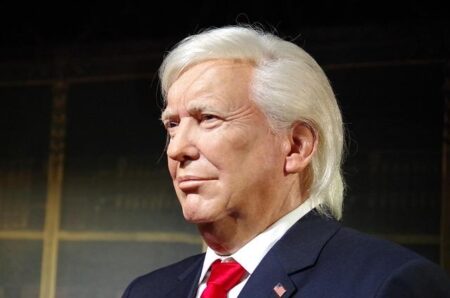

A promising Tuscan olive oil startup that successfully captured the U.S. market is now grappling with the fallout from newly imposed tariffs under the Trump administration. Once buoyed by strong demand across America, the company’s growth has been abruptly challenged as trade policies threaten to upend its business model. This development underscores the broader tension between small international exporters and shifting U.S. trade regulations, highlighting the real-world impact of tariffs on niche agricultural producers.

Tuscan Startup Faces Market Disruption as Trump Tariffs Target Olive Oil Imports

In a sudden blow to its rapid expansion, a small Tuscany-based olive oil startup found its entire U.S. market disrupted as new tariffs imposed under the Trump administration drastically increased import costs. Until recently, the company enjoyed a near-exclusive foothold in American gourmet food circles, with sales fueled by growing consumer interest in authentic, high-quality Italian products. However, the newly enacted tariffs have not only squeezed profit margins but also sent ripples through the supply chain, challenging the startup’s ability to maintain competitive pricing and market presence.

Industry analysts highlight several immediate effects on the company’s operations:

- Surge in Product Costs: Tariffs increased import expenses by up to 25%, directly impacting retail prices.

- Supply Chain Delays: Increased customs scrutiny led to logistical bottlenecks, causing shipment delays.

- Market Uncertainty: Buyers in the U.S. hesitate amid ambiguous trade policies, stalling new deals.

| Impact Area | Pre-Tariff Status | Post-Tariff Change |

|---|---|---|

| Unit Cost | €8.00 per bottle | €10.00 per bottle (+25%) |

| Average Monthly Shipments | 5,000 bottles | 3,200 bottles (-36%) |

| Retail Price (US Market) | $15.00 | $19.00 |

Navigating Trade Barriers The Economic Impact on Small Producers Exporting to the U.S

Small producers like this Tuscan olive oil startup found the U.S. market to be a promising avenue for growth, with demand soaring for authentic, high-quality products. However, the sudden imposition of tariffs under the previous administration disrupted this momentum, introducing unexpected costs that small businesses struggle to absorb. These additional financial burdens not only squeezed profit margins but also forced producers to rethink their pricing strategies, often passing costs onto consumers or shrinking their operational scale.

Key challenges faced by small exporters include:

- Increased shipping expenses due to added customs duties

- Market uncertainty as tariff policies fluctuate

- Reduced competitiveness against larger, tariff-exempt rivals

| Impact | Before Tariffs | After Tariffs |

|---|---|---|

| Export Volume | 1,200 liters / month | 750 liters / month |

| Average Price per Liter | $20 | $24 (with tariffs) |

| Profit Margin | 22% | 10% |

Strategies for Resilience How Olive Oil Exporters Can Adapt to Changing Tariff Policies

Olive oil exporters facing fluctuating tariff landscapes must pivot quickly to maintain market presence and profitability. One effective approach involves diversifying export destinations beyond the U.S. market, focusing on emerging economies where demand for high-quality olive oils is on the rise. Building direct relationships with distributors in Asia, the Middle East, and Europe can create buffers against geopolitical shocks. Additionally, investing in marketing campaigns that highlight product origin and artisanal production helps differentiate brands in competitive markets, making price increases due to tariffs less damaging to consumer loyalty.

Another vital strategy lies in supply chain optimization. Exporters can reduce costs by localizing production elements or sourcing packaging closer to target markets. Collaborating with logistics providers to negotiate better shipping rates and exploring tariff classification revisions can also help mitigate impact. The following table summarizes practical adaptations some exporters have employed:

| Strategy | Benefit | Example |

|---|---|---|

| Diversify Markets | Reduce dependence on a single economy | Expanded sales in South Korea and UAE |

| Brand Differentiation | Increase consumer loyalty despite price hikes | Storytelling about Tuscan heritage |

| Local Sourcing | Lower production and shipping costs | Packaging sourced within EU |

| Tariff Reclassification | Qualify for reduced duties | Align product labeling with customs codes |

In Retrospect

As the ripple effects of international trade policies continue to reshape markets, the experience of this Tuscan olive oil startup underscores the vulnerability of small exporters to sudden tariff changes. Their initial success in the U.S. market highlights the growing global demand for artisanal products, while the challenges posed by shifting tariffs serve as a cautionary tale about the complexities of navigating trade relations in an unpredictable political landscape. Going forward, industry stakeholders and policymakers alike will need to consider how to support such businesses in adapting to and mitigating the impact of evolving trade barriers.