Italy’s bond spread has narrowed to its lowest level in 15 years, signaling renewed investor confidence as traders rally behind Prime Minister Giorgia Meloni’s government. According to Bloomberg, market participants are interpreting this development as a vote of trust in Italy’s fiscal and political stability, reflecting optimism about the country’s economic outlook amid ongoing European Union negotiations and domestic reforms. This milestone underscores a significant shift in sentiment toward Italy’s sovereign debt, highlighting the impact of Meloni’s leadership on market dynamics.

Italy Bond Spread Hits 15-Year Low Reflecting Renewed Investor Confidence in Meloni’s Leadership

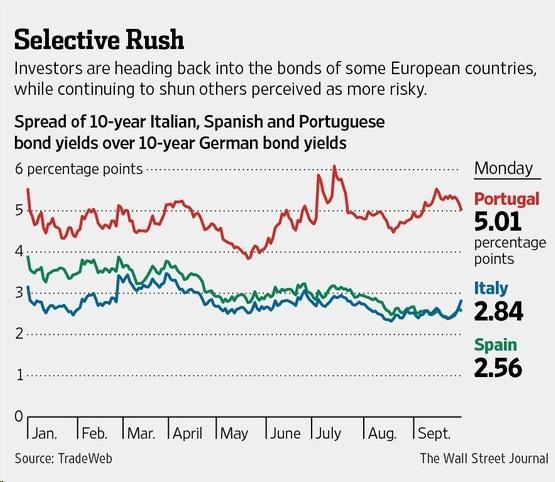

The Italian government’s borrowing costs have seen a significant decline, signaling strong market approval of Prime Minister Giorgia Meloni’s fiscal policies. The spread between Italian 10-year bonds and their German counterparts has tightened to levels not witnessed since the mid-2000s, underscoring heightened investor trust in Italy’s economic direction. Analysts attribute this trend to Meloni’s commitment to fiscal responsibility, public spending reforms, and efforts to stabilize Italy’s debt trajectory while navigating complex EU regulations.

Key factors driving this shift include:

- Enhanced political stability under Meloni’s leadership

- Clear debt reduction strategies supported by credible economic forecasts

- Improved relations with EU institutions, fostering investor confidence

- Robust performance in Italy’s industrial and export sectors

| Metric | Current Value | 15-Year Average |

|---|---|---|

| Italy-Germany 10Y Bond Spread (bps) | 110 | 165 |

| Italy 10Y Yield (%) | 3.5 | 4.8 |

| Italian GDP Growth Forecast | 1.2% | 0.9% |

Market Analysis Reveals Key Drivers Behind Shrinking Yield Gaps and Economic Stability Prospects

Recent market dynamics indicate that diminishing yield gaps between Italian government bonds and their German counterparts are driven by a combination of investor confidence in Italy’s fiscal management and a strengthened political outlook. The active support from traders stems largely from the perceived stability introduced by Prime Minister Giorgia Meloni’s government, which has successfully positioned Italy as a more attractive destination for fixed-income investments. Key economic indicators convey improved debt sustainability and reduced default fears, resulting in these historical lows in bond spreads.

Among the primary catalysts are:

- Fiscal consolidation measures that have alleviated concerns over budget deficits.

- European Central Bank policies that maintain a favorable environment for Italian credit instruments.

- Political stability and decisive governance boosting investor trust.

- Improved macroeconomic metrics signaling sustainable growth and reduced volatility.

The interplay of these factors highlights a cautious yet optimistic forecast for Italy’s economic resilience, while also driving a narrowing in yield differentials that investors watch closely to assess relative risk profiles.

| Indicator | Current Value | Change (6 months) |

|---|---|---|

| Italy-Germany 10Y Spread (bps) | 110 | ↓ 45% |

| Government Debt-to-GDP Ratio | 137% | ↔ Stable |

| Investor Confidence Index | 72 | ↑ 12 pts |

Strategies for Investors to Leverage Italy’s Improving Credit Metrics Amid Shifts in Eurozone Dynamics

With Italy’s bond spread closing in on a 15-year low, investors are presented with a unique opportunity to capitalize on the country’s improving fiscal outlook amid evolving Eurozone dynamics. The strengthening political confidence surrounding Prime Minister Giorgia Meloni has translated into reduced risks for Italian sovereign debt, prompting traders to re-assess yield premiums and recalibrate portfolio allocations accordingly. Key strategies to consider include:

- Selective Bond Accumulation: Target Italian government bonds with mid-to-longer maturities to benefit from potential spread tightening as market optimism strengthens.

- Curve Flattening Trades: Exploit the decreasing disparity between short and long-term yields, anticipating further compression as fiscal reforms and ECB policies take hold.

- Cross-Border Diversification: Leverage Italy’s improved credit metrics within a broader Eurozone bond basket to capitalize on both relative value and systemic stabilization.

Furthermore, macroeconomic shifts in the Eurozone-inflation trajectories, ECB policy pivots, and geopolitical factors-remain crucial in shaping Italy’s credit profile. Investors should maintain agile risk management frameworks, balancing the momentum from Italy’s fiscal progress with potential volatility from broader external pressures. Below is a snapshot comparison of Italy’s bond spread evolution relative to other peripheral Eurozone countries, underscoring Italy’s pronounced improvement:

| Country | Bond Spread (bps) Jan 2009 | Bond Spread (bps) Today | % Change | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Italy | 350 | 110 | -68.6% | ||||||||||||||||

| Spain | 425 | 180 | -57.6% | ||||||||||||||||

| Portugal | 490 | 130 | -73.5% | ||||||||||||||||

| Greece | 1450 | 370 | -74.5%

With Italy’s bond spread closing in on a 15-year low, investors are presented with a unique opportunity to capitalize on the country’s improving fiscal outlook amid evolving Eurozone dynamics. The strengthening political confidence surrounding Prime Minister Giorgia Meloni has translated into reduced risks for Italian sovereign debt, prompting traders to re-assess yield premiums and recalibrate portfolio allocations accordingly. Key strategies to consider include:

Furthermore, macroeconomic shifts in the Eurozone-inflation trajectories, ECB policy pivots, and geopolitical factors-remain crucial in shaping Italy’s credit profile. Investors should maintain agile risk management frameworks, balancing the momentum from Italy’s fiscal progress with potential volatility from broader external pressures. Below is a snapshot comparison of Italy’s bond spread evolution relative to other peripheral Eurozone countries, underscoring Italy’s pronounced improvement:

|