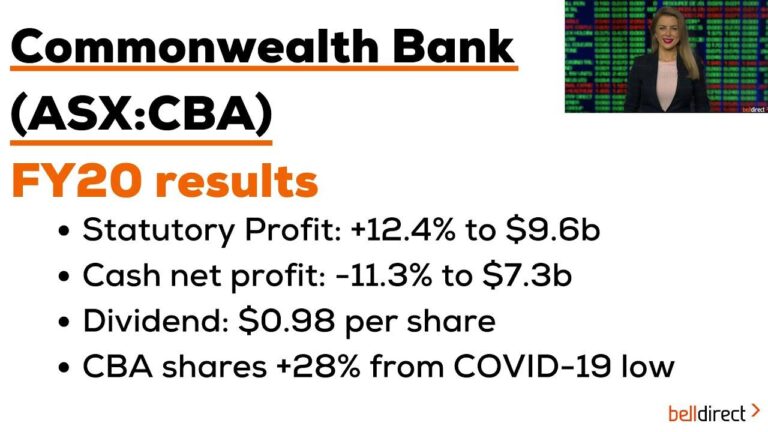

Australia’s Commonwealth Bank (CBA) has announced a record-breaking annual profit, underscoring its position as one of the nation’s leading financial institutions. Despite the bank’s robust earnings report, investors have responded by offloading shares, citing concerns over the stock’s lofty valuation. This contrasting reaction highlights the complexities facing investors amid a shifting economic landscape, even as CBA demonstrates strong financial performance.

Australia’s CBA Reports Record Annual Profit Driven by Strong Lending Growth

Commonwealth Bank of Australia (CBA) has announced its highest-ever annual profit, fueled primarily by robust growth in its lending portfolio. The bank reported a significant uptick in home loans and business lending, reflecting strong consumer demand and favorable economic conditions. Despite facing challenges such as increased regulatory scrutiny and inflationary pressures, CBA’s diversified revenue streams helped cushion the impact, allowing it to post record figures.

However, the market reaction was mixed, as investors responded to the profit report by offloading shares, perhaps deterred by the bank’s high valuation and concerns over future interest rate movements. Analysts noted several key factors influencing the stock’s performance:

- Elevated share prices raising concerns about potential corrections

- Economic uncertainties including inflation and global market volatility

- Regulatory environment tightening around lending practices

- Competition from emerging fintech firms disrupting traditional banking

| Financial Metric | FY 2024 | FY 2023 | Change |

|---|---|---|---|

| Net Profit (AUD Billion) | 12.3 | 10.8 | +13.9% |

| Home Loan Growth | 8.2% | 6.5% | +1.7 pts |

| Business Lending Growth | 7.5% | 5.9% | +1.6 pts |

| Return on Equity | 15.4% | 14.1% | +1.3 pts |

Investor Sentiment Shifts as Share Prices Face Pressure Despite Robust Earnings

Despite reporting a record annual profit, Commonwealth Bank of Australia has seen a notable pullback in its share price, highlighting a disconnect between strong corporate earnings and the current investor mood. Market analysts suggest that while the bank’s financial health remains robust, concerns over rising interest rates, inflationary pressures, and global economic uncertainties have weighed heavily on investor confidence. This shift is reflected in a cautious approach, with shareholders increasingly opting to trim holdings of high-priced stocks in favor of more defensive assets.

Investor behavior indicates a broader trend impacting the banking sector and blue-chip stocks alike, where:

- Profitability growth is being overshadowed by macroeconomic fears

- Valuations are being reassessed in light of potential economic slowdowns

- Short-term market volatility is influencing long-term portfolio strategies

| Metric | FY2023 | Market Reaction |

|---|---|---|

| Net Profit | $12.3 billion | +8% YoY |

| Share Price Change (Post-Report) | -3.7% | Investor Sell-off |

| Dividend Yield | 4.9% | Steady |

Analysts Advise Caution for Investors Amid Valuation Concerns and Market Volatility

Despite the Commonwealth Bank of Australia’s (CBA) impressive record annual profit, market analysts urge investors to exercise prudence due to current valuation pressures and ongoing market fluctuations. The substantial gains have prompted multiple questions regarding whether the stock is overvalued relative to its future growth potential. Experts highlight that while CBA’s earnings growth is robust, the share price has outpaced fundamental indicators, signaling a potential correction in the near term.

Key concerns raised include:

- High price-to-earnings (P/E) ratio: Suggesting inflated market expectations.

- Global economic uncertainties: Which could dampen investor sentiment and impact banking sector performance.

- Interest rate volatility: Affecting borrowing costs and loan demand.

| Metric | Current Value | Industry Average |

|---|---|---|

| P/E Ratio | 18.5 | 14.2 |

| Dividend Yield | 3.8% | 4.2% |

| Price to Book | 2.4 | 1.9 |

Given these factors, analysts recommend a cautious approach to capital allocation, advising investors to balance growth prospects with risk management strategies. Short-term traders might capitalize on volatility-driven price movements, but long-term holders should consider valuation adjustments realistically amid a potentially unstable market backdrop.

The Conclusion

As Commonwealth Bank of Australia announces a record annual profit, investor sentiment tells a more cautious story, with shares shedding value amid concerns over elevated prices. The contrast highlights the complex dynamics facing Australia’s banking sector as it navigates both strong financial performance and evolving market expectations. Investors and analysts alike will be closely watching CBA’s next moves as the bank seeks to balance growth with shareholder returns in an uncertain economic environment.