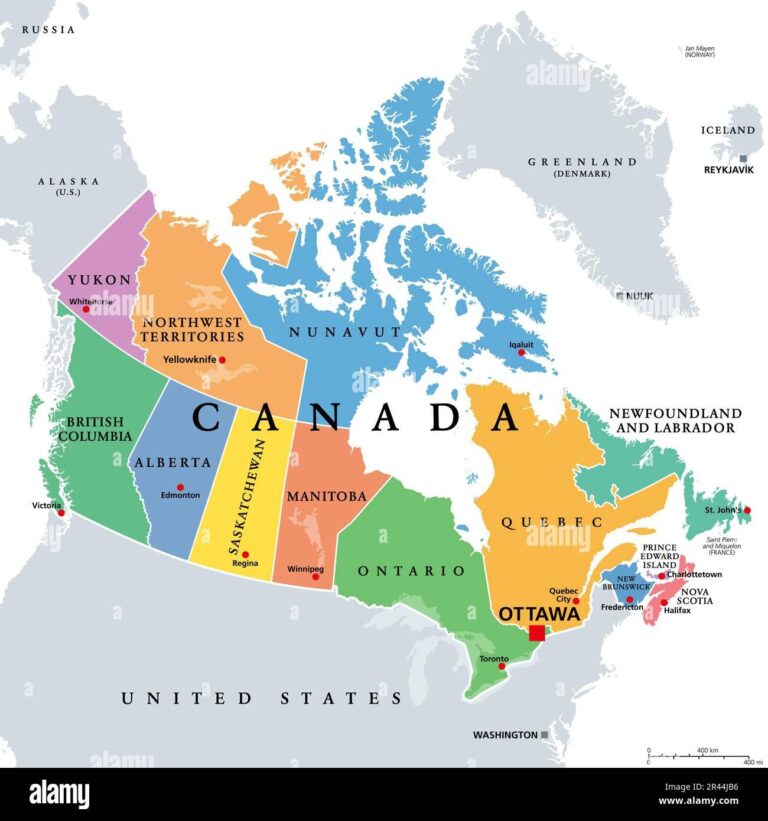

Canada has officially transferred US$1.7 billion in revenues generated from frozen Russian assets to Ukraine, marking a significant move in international efforts to support Kyiv amid ongoing conflict. The funds, derived from seized Russian state-owned assets, represent one of the largest financial seizures connected to the war and underscore Canada’s commitment to bolstering Ukraine’s economic resilience. This unprecedented allocation highlights the evolving strategies employed by Western nations to apply economic pressure on Russia while providing critical aid to Ukraine.

Canada Allocates Frozen Russian Assets to Support Ukraine’s Recovery Efforts

In a significant move demonstrating international solidarity, Canada has transferred US$1.7 billion in revenues generated from frozen Russian assets directly to support Ukraine’s ongoing recovery efforts. These funds will be strategically allocated to aid in rebuilding critical infrastructure, restoring essential services, and providing humanitarian assistance to displaced and affected populations. Canadian officials emphasized the importance of holding aggressors financially accountable while empowering Ukraine to rebuild its sovereignty and stability amidst continued conflict.

The deployment of these resources will prioritize key recovery sectors, outlined as follows:

- Infrastructure Rehabilitation: Repair of damaged roads, bridges, and public utilities.

- Healthcare Support: Strengthening hospitals and medical supply chains.

- Humanitarian Aid: Provision of shelter, food, and psychological support to displaced families.

- Economic Revitalization: Incentives to stimulate small businesses and local agriculture.

| Allocation Area | Estimated Budget (USD) | Impact Focus |

|---|---|---|

| Infrastructure | $700 million | Transport & Utilities |

| Healthcare | $400 million | Medical Services |

| Humanitarian Aid | $350 million | Displaced Families |

| Economic Revitalization | $250 million | Local Economies |

Implications of the US 1.7 Billion Transfer on International Sanctions Enforcement

The recent transfer of US$1.7 billion by Canada, derived from frozen Russian assets, marks a significant precedent in the global enforcement of international sanctions. This move not only underscores the increasing willingness of Western allies to repurpose seized funds in support of Ukraine but also raises critical questions regarding the legal frameworks governing asset freezes and their eventual utilization. As nations navigate this uncharted territory, key considerations include:

- Precedent-setting asset management: How frozen assets can be lawfully redirected without violating international law or property rights.

- Increased cooperation between allies: Coordinated efforts to maximize the impact of sanctions on Russia’s financial networks.

- Potential geopolitical repercussions: How such transfers may influence Russia’s responses and negotiations.

Furthermore, the operation illuminates challenges inherent in balancing effective sanctions enforcement with diplomatic sensitivities. Transparency and accountability in the disbursement and monitoring of these funds are paramount to maintain international legitimacy. Below is a brief overview of key stakeholders and their roles in this evolving landscape:

| Entity | Role | Impact |

|---|---|---|

| Canada | Asset custodian and transferring authority | Sets enforcement standards |

| Ukraine | Beneficiary of transferred funds | Strengthens defense and recovery efforts |

| International community | Observer and enforcer | Monitors precedent and compliance |

Recommendations for Strengthening Asset Recovery and Aid Distribution Mechanisms

To maximize the impact of seized asset transfers, it is crucial to implement transparent and accountable recovery frameworks. Establishing independent oversight bodies can ensure funds are allocated efficiently and reach intended recipients without diversion. Furthermore, creating centralized digital platforms to track asset recovery progress and fund disbursement could significantly enhance public confidence and deter corruption. Encouraging international cooperation through shared databases will also accelerate the identification and release of frozen assets across borders.

Enhancing aid distribution mechanisms requires a focus on both speed and precision. Local partnerships with trusted organizations on the ground can facilitate timely delivery and verification of assistance. Additionally, deploying technology such as blockchain can improve traceability and ensure that the aid benefits targeted communities directly. The table below illustrates key priorities for refining recovery and distribution processes:

| Priority | Recommended Action |

|---|---|

| Transparency | Create public dashboards for tracking funds |

| Accountability | Set up independent audit committees |

| Speed | Leverage local NGOs for rapid aid delivery |

| Traceability | Implement blockchain-based monitoring |

| International Cooperation | Develop shared asset databases |

Future Outlook

The transfer of US$1.7 billion from frozen Russian assets by Canada marks a significant development in international efforts to support Ukraine amid ongoing conflict. As Kyiv continues to face economic and military challenges, such financial measures underscore the growing role of global cooperation in addressing the crisis. Observers will be watching closely to see how these funds are utilized and whether other nations follow suit in redirecting frozen assets to aid Ukraine’s recovery and stability.