German financial Recovery Driven by Auto Tariff Relief

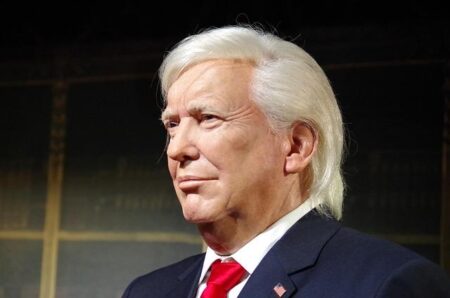

In a remarkable shift, the German financial markets have rebounded considerably from the downturn experienced in April. This resurgence is largely attributed to a recent decision by former President Donald Trump to alleviate auto tariffs, which has sparked optimism among investors and automakers alike. The automotive industry, crucial to Germany’s economic framework, stands to benefit greatly from this tariff reduction, possibly restoring faith in a sector that has faced numerous challenges due to trade disputes and market volatility.

Market analysts have identified several key factors contributing to this positive sentiment:

- Boosted Consumer Confidence: The reduction in tariffs may lead to lower vehicle prices, encouraging increased consumer spending.

- Improved Export Opportunities: German manufacturers could gain an advantage in global markets without the burden of high tariffs.

- Favorable Earnings Projections: Analysts expect enhanced earnings reports from major automotive companies in upcoming quarters.

| Market Index | % change | Closing Value |

|---|---|---|

| DAX | 2.5% | 15,350 |

| MDAX | 3.1% |

This renewed confidence has prompted many investors to pivot towards technology and automotive stocks as they anticipate growth and innovation within thes sectors. This rebound is not merely a reactionary measure but also serves as a potential driver for broader economic expansion within Germany—historically regarded as Europe’s economic powerhouse.

Effects of Trump’s Decision on European Automotive Industry and Investor Confidence

the recent suspension of auto tariffs by former President Trump has revitalized the european automotive landscape—especially in Germany—where investor confidence surged following April’s losses. As one of the pillars of the German economy, the auto sector is now positioned for recovery amid ongoing supply chain issues and rising production costs. Major manufacturers are expected to increase their production rates significantly,which will likely enhance employment opportunities while stimulating related industries that support automobile manufacturing.

This decision carries both immediate benefits and long-term implications for stability within transatlantic trade relations. The pause on tariffs could create an habitat ripe for increased investments driven by changing sentiments among stakeholders who were previously cautious about prior trade policies under Trump’s administration. Key areas worth monitoring include:

- CInvestment Strategies:The adjustments major automotive firms make regarding their financial plans based on new tariff conditions.

- Supply Chain Optimization: Efforts made towards enhancing production efficiency following tariff reductions .

- Consumer Spending Trends: The potential rise in vehicle purchases as manufacturers stabilize pricing .

Strategies for Investors Exploring New Opportunities in Germany

The recovery observed within German markets post-April downturn presents unique investment opportunities following President Trump’s announcement regarding tariff relief for automobiles . Experts advocate adopting proactive strategies while remaining vigilant about policy shifts that may influence market dynamics . Recommended actions include :

- Diversification: Consider expanding beyond conventional sectors like automobiles , exploring technology or renewable energy fields with growth potential . Â

- risk Evaluation: Thoroughly assess political developments affecting economic stability across Germany and Europe at large . Â

- Long-Term Focus: Prioritize investments into companies with robust fundamentals capable of weathering short-term fluctuations , especially those innovating solutions tailored toward future demands . Â

in addition , aligning investment portfolios with lasting practices aligns well with current market trends reflecting growing consumer preferences toward eco-amiable initiatives.

| sectors | Main Growth Drivers | ||

|---|---|---|---|

| Tecnology | A.I advancements ,digital conversion |