Weekend Long Read: Explore the dynamic blend of China’s groundbreaking infrastructure expertise and Brazil’s vibrant cultural energy. Caixin Global reveals how this powerful partnership is unlocking thrilling opportunities and navigating intricate challenges, shaping the future of both countries

Browsing: emerging markets

Microsoft is investing a staggering US$17.5 billion in India to turbocharge AI adoption across the nation. This ambitious initiative promises to spark groundbreaking innovation, elevate digital skills, and create the robust infrastructure required to deliver AI’s transformative benefits to millions throughout the country

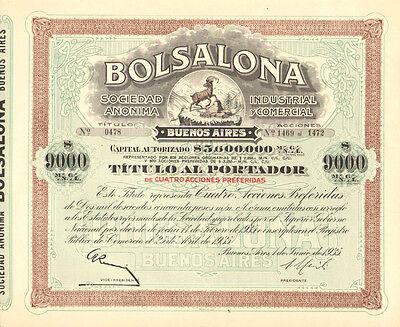

The Global X MSCI Argentina ETF has surged over 200% this year, driven by soaring commodity prices and a wave of renewed optimism about the country’s economic recovery. Investors are buzzing with excitement as Argentina’s market gains unexpected momentum, making it a hotspot to watch closely

Brazil’s central bank is gearing up to inject a hefty $2 billion into the market through dollar auctions with a repurchase agreement on Tuesday. This strategic move aims to stabilize the currency and ease mounting market pressures, providing a vital boost to liquidity amid persistent global uncertainties

Concurrent Technologies and two other rising stars are turning heads as some of the most thrilling investment opportunities in the UK. Industry experts are buzzing about their groundbreaking innovations and remarkable growth potential in today’s dynamic market

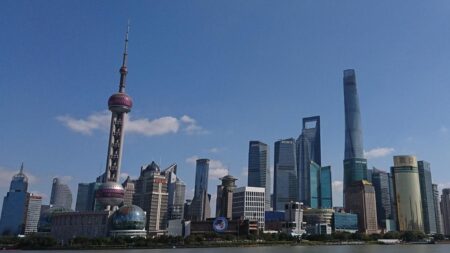

China’s bold innovation strategy is rapidly reshaping global industries, driving technology, cutting-edge research, and sustainable development to the forefront. This dynamic approach not only fuels explosive economic growth but also transforms the very fabric of international trade

Interactive Brokers (IBKR) is broadening its global reach with thrilling new market access to Brazil’s B3 and the UAE, igniting a surge of fresh valuation reviews. Analysts are eagerly exploring how this bold expansion could drive growth and captivate investors around the globe

Bain & Company’s report “How India Invests 2025” reveals a thrilling transformation as India accelerates into the future with booming investments in technology, renewable energy, and consumer sectors. Backed by robust foreign capital and a dynamic startup ecosystem, this surge is powering India’s remarkable economic ascent

China’s $180 billion investment in clean technology is igniting a green revolution across the Global South, driving rapid growth in sustainable infrastructure and dramatically cutting emissions, experts reveal. This groundbreaking shift is redefining the future of global climate cooperation

India’s GDP surged an impressive 8.2% in the latest quarter, beating all expectations and showcasing a robust economic revival. This outstanding growth is fueled by strong domestic demand and a lively rebound in both the manufacturing and services sectors

Profit remittances are poised to put intense pressure on Brazil’s real this December, as investors scramble to repatriate earnings amid growing global uncertainty. Bloomberg reports that the currency is facing substantial strain due to persistent capital outflows

Traders are eagerly searching for the next Argentina as global markets pivot, with former President Trump’s influence continuing to shape investment strategies. Driven by a surge in risk appetite and shifting political landscapes, investors are making daring bets on emerging economies

ProShares Ultra MSCI Brazil Capped stock is poised for an exhilarating 2025 surge, driven by Brazil’s dynamic economic revival and unstoppable market momentum. Fundação Cultural do Pará highlights the critical role of strategic risk management in their latest portfolio updates

Despite ambitious economic reforms, Argentina still struggles to regain investor trust. Persistent inflation, rising debt concerns, and unpredictable policies continue to spark skepticism, leaving foreign capital wary and reluctant to come back

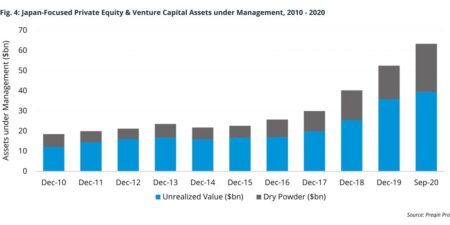

Japan is rapidly emerging as a prime destination for private equity firms, driven by an aging population and transformative corporate reforms. Investors are now setting their sights on this previously overlooked market, discovering thrilling new opportunities and heralding a promising surge of growth ahead

India’s US$50bn Bharat Sovereign Wealth Fund is poised to ignite a new era of strategic investments, driving powerful economic growth. This bold initiative promises significant long-term gains, but experts caution that success will depend on skillfully managing complex geopolitical risks and market volatility

Amid rising U.S. tariffs triggered by Trump’s trade war, Brazil’s Lula and India’s Modi are forging a stronger alliance, tapping into new markets and boosting collaboration to overcome economic hurdles and secure lasting growth

China unveils an exciting new strategy to captivate Gen Z and millennials across Africa, aiming to ignite its brand appeal among the continent’s vibrant youth through dynamic cultural exchanges, cutting-edge digital platforms, and precision-targeted marketing

Argentina’s bonds surged in a thrilling trading session as investors reacted to a measured U.S. pledge of support. Market watchers remain on high alert, navigating persistent economic uncertainty and growing demands for further assistance

Brazil’s debt stability has surged ahead, surprising analysts and boosting market confidence. According to TipRanks, robust fiscal indicators and prudent management showcase a more resilient economy poised to tackle future challenges with strength