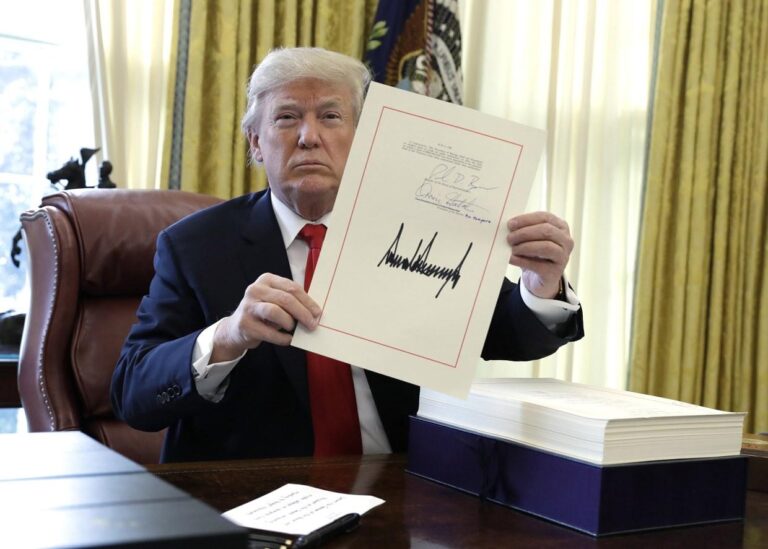

The sweeping tax reforms introduced under former President Donald Trump brought significant changes to the American financial landscape. As taxpayers and businesses continue to navigate these adjustments, understanding when the new rules take effect is crucial. This article breaks down the key provisions of Trump’s tax law and outlines the timeline for their implementation, helping readers grasp how these changes could impact their finances moving forward.

Trump’s Tax Law Could Reshape Your Deductions and Credits

Several key provisions under the new tax legislation have the potential to significantly alter how taxpayers approach their annual filings. Among the most impactful changes are adjustments to standard deductions, which have nearly doubled for many filers, reducing the need for itemized deductions. Meanwhile, various tax credits have been expanded or introduced, offering fresh opportunities to lower tax liabilities. These adjustments are designed to simplify taxes for the majority while still providing targeted relief for specific groups.

Major changes to watch out for include:

- Increased child tax credit amounts with expanded eligibility

- Cap on state and local tax deductions (SALT) set at $10,000

- New limits placed on mortgage interest deductions

- Phase-outs of personal exemptions eliminated

| Deduction/Credit | Pre-law Limit | Post-law Limit |

|---|---|---|

| Standard Deduction (Single) | $6,350 | $12,000 |

| Child Tax Credit | $1,000 per child | $2,000 per child |

| SALT Cap | Unlimited | $10,000 |

Understanding Key Timeline Changes in the New Tax Regulations

The recent tax regulations introduced under the Trump administration bring significant shifts that will affect individual and business finances, with key dates to watch closely. Starting January 1, 2018, many of the changes take effect immediately, impacting tax brackets, standard deductions, and personal exemptions. Homeowners will notice modifications in mortgage interest deductions while families stand to benefit from the nearly doubled child tax credit. It’s crucial to stay informed about these timelines to optimize tax planning and avoid surprises during the filing season.

Some provisions, however, are phased in over time or set to expire after specific periods. For instance, a number of individual tax breaks are scheduled to sunset after 2025 unless extended by future legislation. Meanwhile, corporate tax rate reductions apply instantly, reshaping business profitability and investment decisions. Below is a simplified overview of the most impactful timeline milestones:

| Effective Date | Key Change | Duration |

|---|---|---|

| Jan 1, 2018 | Tax brackets adjusted & standard deduction doubled | 2018-2025 |

| Jan 1, 2018 | Corporate tax rate cut to 21% | Permanent |

| 2018-2025 | Child tax credit increased to $2,000 | Temporary |

| Dec 31, 2025 | Expiration of many individual provisions | TBD |

- Immediate Impact: Tax adjustments and credits that influence 2018 returns and beyond.

- Temporary Measures: Individual tax benefits set to expire unless Congress acts.

- Permanent Changes: Corporate tax cuts offering lasting effects on business finances.

How to Adjust Your Financial Planning to Maximize Benefits

To capitalize on the revised tax landscape, investors and taxpayers need to rethink their financial strategies promptly. One practical step is to review withholding allowances to prevent unexpected tax bills or overpayments. Additionally, adjusting contributions to tax-advantaged accounts like 401(k)s and IRAs can optimize tax savings under the new brackets. For those with significant capital gains, timing the sale of assets to align with lower tax rates can lead to considerable benefits. Consulting with a tax professional to update your portfolio in response to altered deductions and credits will ensure that your financial plan remains both compliant and efficient.

Consider incorporating these key moves into your financial planning:

- Reassess itemized deductions: Some previously deductible expenses may have changed, impacting your overall tax burden.

- Adjust estate plans: The new exemption thresholds could affect inheritance taxes and how wealth is transferred.

- Reevaluate business structures: Certain legal entities may now benefit more under updated corporate tax rates.

- Monitor changes to tax credits: These can directly increase your refund or reduce what you owe.

| Financial Element | Old Policy | New Policy | Impact |

|---|---|---|---|

| Standard Deduction | $12,000 | $24,000 | Reduced itemization; easier to claim standard |

| Capital Gains Rate | Up to 20% | Lower brackets for some taxpayers | Possible tax savings on investments |

| Estate Tax Exemption | $5.6 million | $11.4 million | More assets passed tax-free |

| Tax Credits | Various limits | Expanded in specific areas | Improved direct tax break opportunities |

In Conclusion

As the new tax provisions take effect, Americans are advised to review their financial plans carefully to understand how the changes may impact their individual situations. Staying informed and consulting with tax professionals can help ensure that taxpayers make the most of the updated rules under Trump’s tax law. For ongoing updates and detailed guidance, continue following trusted news sources like USA Today.