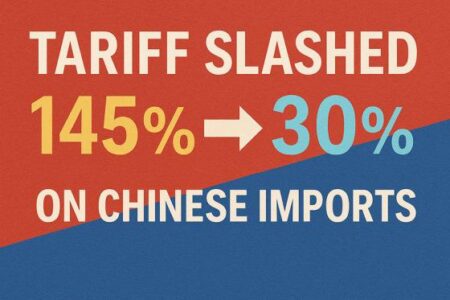

US and China signal easing tensions, igniting a powerful rally across global markets. Oil prices soar on upbeat demand forecasts, fueling investor excitement. Traders remain alert as shifting geopolitical dynamics reshape the economic landscape. Reuters reports

Browsing: US-China relations

Former President Donald Trump fiercely criticized China’s staggering 157% tariffs as “not sustainable,” just days ahead of his highly anticipated meeting with President Xi Jinping in South Korea. His remarks highlight the mounting trade tensions boiling over between these two global giants

Micron Technology is gearing up to exit its server memory chip business in China, insiders tell the South China Morning Post, in response to the latest wave of export restrictions. This move underscores the mounting tensions disrupting the global semiconductor landscape

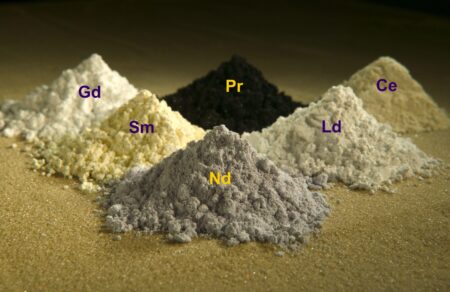

The US is urging its allies to fortify their rare earth supply chains, highlighting rising worries about China’s food security and the strategic threats it presents. This ambitious effort aims to reduce dependence on Beijing for these critical materials amid escalating global tensions

As U.S.-China tensions escalate, investors are rushing to reduce their exposure to Chinese assets. Many are offloading Chinese stocks, shifting their attention to domestic markets, and seeking fresh opportunities in new regions to steer through the mounting geopolitical challenges

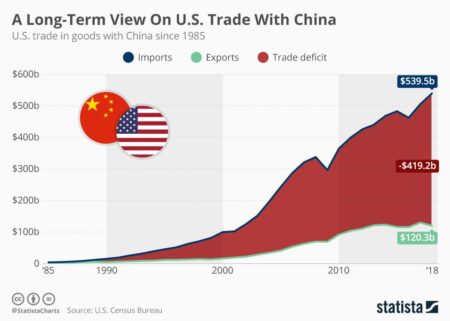

Former President Donald Trump boldly declared, “We’re in a trade war with China right now.” He emphasized the urgent need for strong, decisive measures to address trade imbalances and protect American industries

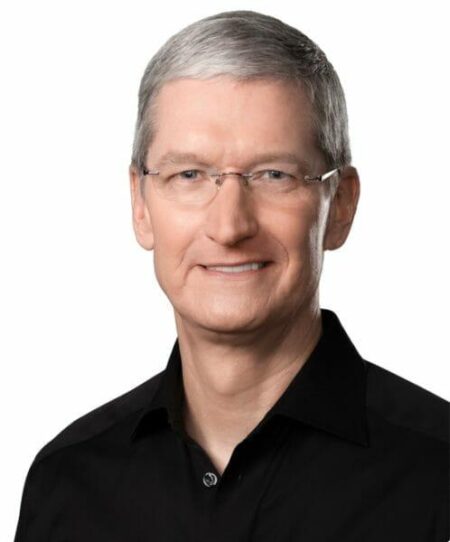

Apple CEO Tim Cook is doubling down on China, pledging even bigger investments despite ongoing tensions with the Trump administration. This bold move underscores Apple’s steadfast dedication to one of its most crucial markets amid the unpredictable landscape of U.S.-China trade relations

President Trump’s escalating trade war with China is sending powerful shockwaves through the global economy, disrupting supply chains and igniting market chaos worldwide. Nations across the globe are facing mounting uncertainty as tariffs ripple far beyond the U.S.-China relationship

Amid rising U.S. tariffs triggered by Trump’s trade war, Brazil’s Lula and India’s Modi are forging a stronger alliance, tapping into new markets and boosting collaboration to overcome economic hurdles and secure lasting growth

Chinese airlines have strongly opposed the US plan to ban their flights from using Russian airspace, citing major safety and operational concerns. Sources tell AP News that this move intensifies tensions amid ongoing geopolitical conflicts

Maryland soybean farmers are bearing the brunt of escalating trade tensions with China. Crushed by soaring tariffs, many are grappling with severe income losses, some even crying out, “You’re killing us,” as the trade war shows no signs of easing

U.S. Trade Representative Greer announced that tariffs on Chinese goods could be implemented sooner than anticipated, signaling escalating tensions in the intense trade showdown between the world’s two largest economies

Dow Jones futures soared as President Trump signaled an “eternity” stance before imposing a staggering 100% tariff on Chinese goods, igniting fierce trade tensions and sending shockwaves through the markets

Rare earth minerals, essential for advanced electronics and national defense, have become the focal point of Trump’s trade threats against China. As China controls the vast majority of their global supply, these minerals now serve as a critical leverage in the intensifying US-China showdown

Former President Trump has just unleashed a bold new 100% tariff on Chinese imports, escalating tensions and reigniting the fierce trade war with Beijing. This dramatic move sends shockwaves through the economy, raising serious concerns about potential fallout and threatening to disrupt global market stability

Former President Donald Trump has just unveiled a bold new strategy: a sweeping 100% tariff on Chinese goods, set to take effect next month. This aggressive move aims to intensify trade pressure amid escalating U.S.-China tensions, sending shockwaves through key industries and shaking up the flow of imports

President Trump has just unveiled a bold new strategy: beginning this November, every Chinese import will be hit with an extra 100% tariff. This striking escalation intensifies trade tensions and piles immense pressure on China amid crucial negotiations, sending shockwaves through global markets and businesses around the world

Former President Donald Trump has announced a daring move to impose a staggering 100% tariff on all Chinese imports, ramping up the trade battle between the U.S. and China, NBC News reports. This bold strategy aims to directly confront trade imbalances and protect American industries from overseas rivals

Markets plunged sharply after former President Trump announced a daring 100% tariff on Chinese goods, doubling the existing rates. This bold escalation has intensified trade tensions, rattling the global economy with far-reaching impact

Wall Street plunged sharply in its steepest slide since April, as former President Trump’s threat to impose new tariffs on China escalated trade tensions, sending shockwaves through the market and stoking fears of an impending economic slowdown