As tensions escalate on the global stage, China’s expanding economic ambitions have sparked fresh concerns about the stability of the world economy. In a recent analysis by National Review, experts warn that Beijing’s strategic maneuvers-ranging from trade practices to technological dominance-pose significant challenges to international markets and geopolitical alliances. This article delves into the multifaceted threats emerging from China’s rise, examining how its policies and actions could reshape the economic order and what that means for global stakeholders.

China’s Growing Economic Influence and Its Global Implications

China’s rapid ascent as a global economic powerhouse has reshaped the international landscape, creating both opportunities and challenges for the world market. Its expanding influence is evident in diverse arenas – from infrastructure investments under the Belt and Road Initiative to technological advancements and dominance in manufacturing supply chains. This shift places traditional economic powers on alert as China not only competes on price but also aggressively pursues strategic sectors like artificial intelligence, 5G, and green technologies. The resulting interdependencies make global markets more susceptible to economic shocks originating from Beijing’s policies or geopolitical moves.

Several critical implications emerge from this growing dominance:

- Supply chain vulnerabilities: Overreliance on Chinese manufacturing risks disruptions amplified by political tensions or pandemics.

- Shift in global trade norms: China’s approach challenges existing multilateral frameworks, favoring bilateral deals and regional blocs.

- Currency influence: The yuan’s growing acceptance could redefine international reserve currencies and financial markets.

| Sector | China’s Global Market Share | Key Export Regions |

|---|---|---|

| Electronics | 45% | Asia, North America |

| Renewable Energy Tech | 38% | Europe, Africa |

| Automotive Parts | 30% | South America, Asia |

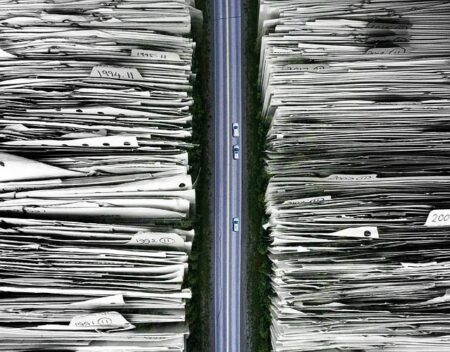

Challenges Posed by Supply Chain Dependencies and Market Dominance

The global economy increasingly hinges on a fragile ecosystem dominated by China’s extensive supply chain networks. This dependency exposes countries to severe risks, including sudden disruptions in manufacturing and logistics. For instance, key industries in electronics, pharmaceuticals, and automotive sectors rely heavily on Chinese raw materials and components. Any interruption-whether due to geopolitical tensions, natural disasters, or policy shifts-can trigger cascading effects, paralyzing production and inflating costs worldwide. The lack of alternative suppliers demonstrates how market dominance translates into economic leverage, which China can wield through strategic embargoes or pricing controls.

Moreover, China’s market leadership skews global trade dynamics in ways that challenge free-market principles. Its control over rare earth minerals, vital for high-tech industries, underscores this dominance:

- 80% of global rare earth supply comes from China.

- 90% of global lithium processing capacity is concentrated within Chinese borders.

- Majority of photovoltaic panels and batteries rely on Chinese-manufactured components.

These monopolistic tendencies inhibit competition and funnel profits back into Beijing’s geopolitical agenda. The table below illustrates how critical sectors are affected by deep-rooted supply dependencies:

| Sector | Dependence Level | Global Impact |

|---|---|---|

| Electronics | High | Production delays, price spikes |

| Renewable Energy | Medium | Supply shortages, slowed green transitions |

| Pharmaceuticals | High | Drug shortages, research setbacks |

| Automotive | Medium | Inventory bottlenecks, increased costs |

Strategic Policy Recommendations to Mitigate Risks and Strengthen Economic Security

To counterbalance the profound economic risks posed by China’s expanding global influence, governments must adopt a multifaceted approach that prioritizes resilience and diversification. Key strategies include strengthening supply chain security by encouraging domestic production of critical goods and reducing dependence on authoritarian regimes. Additionally, enhancing transparency in foreign investments can curb covert capital flows that undermine economic autonomy. Policy-makers should also bolster alliances with like-minded democracies to create alternative trade networks that promote fair competition and reduce vulnerabilities.

- Invest in advanced technologies to maintain innovation leadership and avoid technology transfer risks.

- Implement rigorous due diligence mechanisms for Chinese investments in sensitive sectors.

- Promote regulatory coordination across borders to counteract unfair trade practices and intellectual property theft.

| Policy Focus | Objective | Expected Outcomes |

|---|---|---|

| Supply Chain Resilience | Reduce reliance on Chinese imports | Enhanced national security, fewer disruptions |

| Investment Screening | Prevent strategic asset control by foreign entities | Preserved economic sovereignty |

| Allied Trade Agreements | Establish alternative markets | Balanced global trade dynamics |

Key Takeaways

As global markets grapple with increasing uncertainty, China’s expanding economic influence continues to pose complex challenges for policymakers worldwide. Balancing cooperation with strategic caution will be crucial as nations navigate the repercussions of China’s ambitions on trade, technology, and geopolitical stability. The coming years will reveal whether the international community can effectively address these risks or if the strain on the world economy will deepen.