BASF Coatings is thrilled to unveil its brand-new, state-of-the-art manufacturing plant in Germany-a game-changer that boosts production capacity and drives innovation in automotive and industrial coatings. This advanced facility is engineered to maximize efficiency while leading the way in sustainable practices at every stage

Browsing: Yahoo Finance

E-STORAGE has landed a game-changing Battery Energy Storage System (BESS) supply deal for a groundbreaking energy storage project in Germany, poised to enhance grid stability and fast-track the adoption of renewable energy sources

AlphaTON’s Cyncado Therapeutics teams up with Australia’s ADDRI to launch a groundbreaking investigator-initiated mesothelioma trial of TT-4, perfectly complementing ongoing U.S. clinical efforts and accelerating the fight against cancer

China is gearing up to resume exports of Nexperia chips, Dutch Prime Minister Mark Rutte announced, sparking a wave of relief amid growing global concerns over tech supply shortages. This move is poised to send ripples through the semiconductor market like never before

A staggering $300 million crypto scheme has uncovered explosive connections between a notorious crypto kingpin and Spain’s far-right movement, raising urgent concerns about the dark side of digital currencies fueling illicit financing and political power plays

Yum China Holdings, Inc. (NYSE:YUMC) just revealed its Q3 earnings, thrilling investors with standout same-store sales growth that surpassed analyst expectations. Following this strong performance, analysts have enthusiastically raised their revenue and profit forecasts

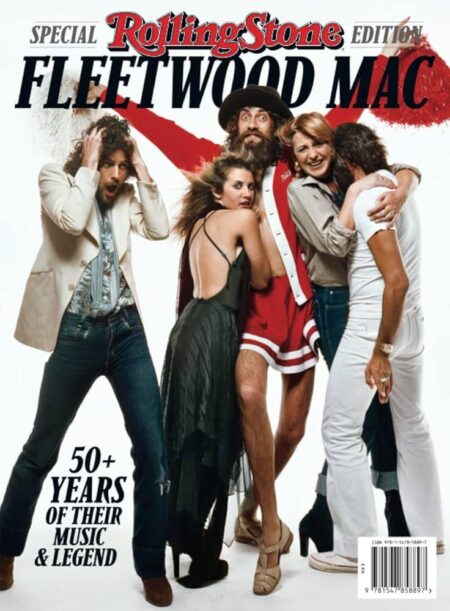

Rolling Stone, USA Today, and OPIS are spotlighting SMX’s game-changing “Proof as Currency” platform, unveiling a revolutionary new way to blend digital identity with blockchain in the finance world. Dive into the full story on Yahoo Finance!

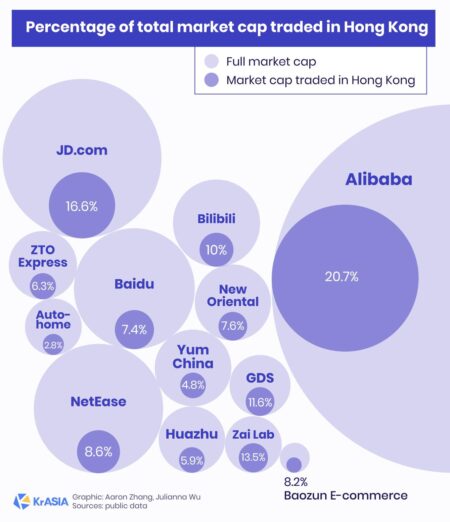

China’s autonomous driving trailblazer WeRide is gearing up to shake things up with an ambitious plan to raise approximately $308 million through a Hong Kong IPO, Bloomberg News reports-marking a significant milestone in the region’s rapidly evolving tech scene

Japan Tissue Engineering (TSE:7774) has sharply reduced its losses, igniting fresh investor enthusiasm as the company moves closer to a significant profitability milestone. This exciting development is driving robust bullish momentum ahead of the upcoming earnings report

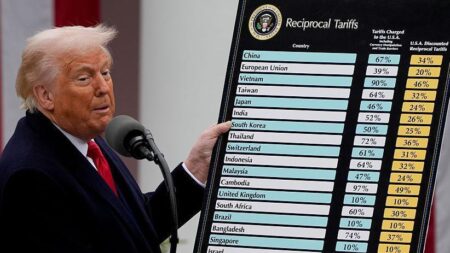

US and China have declared a truce in their ongoing tariff battle, with President Trump describing his meeting with Xi Jinping as “amazing.” This breakthrough signals a potential easing of trade tensions, igniting cautious optimism across global markets

President Trump is driving hard to lock in a “great deal” with China, proposing tariff cuts to fast-track the crucial trade talks. At the center of this high-stakes negotiation is Nvidia, highlighting just how pivotal the tech industry has become in these discussions

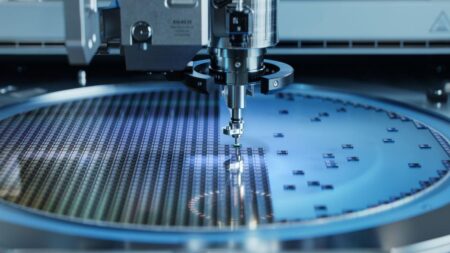

GlobalFoundries is making a bold leap forward with a billion-euro investment to expand its chip manufacturing facilities in Germany, turbocharging Europe’s semiconductor production to keep pace with skyrocketing global demand, Yahoo Finance reports

Former President Donald Trump praised Japan as a crucial ally and passionately threw his full support behind candidate Sanae Takaichi, vowing to deliver “anything you want” to power up her campaign, Yahoo Finance reports

USA Rare Earth, Iren, Novartis, and Softbank are capturing attention with remarkable stock surges this week. Investors are abuzz as market experts reveal the hottest trends and key breakthroughs driving their shares on Yahoo Finance

RAMM Pharma Corp. has just shared a crucial update regarding the Canada Post strike, warning shareholders that there may be delays in receiving the company’s meeting materials. Stay alert and watch your inbox for the latest news!

Canada’s largest family medicine event is heading to Winnipeg this November! Connect with healthcare professionals nationwide as they dive into cutting-edge innovations and confront the biggest challenges in primary care

Former President Donald Trump issued a stark warning that he would be “very upset” if the Chinese military ever set foot in Argentina, highlighting mounting concerns over China’s expanding influence throughout Latin America

Investors are buzzing about three Canadian growth stocks that are set to explode in 2024. With strong fundamentals and incredible market potential, experts are urging buyers to act fast before prices skyrocket.

Fintel and two other UK penny stocks are sparking excitement among investors with their impressive growth potential. Analysts highlight these budget-friendly shares as prime opportunities in a turbulent market, urging a smart blend of optimism and careful strategy

Japan markets surged with volatility following the stunning victory of Abe-disciple Sanae Takaichi, reigniting investor concerns over policy stability and the nation’s economic outlook. This unexpected win sent powerful shockwaves through market confidence amid a backdrop of ongoing political shifts