Goldman Sachs bankers foresee a surge of mergers and acquisitions in Brazil following the upcoming election, anticipating that renewed investor confidence and bold economic reforms will spark a dynamic wave of deal-making, Bloomberg reports

Browsing: financial markets

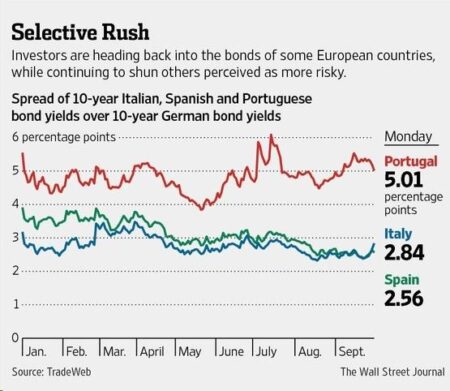

Italy’s bond spread has plunged to a 15-year low, showcasing soaring investor confidence in Prime Minister Meloni’s leadership, Bloomberg reports. Traders are enthusiastically backing her economic policies as clear signs of fiscal stability take center stage

A controversial Brazilian credit product that once led to significant investor losses is making a surprising comeback, drawing renewed attention as market conditions shift. Experts warn investors to proceed with caution and thoroughly evaluate the risks before diving in

Germany is dramatically ramping up its borrowing to unprecedented heights, powering bold economic recovery plans and pioneering green initiatives. This daring surge in debt marks a significant shift in the nation’s fiscal strategy, sparking vibrant debate across Europe

Former President Trump announced that the U.S. and China have struck a groundbreaking trade deal, igniting a powerful rally in Chinese stock markets. This landmark agreement marks a major step forward in easing years of economic tensions between the two global powers

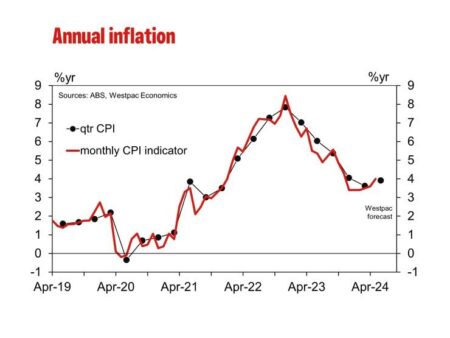

Australia’s CPI inflation slowed more than expected in May, easing pressure on the Reserve Bank and sparking renewed market optimism about potential rate cuts. Investors are now eagerly watching upcoming economic data for new clues

Japan is gearing up to reduce sales of super-long government bonds in its upcoming fiscal year revision, striving to better control debt issuance and foster greater stability in the market, Reuters reported via Investing.com

China is gearing up to turbocharge the yuan’s global reach with an exciting new operations centre, unveiled by the People’s Bank of China. This ambitious move aims to boost the currency’s international clout and speed up cross-border transactions like never before

U.K. shares edged lower on Tuesday, with the Investing.com United Kingdom 100 index falling 0.47%. Investors stayed on edge, weighing fresh economic data against corporate earnings as they braced for key reports on the horizon

The Bank of Japan held interest rates steady and announced a gradual easing of its bond purchase taper, signaling a cautious approach amid ongoing economic uncertainties, according to the Caledonian Record

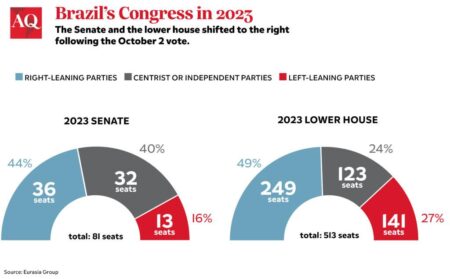

Brazil’s political landscape is buzzing with dynamic shifts, sparking new waves of change that are sending ripples through the markets. Investors need to stay sharp, watch for policy signals, and be prepared to adjust their strategies as uncertainty rattles stocks and currency values

Japan has issued rare warnings about its bond market in the latest policy roadmap, highlighting growing concerns over rising yields and potential market turbulence, Reuters reports. This signals a careful shift in the nation’s traditionally steady monetary approach

Germany’s inflation rate held firm at 2.1% in May, reflecting steady consumer prices amid ongoing economic challenges. This encouraging data sparks cautious optimism for Europe’s largest economy. (NYSEARCA:EWG)

Argentina triumphantly secured $1 billion in a high-stakes international bond auction, igniting fresh investor confidence and propelling momentum behind President Javier Milei’s ambitious economic agenda, the Financial Times reports

Japan’s ultra-long government bonds slipped as stock markets soared, capturing the cautious mood of investors amid ongoing stimulus discussions. Traders navigated the delicate balance between potential policy shifts and their impact on yields and equities

China’s central bank has injected a fresh wave of liquidity to ease worries over a potential cash crunch, underscoring its dedication to maintaining stable credit conditions amid slowing economic growth, reports the Wall Street Journal

Brazil has just secured an impressive $2.75 billion in its second dollar bond offering of 2025, Reuters reports. This robust demand reflects a surge in investor confidence, as the country’s credit default swaps (CDS) have fallen to their lowest level in a year, signaling optimism about Brazil’s financial future

The RBA is poised to deliver rapid rate cuts if economic instability arises from Trump’s policies, according to minutes that highlight a determined commitment to strengthening Australia’s economy amid global uncertainties

Japan has launched an ambitious economic policy roadmap aimed at boosting domestic ownership of Japanese Government Bonds (JGBs). This bold move seeks to enhance financial stability and reduce reliance on foreign investors, Reuters reports

Argentina has unveiled plans to launch a new government bond, navigating through persistent economic uncertainty. This bold step comes as officials stand firm against buying U.S. dollars, determined to strengthen and stabilize the peso