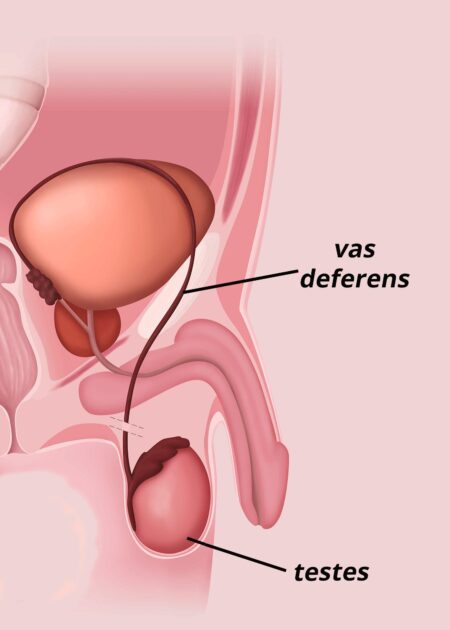

Health Canada has broadened the approval of Evkeeza® (evinacumab) to treat homozygous familial hypercholesterolemia (HoFH) in children as young as 6 months, offering exciting new hope for early and powerful treatment

Browsing: Yahoo Finance

UK’s tech scene is booming with high-growth stocks stealing the spotlight from eager investors. From revolutionary startups to pioneering industry giants, these companies are shaping the future of innovation. Yahoo Finance uncovers the top tech stocks you can’t afford to miss right now

Chinese President Xi Jinping is signaling a bold new strategy to put an end to the prolonged deflationary price wars, with the goal of stabilizing markets and sparking robust economic growth, Yahoo Finance reports. This move has the potential to reshape China’s competitive landscape in a profound way

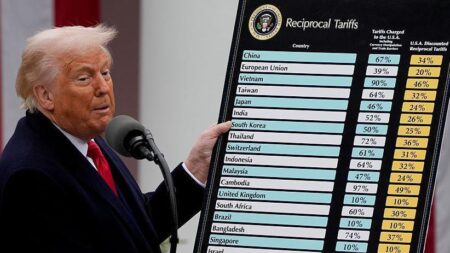

President Trump has firmly announced he will not push back the August 1 deadline for tariffs, despite recent letters to Japan, South Korea, and other countries suggesting a potential easing of U.S. trade tensions. Stay tuned for the latest updates on Yahoo Finance!

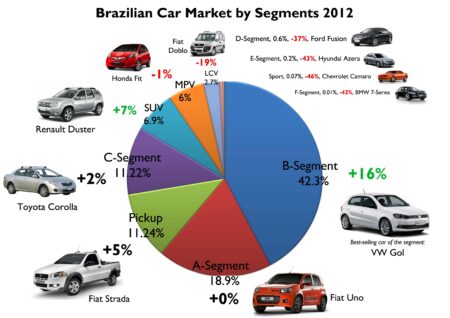

Brazil’s auto industry hit a rough patch in June, as both sales and production dipped amid ongoing economic hurdles and supply chain disruptions. This downturn underscores the persistent challenges shaping the market’s future

President Trump’s bold threat to slap a staggering 35% tariff on Japanese imports has sent shockwaves through Tokyo, igniting fears of economic upheaval and escalating trade tensions between the U.S. and Japan, sources reveal

The U.S. has officially ended the tax-free exemption on low-value imports from China, sending shockwaves through air shipments and pushing costs higher for retailers and consumers alike. This move marks a significant turning point in cross-border trade regulations, transforming the future of international commerce

Japan’s Minna Bank has joined forces with Solana and Fireblocks to unveil an exciting stablecoin use case study, exploring groundbreaking blockchain technology that promises to transform secure and seamless digital asset transactions

China’s $50 billion chip fund is boldly reshaping its strategy to outmaneuver US restrictions, focusing fiercely on self-reliance and homegrown technological breakthroughs. This dynamic pivot aims to dramatically reduce reliance on foreign semiconductor supplies amid rising trade tensions

US trips to Japan have soared, surpassing Paris as the top summer vacation destination, reports Yahoo Finance. Travelers are eagerly drawn to Japan’s enchanting culture, delicious cuisine, and vibrant summer festivals as travel restrictions continue to relax

UK insider-owned growth stocks are stealing the spotlight this June 2025, as savvy investors flock to companies backed by powerful insider buying. Yahoo Finance highlights the top contenders, revealing thrilling momentum and unwavering leadership confidence driving their success

Argentina, often dubbed the IMF’s wild child, has missed its foreign exchange reserve targets but is on the brink of securing a vital waiver. This crucial move aims to propel debt relief talks forward, providing a much-needed lifeline to ease mounting financial pressures

B.P. Marsh & Partners, alongside two dynamic UK firms on the rise, are rapidly carving out a powerful presence in the market. Their innovative strategies and steady growth are capturing keen investor interest amid a transforming industry landscape

Trump secures a landmark win with a groundbreaking UK trade deal as EU negotiations hit a standstill. Meanwhile, Japan intensifies its stance in escalating tariff battles, fueling rising global trade tensions

At Russia’s Davos-style economic forum, vibrant Putin T-shirts and cutting-edge robot displays captured everyone’s attention, while the Taliban made a surprising and rare appearance. Yet, the event was marked by a striking absence of Western delegates, underscoring ongoing geopolitical tensions

The IMF has applauded Argentina’s recent reform efforts, calling them a promising sign as the much-anticipated visit at the end of June approaches. These bold moves showcase the country’s strong commitment to meeting the vital economic targets set out in the bailout agreement

Argentina is poised for a thrilling surge in mergers and acquisitions under President Milei, with the energy sector shining as a prime hotspot for eager investors, according to PwC. The market buzzes with anticipation as fresh reforms pave the way for an exciting wave of investment opportunities

Tesla is now grappling with eight consecutive months of declining sales in China, while local rival BYD continues to surge ahead. This dramatic shift in the electric vehicle landscape highlights the mounting challenges Tesla faces in its most vital growth market

President Trump intensifies his drive for fresh trade agreements amid rising concerns that tariffs could disrupt the global economy. Stay with Yahoo Finance for the latest updates on unfolding negotiations and market reactions

Germany is reportedly gearing up to introduce a 10% digital tax aimed at tech giants like Alphabet and Meta, seeking to boost revenue from their massive online activities within the country, sources reveal