Japan’s Nikkei 225 surged to an all-time peak on Tuesday, powered by stellar corporate earnings and promising economic indicators. Throughout Asia, the majority of stock markets rallied, buoyed by growing investor confidence sweeping across the region

Browsing: trading

Australia’s stable government and robust economy create a gateway to thrilling investment opportunities. Barchart.com highlights a standout trade flourishing in this dynamic market, offering promising potential gains within Australia’s vibrant financial scene

The Nikkei 225 surged an impressive 3% following Japan’s announcement of a snap election, driven by a softer yen against major currencies. Investors are eagerly embracing market-friendly policies, igniting fresh optimism and momentum in the equity markets, IG.com reports

Brazil’s stock market took a hit on Thursday, as the Bovespa index slipped 0.99%. Investor nerves ran high ahead of key economic data releases, while mixed signals from global markets added to the uncertainty, cooling market excitement

On January 6, Italy faces a pivotal moment as key economic data and political developments are poised to influence market sentiment. Watch closely for inflation figures and government stability-these elements could dramatically impact the euro and Italian stock markets

Germany’s stock market soared, with the DAX jumping 0.57% driven by a wave of investor optimism. Strong performances in the automotive and technology sectors ignited this rally, boosting confidence throughout the entire market

Japan’s Nikkei soared to a robust close, driven by impressive gains in tech stocks that mirrored Wall Street’s optimistic momentum. Investor confidence is climbing as global markets rally, lifted by easing concerns across the globe

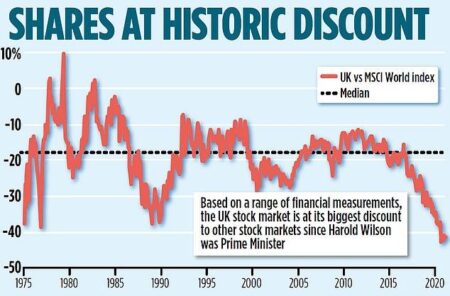

U.K. stocks ended the day on a strong note, with the Investing.com United Kingdom 100 index rising 0.11%. Investor enthusiasm soared ahead of key economic data releases, driving steady gains throughout the session. The market closed with a sense of confidence and momentum

Traders are eagerly searching for the next Argentina as global markets pivot, with former President Trump’s influence continuing to shape investment strategies. Driven by a surge in risk appetite and shifting political landscapes, investors are making daring bets on emerging economies

Australia’s DroneShield shares plunged to a 5-1/2-month low, swept up in relentless selling pressure as investor concerns continue to mount. This sharp decline highlights the challenging market climate the company is navigating, despite its bold strides in cutting-edge drone defense technology

UK investors are buzzing with excitement this November 2025, diving into promising penny stocks as market volatility creates thrilling new opportunities. At the forefront are innovative tech startups and dynamic green energy companies, both shining with remarkable growth potential

Australia’s Neuren Pharma shares plunged to their lowest level in more than two months after the company dramatically cut its royalty forecast, sparking investor concerns over potential profit declines. Market watchers remain on edge as the stock faces renewed selling pressure

BREAKING: France’s industrial production soars past expectations, showcasing robust economic momentum. This positive surge boosts market confidence, driving EURUSD slightly upward amid growing investor optimism. – XTB.com

The Nikkei 225 skyrocketed past the 50,000 mark for the very first time, marking a historic breakthrough in Japan’s stock market. Investors erupted with excitement, driven by strong corporate earnings and a surge of economic optimism

Japan’s rubber futures plunged sharply, hammered by a soaring yen and sluggish demand. Traders highlight the currency’s rally and weak global consumption as key factors driving prices lower, reports Finimize

U.S. stocks slipped on Friday as investors turned cautious ahead of the Labor Day weekend, digesting a blend of economic signals. Despite the dip, major indexes closed the month with impressive gains, highlighting the market’s remarkable resilience

U.K. stocks edged up modestly, with the Investing.com United Kingdom 100 index rising 0.09%. Investors showed cautious optimism, carefully weighing a mix of mixed economic data alongside unfolding geopolitical developments

The United Kingdom shares dipped, with the Investing.com United Kingdom 100 index falling 0.61% by the close of Tuesday’s trading session, as investors stayed cautious amid persistent global market uncertainties

TotalEnergies has taken a bold step in South America, selling its 45% stake in Argentina oil blocks to YPF for $500 million. This move marks a significant strategic shift in the company’s regional operations, TradingView reports

Japan’s stocks are poised to slip as disappointing U.S. economic data reignites concerns over global growth. Investors remain cautious, bracing for potential ripple effects throughout Asian markets, Bloomberg reports