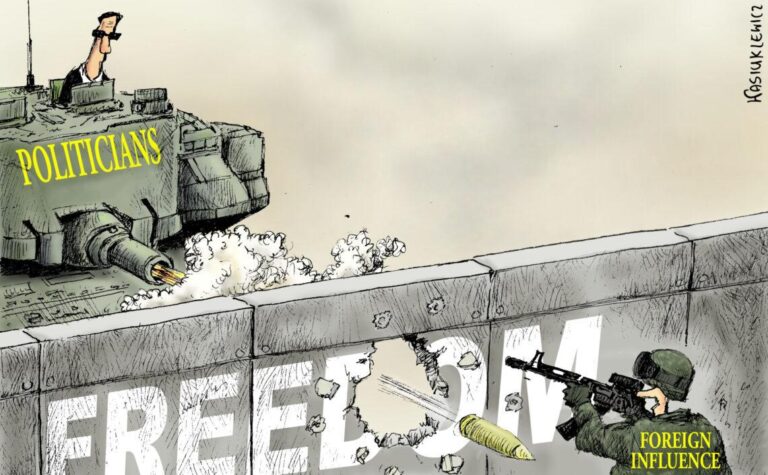

When politicians interfere with the integrity of economic data, the consequences can ripple across markets, erode public trust, and distort policy decisions. Argentina’s recent history offers a stark example of how government manipulation of statistics can undermine both domestic and international confidence. This article delves into the repercussions of politicizing economic indicators in Argentina, exploring the implications for the country’s economy and its standing on the global stage.

The Impact of Manipulated Economic Data on Investor Confidence in Argentina

Investor confidence in Argentina has long been sensitive to the credibility of its economic data. When key indicators such as inflation rates, GDP growth, and unemployment figures are subject to manipulation, both domestic and international investors grow wary. This skepticism can trigger a chain reaction, leading to capital flight, increased borrowing costs, and a slowdown in foreign direct investment. The perceived unreliability of statistics undermines transparency, making it harder for investors to assess risks and plan long-term strategies.

Consequences of manipulated data:

- Distorted economic forecasts affecting portfolio decisions

- Heightened volatility in the Argentine stock and bond markets

- Reduced access to international credit due to trust deficits

- Decline in domestic entrepreneurship and job creation

| Year | Reported Inflation (%) | Independent Estimates (%) | Investor Sentiment Index |

|---|---|---|---|

| 2015 | 10.5 | 25.7 | 45 |

| 2017 | 12.3 | 23.0 | 38 |

| 2019 | 16.2 | 54.5 | 30 |

How Politicians Use Economic Statistics to Shape Public Perception

Politicians often capitalize on the public’s limited understanding of complex economic indicators to present an optimistic image of the country’s financial health. By selectively highlighting favorable data points or employing adjusted metrics, they create narratives that support their policy agendas. In Argentina, for example, the government has been accused of manipulating inflation rates and unemployment figures to downplay economic difficulties. This manipulation not only misleads citizens but also undermines the credibility of official statistics, creating a rift between the government and independent analysts.

Common strategies used include:

- Revising baseline figures to reflect more favorable trends

- Omitting negative data in public communications

- Utilizing alternative indexes that may exclude volatile sectors

- Timing the release of data to influence market or voter sentiment

| Indicator | Official Rate | Independent Estimate | Impact on Public |

|---|---|---|---|

| Inflation | 25% | 45% | False sense of price stability |

| Unemployment | 8% | 14% | Underestimated job market struggles |

| GDP Growth | 3.5% | 1.2% | Exaggerated economic recovery |

Recommendations for Ensuring Transparency and Accountability in Economic Reporting

Guaranteeing the integrity of economic data requires a multi-layered approach centered on independence and stringent oversight. Establishing autonomous statistical agencies insulated from political pressures is critical; these bodies must operate transparently, adhering to internationally recognized methodologies. Regular audits by third-party organizations, such as global statistical watchdogs, ensure that reported figures are both accurate and free from manipulation. Moreover, implementing open data policies, where raw datasets and methodologies are publicly accessible, empowers analysts and journalists to verify and interpret information independently.

Accountability further demands robust legal frameworks that penalize data falsification and enforce whistleblower protections, encouraging insiders to report discrepancies without fear of reprisal. Training programs tailored for public officials and statisticians can cultivate a culture of ethical reporting, emphasizing the societal consequences of data distortion. The following table outlines key pillars necessary for safeguarding economic reporting integrity:

| Measure | Purpose | Impact |

|---|---|---|

| Independent Statistical Agency | Remove political interference | Objective, unbiased data |

| Third-Party Audits | Verify accuracy | Increased trust |

| Open Data Access | Enhance transparency | Public scrutiny |

| Legal Enforcement | Deter manipulation | Accountability |

| Whistleblower Protections | Encourage reporting | Early detection |

To Conclude

Argentina’s experience serves as a cautionary tale of the far-reaching consequences when political interference distorts economic data. Manipulating statistics may offer short-term political gain, but it ultimately undermines public trust, hampers effective policymaking, and damages a country’s credibility on the global stage. As Argentina continues to grapple with these challenges, the importance of transparency and independence in economic reporting remains clear-not only for national stability but also for maintaining investor confidence and fostering sustainable growth.