Argentina’s central bank is on a remarkable dollar-buying streak, propelling foreign reserves to their highest levels since the Milei administration took office-showcasing a bold and determined effort to stabilize the economy despite ongoing challenges

Browsing: central banking

Economists anticipate the Bank of Canada will keep interest rates steady in 2026, focusing on taming inflation amid a cautious economic outlook. Market experts predict gradual policy adjustments designed to support steady, sustainable growth

Japan’s two-year government bond yield has surged to its highest level since 2008, driven by growing market excitement over potential rate hikes. Investors are now closely watching the Bank of Japan, eagerly awaiting its next move in shaping monetary policy

The Bank of Japan is preparing to possibly raise interest rates at its December meeting, the Chief Governor revealed, signaling a major departure from the central bank’s decades-long ultra-loose monetary policy

Brazil’s central bank decided to hold interest rates steady, signaling a strategic pause designed to fuel economic recovery as inflation eases. This choice reflects cautious optimism amid persistent global uncertainties

Scott Bessent, a renowned investor, raises a red flag, warning that Japan is dangerously “behind the curve” on interest rates. As global central banks accelerate their monetary tightening, he shines a spotlight on the growing risks tied to Japan’s slow pace in raising rates

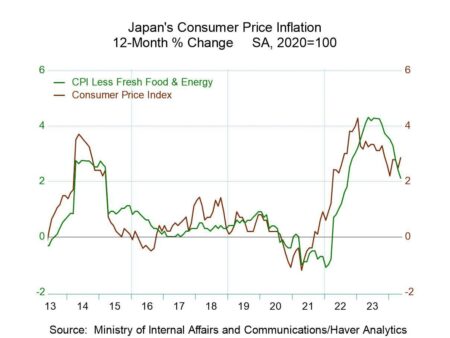

Japan’s core inflation slipped slightly but remained above the Bank of Japan’s 2% target, sparking market excitement over a potential rate hike as policymakers navigate the delicate balance between inflation pressures and economic growth

China’s central bank has injected a fresh wave of liquidity to ease worries over a potential cash crunch, underscoring its dedication to maintaining stable credit conditions amid slowing economic growth, reports the Wall Street Journal

The RBA is poised to deliver rapid rate cuts if economic instability arises from Trump’s policies, according to minutes that highlight a determined commitment to strengthening Australia’s economy amid global uncertainties

As former Bank of Canada Governor Mark Carney gears up for his meeting with Donald Trump, he’s in for a dynamic exchange filled with economic insights and potential policy debates. Expect lively discussions on crucial topics like trade, climate change, and the ever-evolving global financial landscape as both leaders tackle the intricate challenges facing our world today.

China is making a strategic move to lessen its dependence on US Treasuries, redirecting its investments towards more dynamic options like commodities and emerging markets. This shift not only showcases a savvy financial strategy but also underscores China’s commitment to bolstering its financial stability in the face of rising geopolitical tensions

In a defining moment for Canadian economic leadership, Mark Carney steps into the spotlight with the ambitious mission of transforming the nation’s economy. His appointment marks a significant turning point as Canada embarks on a journey through intricate fiscal landscapes, all while striving for sustainable growth.

The Bank of Canada’s governing council recently explored the idea of slashing interest rates once more in April, highlighting their persistent worries about economic growth. This discussion is part of a larger strategy aimed at tackling inflation while bolstering the Canadian economy.

The Bank of Canada has chosen to keep its interest rates steady as it carefully evaluates the effects of recent tariffs on the economy. This decision highlights the central bank’s commitment to striking a balance while addressing new economic hurdles.

The Bank of Canada has decided to maintain its key interest rate at 2.75%, citing concerns that escalating trade tensions could lead to a potential recession. The decision reflects ongoing economic uncertainty amid global trade disputes.

German officials are raising concerns about the validity of the $109 billion in U.S. gold reserves, demanding verification of bullion bars held at the New York Federal Reserve. This request could have significant implications for international gold holdings.

Germany is contemplating the withdrawal of its 1,200-ton gold reserves stored in the U.S., a move seen as a response to rising tensions during Donald Trump’s presidency. This potential action highlights ongoing concerns over international trust and economic security.

Japan’s inflation rate has slowed more than anticipated, yet remains elevated, prompting speculation about the Bank of Japan’s potential interest rate hikes. Analysts suggest that persistent price pressures may force the central bank to act sooner than expected.

Japan’s 10-year government bond yield has reached its highest level since 2008, driven by investor speculation regarding potential interest rate hikes by the Bank of Japan. This shift marks a significant change in the country’s longstanding monetary policy stance.

In a concerning indication of economic strain, the German Central Bank reported significant losses, highlighting challenges ahead for Europe’s largest economy. Analysts warn this trend may reflect deeper issues, raising alarms about Germany’s financial stability.