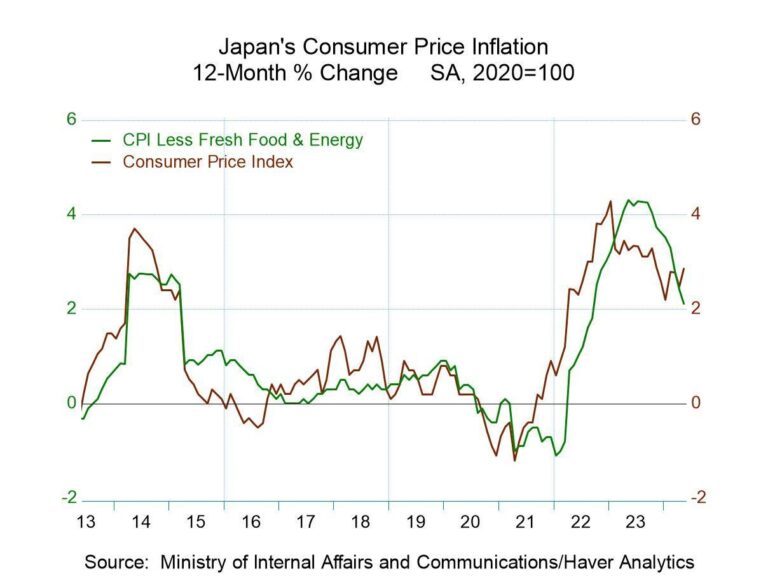

Japan’s core inflation rate eased in the latest data release but remained above the Bank of Japan’s (BOJ) 2% target, signaling persistent underlying price pressures in the world’s third-largest economy. The slowdown in inflation, however modest, has not diminished market expectations that the BOJ may proceed with cautious monetary tightening after years of ultra-loose policy. Analysts and investors are closely monitoring upcoming economic indicators and policy signals as the central bank balances its commitment to supporting growth with the need to contain inflationary risks, keeping the outlook for interest rate hikes on the table.

Japan’s Core Inflation Moderates Amid Persistent Consumer Price Pressures

Japan’s core inflation has shown signs of easing but remains stubbornly above the Bank of Japan’s (BOJ) 2% target, signaling persistent consumer price pressures that continue to influence market expectations. Key sectors such as energy and food have maintained elevated price levels, counterbalancing the modest slowdown observed in other areas. This dynamic has kept the debate over potential monetary policy adjustments active, with investors weighing the possibility of a shift away from the BOJ’s historically accommodative stance.

- Energy costs: Continued volatility in global oil prices sustains high household expenses.

- Food prices: Supply chain constraints and adverse weather patterns contribute to price gains.

- Services inflation: A slower rise signals easing demand pressures but remains above pre-pandemic norms.

| Month | Core CPI YoY (%) | BOJ Target (%) |

|---|---|---|

| March | 3.5 | 2.0 |

| April | 3.1 | 2.0 |

| May | 2.8 | 2.0 |

Market participants remain cautious but engaged, interpreting the moderated inflation pace as a complex signal rather than a clear mandate for policy change. Continued upward pressure on prices, driven by structural factors and external shocks, suggests the BOJ may soon face increased scrutiny regarding its ultra-loose policies. Analysts highlight that any decision to tighten monetary policy will need to carefully balance the risks of derailing the fragile economic recovery against the rising cost burdens felt by consumers.

Factors Behind Slowing Inflation and Impact on BOJ’s Monetary Policy Outlook

Core inflation in Japan has shown signs of slowing, primarily driven by easing energy costs and moderated consumer demand amid ongoing global uncertainties. Key contributors include:

- Decline in imported raw material prices, reducing production costs for manufacturers.

- Weaker domestic consumption, as households exercise caution amid uncertain economic growth.

- Stabilizing supply chains, which help alleviate price pressures on goods and services.

Despite the deceleration, inflation remains stubbornly above the Bank of Japan’s 2% target, sustaining speculation around a potential policy shift. The BOJ faces a complex balancing act:

| Monetary Policy Factor | Implication |

|---|---|

| Inflation above target | Supports arguments for tightening |

| Slowing inflation rate | Encourages patience in adjustment timing |

| Economic growth uncertainty | Limits aggressive hike moves |

Overall, policymakers are likely to maintain a cautious stance, weighing inflation trends against growth dynamics, keeping markets attentive to subtle shifts in BOJ communication and data.

Investor Strategies as BOJ Maintains Hawkish Stance Despite Cooling Price Growth

Investors are recalibrating their portfolios amid the Bank of Japan’s unwavering commitment to a hawkish policy stance, even as core inflation shows signs of moderation. Market participants remain cautious, factoring in the possibility of further rate hikes despite slowing price growth, which keeps the yen and Japanese equities volatile. The persistence of inflation above the central bank’s 2% target continues to fuel speculation that the BOJ might gradually tighten its ultra-loose monetary policy, prompting strategic shifts in asset allocation.

Key investor approaches currently gaining traction include:

- Defensive positioning: Increased exposure to dividend-paying stocks and sectors with stable cash flows to hedge against market uncertainties.

- Currency hedging: Active management of yen exposure through derivatives to navigate potential volatility stemming from policy surprises.

- Yield curve plays: Tactical investments in JGBs anticipating a gradual steepening as the market prices in potential rate adjustments.

| Strategy | Rationale | Expected Outcome |

|---|---|---|

| Dividend Stocks | Stable income during volatility | Capital preservation & yield |

| Currency Hedging | Mitigate yen fluctuation risk | Reduced portfolio volatility |

| Yield Curve Plays | Benefit from possible rate hikes | Enhanced fixed income returns |

In Conclusion

As Japan’s core inflation decelerates yet remains above the Bank of Japan’s 2% target, market speculation over potential interest rate hikes persists. The central bank faces a delicate balancing act between supporting economic growth and curbing inflationary pressures. Investors and policymakers alike will closely monitor upcoming data and BOJ communications to gauge the trajectory of Japan’s monetary policy in the months ahead.