Brazil’s Itau Unibanco has unveiled a remarkable $4.4 billion payout in dividends and interest on equity, showering its shareholders with significant returns. This bold move showcases the bank’s robust financial health and steadfast confidence in its future growth

Browsing: finance

Traders are eagerly searching for the next Argentina as global markets pivot, with former President Trump’s influence continuing to shape investment strategies. Driven by a surge in risk appetite and shifting political landscapes, investors are making daring bets on emerging economies

Brazil has awarded concessions for 13 airports, attracting a remarkable US$135 million in investments. This bold move aims to modernize infrastructure and boost regional connectivity, propelling the country’s aviation industry into an exciting new era of growth

J.P. Morgan envisions India’s Nifty 50 skyrocketing to 30,000 by the close of 2026, powered by anticipated rate cuts and enticing tax incentives. These dynamic forces are highlighted as key catalysts set to drive robust, long-term market growth

India’s manufacturing powerhouse Zetwerk is gearing up to make a splash with a $750 million IPO, backed by six leading banks driving the offering. This ambitious step signals a major leap forward as Zetwerk sets its sights on expanding its influence in the global supply chain landscape

A once-banned Chinese bond strategy that catapulted yields from 8% to a staggering 16% is staging a dramatic comeback, defying regulatory crackdowns. Investors are rushing back, driven by an insatiable appetite for high returns, Bloomberg reports

KPMG’s latest report highlights Germany’s vibrant economy, featuring strong industrial output, steady export growth, and impressively low unemployment. Driving this momentum are key sectors such as automotive, technology, and renewable energy powering the nation’s success

Argentina’s President Javier Milei is preparing for a pivotal meeting with JPMorgan CEO Jamie Dimon this week, Reuters reports. This high-profile encounter could unlock thrilling new investment opportunities and forge powerful economic partnerships between Argentina and the global financial giant

India’s billionaire ranks have surged as Groww shares soared, propelling valuations to new heights and rewarding key stakeholders handsomely. This unexpected surge of market excitement highlights a growing wave of investor confidence in the fintech sector. Bloomberg.com reports

Tencent’s latest earnings reveal a remarkable surge, powered by AI-driven ad acceleration and a booming mini-game monetization wave-highlighting strong momentum in its digital revenue streams, Morningstar Canada reports

TD is driving AI innovation in Canada by backing cutting-edge research, empowering startups, and pioneering data-driven solutions that revolutionize customer experiences and supercharge operational efficiency across industries

Japan’s Ministry of Finance remains confident in steady growth across all regions, standing firm on its economic outlook despite ongoing global uncertainties, according to the latest report on nippon.com

Canada is gearing up to boost budget deficits in a bold strategy designed to ignite economic growth amid global uncertainties. The government is set to turbocharge investments in infrastructure and social programs, fueling a dynamic and resilient post-pandemic recovery

China’s autonomous driving trailblazer WeRide is gearing up to shake things up with an ambitious plan to raise approximately $308 million through a Hong Kong IPO, Bloomberg News reports-marking a significant milestone in the region’s rapidly evolving tech scene

Argentina’s Central Bank has slashed reserve requirements to unleash a wave of liquidity into the financial system, sparking hopes for a much-needed boost in economic activity amid ongoing market hurdles, Bloomberg reports

The Wall Street Journal stirs the debate on India’s global influence with the bold headline, “Does India Even Have Any Cards?” This compelling article takes a closer look at the nation’s geopolitical position and explores its strategic moves amid rising international tensions

The Bank of Canada has just cut its key interest rate to 2.25%, hinting at a potential pause in future cuts for now. This calculated step aims to strengthen the economy as it faces ongoing challenges, CBC reports

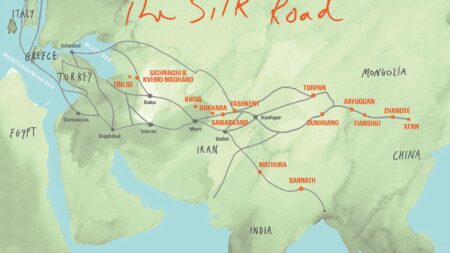

Silk Road Week concluded in Brazil with vibrant energy, marking its thrilling South American debut. The event unveiled exciting new trade opportunities and strengthened the ties between Asia and Latin America, opening an inspiring new chapter in global collaboration

Despite ambitious economic reforms, Argentina still struggles to regain investor trust. Persistent inflation, rising debt concerns, and unpredictable policies continue to spark skepticism, leaving foreign capital wary and reluctant to come back

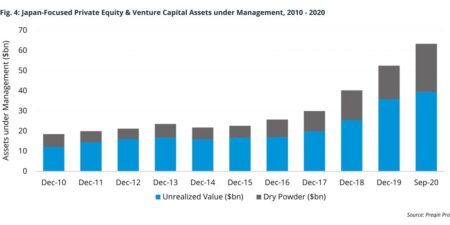

Japan is rapidly emerging as a prime destination for private equity firms, driven by an aging population and transformative corporate reforms. Investors are now setting their sights on this previously overlooked market, discovering thrilling new opportunities and heralding a promising surge of growth ahead