Positive Investor Sentiment Following US-China Tariff Truce

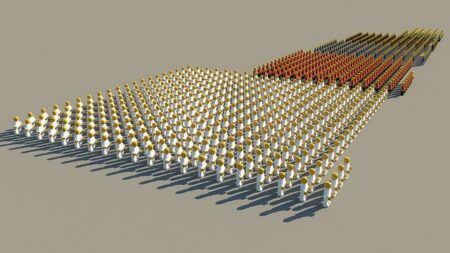

In a pivotal moment for teh international economy,the proclamation of a ceasefire in the long-standing tariff conflict between the United States and China has elicited an encouraging response from investors. As these two major economic powers work through their intricate trade relationship, the reduction of tariff tensions has generated a surge of optimism within financial markets. Still, experts are advising prudence, highlighting that while this temporary halt in hostilities is certainly beneficial, achieving a thorough and enduring trade agreement will likely encounter numerous obstacles. Stakeholders are attentively observing ongoing discussions, cognizant that subtle policy shifts could significantly influence economic stability and growth in the near future.

Investor Optimism considering US-China Tariff Ceasefire

The recent tentative accord aimed at alleviating tariff disputes between the United States and China has led to an observable boost in market sentiment. Investors are reacting favorably to what appears to be more stable trade relations—an aspect that has historically contributed to uncertainty across global markets. Sectors poised for potential gains include technology, agriculture, and manufacturing; analysts have identified several factors likely to sustain this positive outlook:

- Supply Chain stabilization: Companies may revert to pre-trade war sourcing practices.

- Recovery in Corporate earnings: Businesses anticipate enhanced profitability as tariffs decrease.

- Job Growth Forecasts: A more favorable trading environment could lead to heightened labor demand.

Despite this newfound hope ignited by the truce, investors remain cautious regarding a extensive resolution. The intricacies involved in negotiations combined with political dynamics on both sides present ongoing challenges. Market analysts warn that without a solid agreement in place, volatility may return swiftly. Key indicators warranting attention include:

| Indicator | Status |

|---|---|

| Status of Trade Negotiations | In Progress |

| Mild market Volatility Index | |

| =high> |

Economic Experts Call for Caution Amid Uncertainty Over Final Agreement

The optimistic investor reaction following the recent truce between US and China tariffs is tempered by caution from economic experts who recognize notable uncertainties ahead on the path toward finalizing any agreement. While this brief easing of trade tensions has revitalized global markets—bringing joy among traders—it’s crucial for stakeholders to maintain realistic expectations as vital details about how any deal will be implemented remain unclear. Major concerns include:

- Lack of Clear Timelines: Analysts express doubts about when any formal agreement might be established , leaving room for possible setbacks .

- Enforcement Mechanisms: Without robust enforcement protocols ,maintaining stability within this truce could prove challenging .

- wider Economic Implications: The broader effects on global supply chains along with foreign policy considerations continue being evaluated . Â Â

- Enforcement Mechanisms: Without robust enforcement protocols ,maintaining stability within this truce could prove challenging .

The implications stemming from these uncertainties are particularly relevant concerning future investor confidence levels and overall economic growth trajectories . A lackluster resolution might undermine trust , leading towards increased volatility across equity markets alongside commodity pricing fluctuations .As dialogues progress between these two powerhouse economies , it becomes essential not only monitor rhetoric but also substantive proposals being put forth. Recent surveys conducted among industry leaders revealed several areas generating concern :

| Concern | ||

|---|---|---|

| Potential Future Tariff Increases | ||

| Market Volatility | ||

| Disruptions Within Supply Chains |

This data underscores growing apprehension regarding sustainability surrounding evolving trade dynamics moving forward . As negotiations persist , striking an equilibrium between optimism versus caution remains paramount for investors navigating through such complex economic terrains.

Sector-Specific Strategies To navigate The Changing Trade Environment

the recent ceasefire concerning tariffs imposed by both U.S.and China has instigated renewed enthusiasm amongst investors ; however many proceed cautiously given lingering uncertainties surrounding comprehensive agreements yet finalized. Businesses spanning various sectors now face challenges requiring strategic planning amidst fluctuating tariffs alongside potential retaliatory actions arising thereafter.In light thereof sector-specific strategies can prove favorable enabling companies mitigate risks while capitalizing upon emerging opportunities.Key focal points encompass :

- Technology Sector : Â Stay proactive through diversifying supply chains coupled with investing locally thereby avoiding adverse impacts stemming from tariffs.

- Manufacturing Sector : Implement adaptable production methodologies ensuring swift responsiveness towards shifting tariff landscapes thus maintaining competitive pricing structures.

- Agricultural Sector : Seek out alternative marketplaces whilst enhancing export capabilities counterbalancing losses incurred via traditional sales channels.

to assist businesses making informed decisions it’s imperative analyse vulnerabilities specific each sector alongside strengths therein Industry leaders must harness data analytics coupled market insights proactively adjusting strategies accordingly.The table below illustrates how diverse sectors can prepare themselves against varied outcomes resulting from ongoing trade negotiations:

| Sectorth/> | POTENTIAL RISKS/th/> | STRATEGIC OPPORTUNITIES/th/> |

|---|---|---|

| “Technology”/ | “Rising import duties”/ | “global supplier diversification”/ /tbody/> |

Conclusion: Navigating Forward Amidst Uncertainties/h2

While recent developments regarding U.S.-China tariff negotiations have sparked considerable enthusiasm among investors,the journey toward establishing lasting agreements remains riddled with unpredictability.Market participants keenly recognize complexities inherent within relationships shared by these two dominant economies pose ample risks.As stakeholders closely observe unfolding events,cautious optimism highlights delicate balance existing between aspirations centered around achieving greater economic stability juxtaposed against geopolitical realities.The forthcoming weeks will play critical roles determining whether current truces evolve into lasting resolutions or merely serve as temporary reprieves before further confrontations arise.For now,informed vigilance remains essential allowing adaptability amidst ever-evolving landscape characterizing U.S.-China relations.