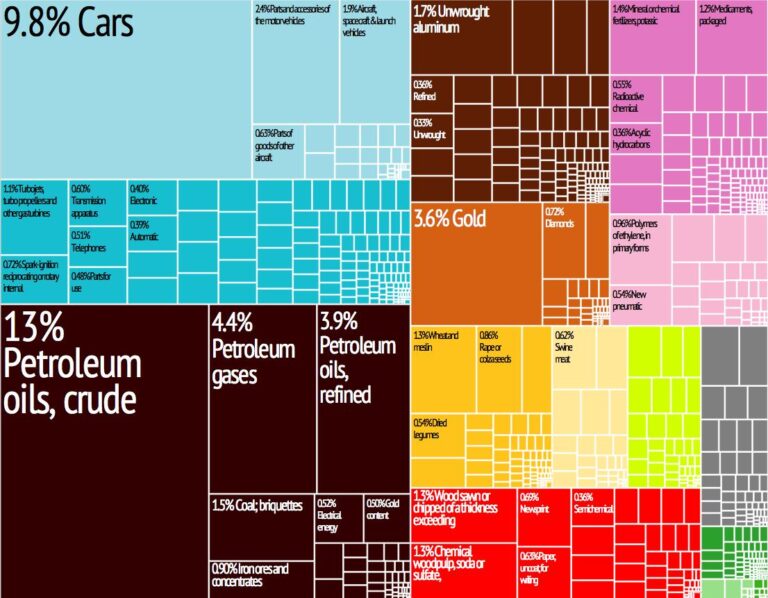

Canada stands as one of the world’s leading players in global trade, leveraging its vast natural resources and advanced manufacturing sectors to maintain a dynamic export and import profile. According to The Observatory of Economic Complexity, Canada’s economic landscape is intricately connected with a diverse network of trade partners, shaping the flow of goods and services across international borders. This article delves into the latest data on Canada’s exports and imports, highlighting key commodities and trading relationships that drive the nation’s economy and influence global markets.

Canada Export Trends Reveal Growing Demand for Natural Resources

Recent data highlights a significant shift in Canada’s export portfolio, with a marked increase in the demand for its abundant natural resources. Forestry products, minerals, and energy commodities such as crude oil and natural gas have surged as primary drivers of export growth. This rising appetite stems from global markets focusing on sustainable energy transitions and infrastructure investments, boosting Canadian resource exports particularly to Asia and Europe. Key sectors benefitting include lumber, copper, and potash, reflecting Canada’s strategic positioning in global supply chains.

Top Natural Resource Exports (2023)

- Crude Petroleum – 27%

- Wood and Lumber – 18%

- Natural Gas – 14%

- Copper Ores and Concentrates – 11%

- Potash and Fertilizers – 9%

| Export Partner | Resource Export Share | Growth (YoY %) |

|---|---|---|

| China | 35% | 12% |

| United States | 40% | 7% |

| Germany | 10% | 9% |

| Japan | 8% | 15% |

Key Import Categories Reflect Shifts in Domestic Consumption Patterns

Canada’s import landscape reveals a dynamic evolution in consumer preferences and industrial demands. Notably, imports of electronics and machinery have surged, reflecting a growing domestic appetite for advanced technology and automation equipment. Additionally, the rise in pharmaceutical products and medical devices points to an increased focus on healthcare and wellness sectors. Meanwhile, the expansion of the automotive parts and components category underscores Canada’s ongoing commitment to maintaining a robust manufacturing base amid shifting global supply chains.

Changes in food and beverage imports further illustrate shifting domestic consumption patterns. There is a marked increase in the import of organic and specialty food products, catering to a more health-conscious and diverse population. Simultaneously, Canada’s growing demand for energy products, particularly refined petroleum and natural gas, highlights the balance between domestic production limitations and consumption needs. The table below summarizes some of the key import categories and their recent trends:

| Import Category | Trend | Implication |

|---|---|---|

| Electronics & Machinery | Sharp Increase | Tech-driven growth |

| Pharmaceuticals & Medical Devices | Steady Rise | Focus on healthcare |

| Automotive Parts | Moderate Growth | Supply chain resilience |

| Organic & Specialty Foods | Significant Growth | Changing consumer tastes |

| Energy Products | Stable Demand | Supply-demand balance |

Strategic Recommendations for Strengthening Trade Partnerships and Market Diversification

To enhance the resilience of Canada’s trade landscape, businesses and policymakers should prioritize diversifying export destinations beyond traditional partners such as the United States. Expanding outreach to emerging markets in Asia, Latin America, and Africa can open new revenue streams and reduce vulnerability to geopolitical shifts. Adoption of advanced data analytics will allow stakeholders to identify niche sectors with high growth potential, such as clean energy technologies and value-added agricultural products, thereby capitalizing on shifting global demands. Additionally, strengthening trade agreements with dynamic economies will foster streamlined regulatory frameworks and reduce tariff barriers, facilitating smoother cross-border commerce.

Efforts to deepen cooperation with existing trade partners must focus on enhancing supply chain integration and innovation exchange. Initiatives like joint research projects, intellectual property sharing, and harmonized standards can boost competitiveness and long-term trade sustainability. The table below outlines key strategic focus areas alongside actionable initiatives:

| Focus Area | Actionable Initiative | Expected Outcome |

|---|---|---|

| Market Expansion | Target emerging markets via trade missions and digital platforms | Increased export volume & diversified risk |

| Supply Chain Optimization | Develop regional logistics hubs with partner countries | Reduced costs & improved delivery times |

| Innovation Collaboration | Establish bilateral R&D funding programs | Enhanced product competitiveness |

To Conclude

In summary, Canada’s dynamic trade landscape, characterized by a diverse range of exports and imports, continues to play a pivotal role in the global economy. As detailed by The Observatory of Economic Complexity, key trade partnerships and shifting market trends highlight Canada’s strategic position in international commerce. Monitoring these developments will be essential for policymakers and businesses alike, as the country navigates the evolving challenges and opportunities of global trade.