Spain’s unemployment surged by 0.91% in October compared to September, driving the total number of jobless individuals to a staggering 2.44 million, according to TradingView data. This increase highlights the ongoing challenges and uncertainties gripping Spain’s labor market

Browsing: economic indicators

Germany’s economy came to a halt in Q3, igniting fresh fears of an impending recession. The flat GDP highlights growing challenges from global uncertainties and domestic hurdles, ramping up urgent demands for bold policy measures to avoid a prolonged downturn

Spain’s inflation rate jumped from 2.9% to 3.1% in October, spotlighting the relentless upward pressure on prices. This increase highlights the continuing economic hurdles driven by volatile global markets

Australia’s annual inflation surged dramatically to 3.2% in the September quarter, up from 2.1% in June. This steep climb, driven by soaring fuel and food prices, underscores the growing cost-of-living challenges facing households, the Australian Broadcasting Corporation reports

German business confidence has surged to its highest point since 2022, igniting renewed optimism as supply chain hurdles ease and inflation holds steady. Experts see this upswing as a strong sign of hope for Europe’s largest economy

German business activity soared to its highest level in over two years this October, driven by strong expansion in both manufacturing and services, according to the latest Purchasing Managers’ Index (PMI) data released by Reuters

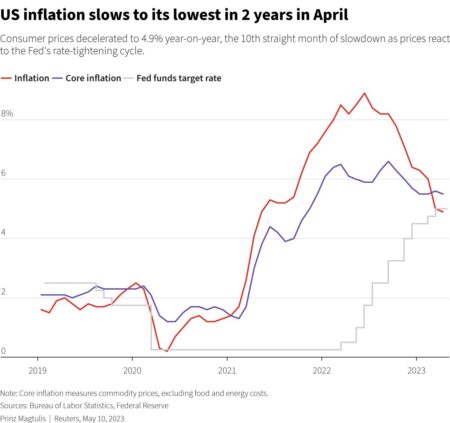

This week, investors are on high alert as key data drops, featuring CPI numbers from the US, UK, Japan, and Canada, along with the Flash Global PMIs. Attention is also riveted on Japan’s crucial upper house election. Markets are gearing up for significant shifts as inflation trends and growth indicators take center stage

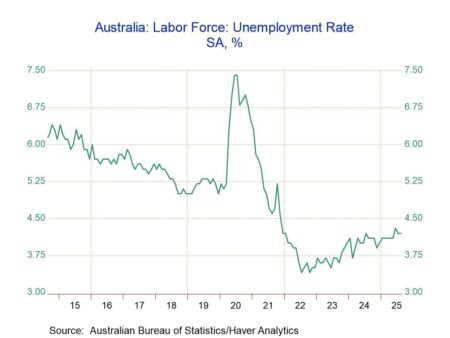

Australia’s unemployment rate has surged to its highest point in four years, raising fresh concerns about the country’s economic future. To revive the struggling job market, the Reserve Bank of Australia is now considering a cut in interest rates

Australia (AUS) shines with a dynamic trade landscape, exporting abundant minerals and vibrant agricultural products while importing state-of-the-art machinery and electronics. Partnering closely with economic giants like China, Japan, and the United States, Australia plays a crucial role on the global stage

Australia’s consumer sentiment plunged to its lowest level in six months this October, as soaring inflation concerns take the spotlight, Westpac revealed. This decline underscores growing unease among households about the economy and their upcoming spending decisions

Russia’s private sector activity has plunged to its lowest point in three years, highlighting growing economic struggles amid persistent sanctions and escalating geopolitical tensions, reports The Moscow Times

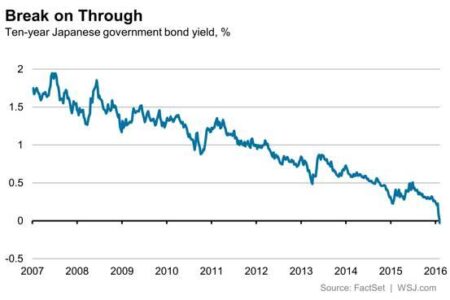

Japan’s bond yields have surged to a 16-year high, igniting a wave of speculation about a potential interest rate hike. Investors are on edge, closely watching the Bank of Japan’s next move as inflation pressures steadily mount

Brazil’s corporate sector is facing a storm as a wave of high-profile business collapses reveals profound economic instability. Experts warn that this troubling trend could rattle investor confidence and derail the nation’s journey toward recovery

Poverty in Argentina dropped to 31.6% in the first half of 2025, according to INDEC data. This remarkable decline signals a hopeful shift amid ongoing economic struggles, showcasing a steady rise in living standards for countless Argentinians

India’s trade scene is a dynamic tapestry, exporting a dazzling array of goods from petroleum products to colorful textiles. Meanwhile, it brings in essential items like crude oil and state-of-the-art electronics. Partnering with global giants such as the US, China, and UAE, India’s international ties are expanding at an exciting pace, reports The Observatory of Economic Complexity

German investor morale soared unexpectedly in September, according to the ZEW Economic Sentiment Index released on Thursday. This remarkable upswing signals a fresh wave of optimism, shining through despite persistent economic uncertainties

The Canadian dollar dipped further on Monday, weighed down by growing global uncertainties and a drop in commodity prices, according to market experts at Mitrade

China’s export growth in August hit its slowest pace in six months, falling short of analyst predictions. This decline highlights ongoing struggles with global demand amid economic uncertainties, intensifying pressure on the world’s second-largest economy

Spain’s services PMI dipped from 55.1 in July to 53.2 in August, signaling a cooling in the sector’s rapid expansion. Yet, with the index firmly above the 50-point mark, steady growth remains on track

German manufacturing showed unexpected strength in August, with the PMI indicating a softer decline than many had predicted. This encouraging data fuels cautious optimism amid ongoing economic challenges, Reuters reports