China’s rare earth export controls have become a focal point in the global supply chain discussion, drawing widespread attention from industry leaders and policymakers alike. As the world increasingly relies on these critical minerals for everything from electronics to defense technologies, Reuters examines what stakeholders need to understand about Beijing’s regulatory measures, their potential impact on international markets, and the broader geopolitical implications. This article delves into the latest developments, export restrictions, and the strategic significance of China’s dominance in the rare earth sector.

China’s Strategic Leverage in Global Rare Earth Markets

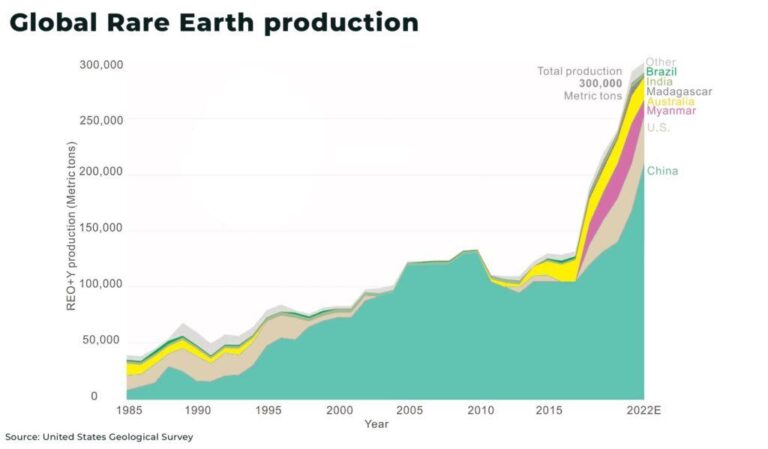

China’s dominance in the rare earth elements (REE) market stems from its substantial reserves and integrated supply chains, which span from mining to refining. Controlling nearly 60% of global rare earth production, Beijing holds a critical advantage that it leverages in trade negotiations and geopolitical disputes. This strategic control enables China to influence global supply dynamics, often prompting foreign industries to reconsider their dependence on these materials vital for electronics, renewable energy technologies, and defense systems.

Key aspects of China’s leverage include:

- Export quotas and tariffs that limit or raise costs for foreign buyers.

- Investment in downstream processing, securing added value beyond raw materials.

- Strict environmental regulations at home that reduce illegal mining and stabilize the market.

| Rare Earth Element | China’s Share (%) | Global Demand (Tonnes) |

|---|---|---|

| Neodymium | 70 | 28000 |

| Lanthanum | 65 | 40000 |

| Yttrium | 80 | 12000 |

By maintaining tight export controls, China creates leverage by fueling market uncertainty and compelling countries to develop alternate supply chains or invest in domestic exploration. While this strategy enhances China’s geopolitical standing, it also accelerates global efforts to diversify sources and develop substitute technologies, underscoring the fragile balance inherent in the international rare earth ecosystem.

Impact of Export Controls on Global Supply Chains and Technology Industries

China’s stringent export controls on rare earth elements have sent ripples through global supply networks, revealing the vulnerability of industries heavily reliant on these critical materials. As the world’s largest supplier of rare earths, China’s policies directly influence production timelines and pricing structures across multiple sectors, from consumer electronics to renewable energy technologies. The ripple effects are especially pronounced in technology industries, where delays in accessing key components can stall innovation and disrupt product launches worldwide.

Key challenges facing global industries include:

- Supply chain bottlenecks due to reduced export quotas

- Increased manufacturing costs resulting from scarcity and tariffs

- Urgency to diversify sourcing strategies beyond China

- Heightened geopolitical tensions influencing trade policies

| Industry | Dependency on Chinese Rare Earths (%) | Potential Impact Level |

|---|---|---|

| Consumer Electronics | 85% | High |

| Electric Vehicles | 70% | Moderate to High |

| Renewable Energy | 65% | High |

Navigating Trade Risks and Securing Alternative Sources for Rare Earth Elements

Global industries reliant on rare earth elements (REEs) now face unprecedented challenges as China enacts stricter export controls. These measures heighten supply chain vulnerabilities, compelling businesses to reassess their sourcing strategies rapidly. Companies and governments alike are prioritizing diversification to mitigate the risks posed by geopolitical tensions and regulatory shifts. Key considerations include:

- Assessing supply chain dependencies: Understanding the current footprint of rare earth sourcing to identify potential disruption points.

- Engaging with alternative suppliers: Exploring emerging markets in Australia, the U.S., and Africa to reduce China’s dominance.

- Investing in recycling and substitution: Developing technologies to recycle REEs from end-of-life products or find viable material alternatives.

In a fast-evolving landscape, stakeholders must act decisively to secure stable access to these critical materials. The table below highlights comparative advantages of alternative rare earth suppliers, underscoring factors crucial for future investment decisions:

| Supplier Country | Estimated Reserves (Mt) | Production Capacity | Political Stability | Accessibility |

|---|---|---|---|---|

| Australia | 22 | Moderate | High | Good infrastructure |

| United States | 15 | Low | High | Developing projects |

| South Africa | 18 | Emerging | Medium | Challenging terrain |

Wrapping Up

As China continues to play a pivotal role in the global supply of rare earth elements, its export controls remain a critical factor for industries and governments worldwide. Understanding the scope and implications of these measures is essential for anticipating shifts in the market and crafting effective policy responses. Stakeholders should closely monitor developments in China’s regulatory stance, as changes could have far-reaching impacts on technology sectors reliant on these vital materials.