating hostility toward China is raising urgent alarm among experts. Analysts warn that his aggressive approach could destabilize global order and ignite significant economic and geopolitical turmoil

China’s factory activity stumbled in May, weighed down by rising US tariffs. This downturn underscores growing hurdles for the manufacturing sector amid ongoing trade tensions, Reuters reports

President Trump intensifies his drive for fresh trade agreements amid rising concerns that tariffs could disrupt the global economy. Stay with Yahoo Finance for the latest updates on unfolding negotiations and market reactions

TACO trade” is a memorable Trump-era term for tariffs aimed at turbocharging American manufacturing and protecting domestic jobs. This bold trade strategy sparked spirited debates about its impact on the economy and global relations throughout his administration

The Trump administration has chosen to postpone the implementation of a 25% tariff on Chinese-made graphics cards. This strategic decision aims to ease supply chain pressures amid soaring demand for semiconductor components

Former President Donald Trump has accused China of breaking their trade agreement and announced a bold plan to double tariffs on steel and aluminum imports, intensifying the trade war between these two economic powerhouses

Former President Donald Trump claims that China has “totally violated” the tariff pause agreement, accusing Beijing of breaking its trade commitments. This bold accusation intensifies the already heated US-China trade negotiations, Axios reports

Japan calls President Trump’s tariffs a “national crisis,” highlighting their devastating impact on its export-driven economy. These measures put critical industries at risk, intensifying tensions in U.S.-Japan trade relations during crucial negotiations

Australia has voiced strong opposition after former President Trump proposed tariffs on Australian goods. Officials caution that these measures could seriously damage the trusted trade relationship between the two countries

Germany has firmly rejected a proposed ceasefire, overturned a recent tariff ruling, and launched efforts to repatriate its gold reserves. These decisive moves highlight a dramatic shift in the country’s economic and geopolitical priorities

In a dramatic turn of events, former President Trump has intensified his threats against tech titans such as Apple and Samsung, along with the European Union. This bold maneuver marks a significant escalation in the ongoing trade war, raising concerns about its potential ripple effects on global markets