France is confronting a challenging series of credit rating assessments as ongoing political turmoil casts a shadow over its economic stability. Amid a backdrop of governmental uncertainty and widespread protests, financial markets and international rating agencies are closely monitoring the country’s fiscal outlook. This critical period poses significant implications for France’s borrowing costs and investor confidence, raising questions about the resilience of its economy in the face of mounting political unrest.

France’s Credit Rating Under Scrutiny as Political Unrest Escalates

France is currently navigating turbulent financial waters as escalating political unrest raises concerns among global credit rating agencies. The ongoing protests, primarily fueled by contentious labor reforms and widespread public dissatisfaction, have intensified uncertainties surrounding the country’s economic stability. Analysts warn that sustained demonstrations could undermine investor confidence, potentially prompting agencies to reassess France’s sovereign debt outlook.

Key factors placing pressure on France’s credit ratings include:

- Disruption to economic activities: Strikes and blockades affecting transport and manufacturing sectors.

- Fiscal strain: Rising government expenditure aimed at addressing social grievances.

- Political volatility: Questions over policy continuity and leadership effectiveness.

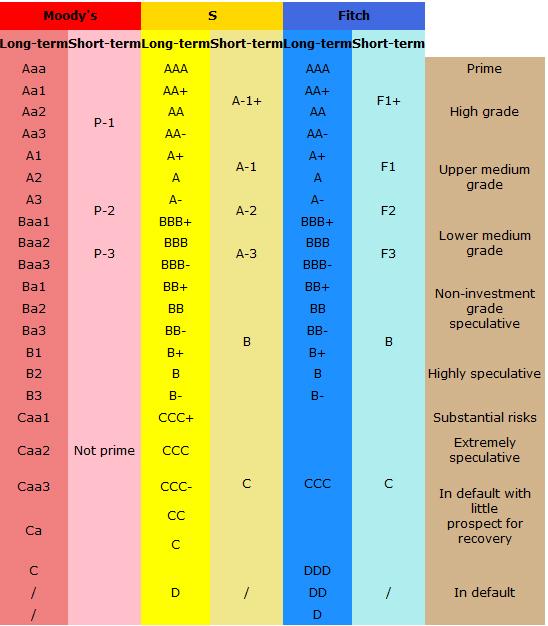

| Agency | Current Rating | Potential Adjustment |

|---|---|---|

| Moody’s | Aa2 (Stable) | Watch negative |

| S&P Global | AA (Stable) | Negative outlook |

| Fitch | AA (Stable) | Potential downgrade |

Economic Implications of Government Instability on Investor Confidence

The ongoing political turmoil in France is sending ripples through global financial markets, shaking investor confidence to its core. Political instability often breeds uncertainty, prompting both domestic and international investors to hit pause on large-scale commitments. Market players are increasingly concerned about potential policy reversals and delays in economic reforms, which could undermine France’s fiscal discipline and growth prospects. This environment of unpredictability leads to heightened volatility in bond yields and stock market indices, further complicating the investment landscape.

Key economic repercussions include:

- Rising borrowing costs due to increased perception of risk

- Delayed foreign direct investments as businesses weigh political risks

- Dampened consumer spending tied to eroding sentiment

- Pressure on France’s credit ratings, potentially elevating debt servicing expenses

| Indicator | Current Trend | Impact Level | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Government Bond Yields | Rising | High | |||||||||||

| Foreign Direct Investment | Declining | Moderate | |||||||||||

| Consumer Confidence Index | Strategic Measures for Navigating Financial Risks Amid Uncertain Political Landscape

In the current climate marked by political volatility, businesses operating in France must adopt a proactive approach to mitigate financial risks. Key strategies include diversifying investment portfolios to cushion against market fluctuations and strengthening liquidity reserves to maintain operational flexibility. Close monitoring of credit rating updates is essential, as downgrades can rapidly alter borrowing costs and investor confidence. Furthermore, engaging in scenario planning allows companies to anticipate potential policy changes and adjust financial plans accordingly. Risk managers should also prioritize communication with stakeholders, ensuring transparency around fiscal health and contingency measures. Leveraging financial instruments such as hedging can provide additional layers of protection against currency and interest rate volatility. The following table summarizes critical strategic measures and their primary benefits, offering a concise guide for navigating the complexities of France’s economic environment amid political chaos:

In ConclusionAs France navigates this tumultuous period marked by political instability and economic uncertainty, the coming weeks will be critical in determining its creditworthiness on the global stage. Credit rating agencies are poised to deliver assessments that could influence investment flows and borrowing costs, adding a new layer of pressure on policymakers. How France manages this intersection of politics and finance will not only shape its economic trajectory but could also set a precedent for other nations grappling with similar challenges. |