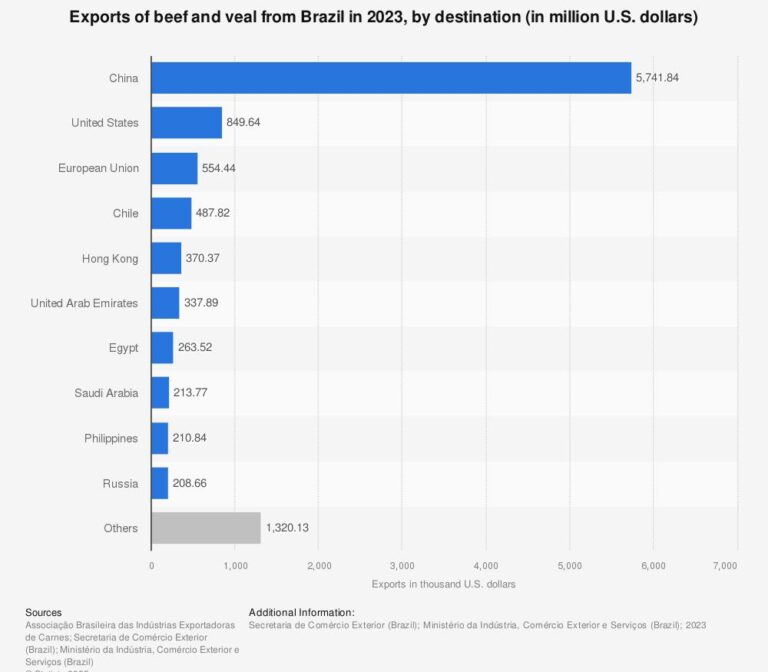

Brazil’s beef exports to China have soared amid shifting global trade dynamics triggered by U.S. tariffs under the Trump administration. As Beijing seeks alternative suppliers to offset rising costs and supply uncertainties, Brazilian producers are capitalizing on increased demand, reshaping the global beef market. This development highlights the broader impact of trade policies on international supply chains and economic relations, with significant implications for both South American exporters and Asian consumers.

Brazil’s Beef Exports to China Reach New Heights Amid Shifting Trade Dynamics

In the wake of shifting international trade policies, Brazil has emerged as a dominant player in the global beef market, capitalizing on China’s increased import demand. With tariffs imposed by the United States under the previous administration disrupting traditional supply chains, China has sought alternative suppliers to fulfill its growing appetite for beef. Brazil’s vast cattle industry and competitive pricing positioned it as an ideal beneficiary of this realignment, driving export volumes sharply upward in recent months. Industry insiders note that Brazilian producers have ramped up production and streamlined logistics to meet the surging Chinese demand, signaling a durable shift in trade patterns.

Several key factors underpin this export surge:

- Competitive advantage: Brazil’s ability to offer high-quality beef at lower costs compared to other exporters.

- Trade agreements: Favorable diplomatic ties and reduced tariffs between Brazil and China enhance market access.

- Supply chain resilience: Brazilian infrastructure investments have improved export capacity.

Below is a snapshot of Brazil’s monthly beef export trends to major markets (in thousand tons):

| Month | China | USA | EU |

|---|---|---|---|

| Jan 2024 | 45 | 12 | 18 |

| Feb 2024 | 50 | 11 | 17 |

| Mar 2024 | 53 | 13 | 19 |

Impact of US Tariffs on Global Beef Supply Chains and Market Realignments

The imposition of tariffs on US beef by major trading partners has triggered a notable shift within global beef supply chains, compelling buyers and sellers to realign their strategies. The ripple effects are most apparent in the rise of alternative exporters like Brazil, which has stepped into the void left by the United States in key Asian markets. With China imposing retaliatory tariffs on American beef during the Trump administration, its demand has rapidly pivoted toward Brazilian suppliers, who have leveraged competitive pricing and increased production capacity to capture market share.

- Supply chain diversification: Importers have sought to lessen dependency on US beef, fostering broader supplier networks in South America.

- Price competitiveness: Brazilian beef suppliers have benefitted from depreciated currency rates, making exports more attractive.

- Regulatory adaptations: Enhanced quarantine and certification processes have smoothed trade channels between Brazil and China.

- Market volatility: Fluctuating US tariffs have injected uncertainty, encouraging longer-term contracts with emerging exporters.

| Country | Beef Export Volume to China (2020) | Beef Export Volume to China (2023) | Percentage Change |

|---|---|---|---|

| United States | 120,000 tons | 50,000 tons | -58.3% |

| Brazil | 70,000 tons | 150,000 tons | +114.3% |

| Australia | 90,000 tons | 100,000 tons | +11.1% |

These market realignments not only impact trade balances but also influence domestic agricultural policies and production practices. Brazil’s beef industry, now more integrated with global demand networks, is investing heavily in sustainable farming and traceability systems to meet stringent quality standards demanded by Chinese consumers. Meanwhile, US exporters are recalibrating their focus towards alternative markets and premium beef segments to offset tariff-induced losses. The evolving geopolitical landscape underscores how trade policies can reverberate deeply through supply chains, triggering far-reaching economic and operational changes.

Strategic Recommendations for Brazilian Producers to Sustain Growth in Asian Markets

To capitalize on the growing demand for Brazilian beef in Asian markets, producers must prioritize diversification of product lines. While China remains the dominant importer, expanding outreach to emerging markets such as South Korea, Japan, and Vietnam can mitigate risks associated with geopolitical uncertainties and trade policy shifts. Emphasizing quality certification, traceability, and sustainable practices will build trust among discerning Asian consumers, who increasingly associate premium beef with responsible sourcing. Furthermore, leveraging technology for cold chain logistics and supply chain transparency can enhance Brazil’s competitive edge by reducing spoilage and ensuring consistent product quality.

In addition, strategic partnerships and tailored marketing campaigns are essential to deepen brand presence. Brazilian exporters should collaborate with local distributors and retailers to adapt to regional preferences and consumption habits. Investing in consumer education initiatives about the unique characteristics of Brazilian beef can encourage brand loyalty and justify premium pricing. The table below outlines key focus areas for sustained growth:

| Strategic Focus | Key Actions | Expected Impact |

|---|---|---|

| Product Diversification | Introduce cuts & value-added products | Broader market appeal, risk mitigation |

| Supply Chain Innovation | Implement cold chain tech & traceability | Improved quality & consumer confidence |

| Market Penetration | Partner with local distributors | Enhanced regional access & brand presence |

| Consumer Engagement | Launch educational campaigns | Increased awareness and product loyalty |

The Conclusion

As Brazil’s beef exports to China continue to soar amid shifting global trade dynamics, the ripple effects of U.S. tariff policies remain evident in international markets. This surge underscores the growing influence of geopolitical decisions on commodity flows and highlights Brazil’s expanding role as a key supplier in meeting China’s rising demand. Observers will be closely watching how these trade realignments evolve, and what they mean for producers and consumers alike in the months ahead.