A recent map reveals the extent of gold reserves stored by various countries in the United States, highlighting Germany’s consideration of repatriating its gold. As global economic concerns rise, this move sparks debate on the security and accessibility of national assets.

Browsing: finance

Germany has officially formed a new government, unveiling plans to reduce corporate taxes as part of its economic strategy. The move aims to boost investment and competitiveness amid global economic challenges, signaling a shift in fiscal policy.

Stocks plunged in a dramatic mid-day reversal, erasing a 4% gain as investor sentiment soured. Concerns over rising interest rates and slowing economic growth weighed heavily on market momentum, prompting widespread sell-offs across multiple sectors.

In a recent statement, JPMorgan CEO Jamie Dimon advised former President Trump to consider the resilience of countries like India as the U.S. faces potential recession risks. Dimon emphasized the importance of global economic dynamics amid domestic challenges.

In a recent statement, Treasury Secretary Bessent criticized China’s recent aggressive actions, labeling them a “big mistake.” He emphasized that the country is operating from a “losing hand,” signaling potential economic repercussions amid rising tensions.

In a stark warning about the economic landscape, finance leaders Jamie Dimon, Larry Fink, and Bill Ackman have expressed concerns over the impact of President Trump’s tariffs. They caution that these trade policies could hinder growth and destabilize markets.

“Views From The Ground: Why Brazil And Why BRAZ? 2025” on Seeking Alpha explores Brazil’s economic landscape and the potential of the BRAZ ETF. Analysts emphasize Brazil’s growth opportunities amid global market shifts, making it a focal point for investors.

Germany is contemplating the withdrawal of its 1,200-ton gold reserves stored in the U.S., a move seen as a response to rising tensions during Donald Trump’s presidency. This potential action highlights ongoing concerns over international trust and economic security.

In a recent announcement, former President Donald Trump renewed threats of tariffs on Indian pharmaceutical imports, marking a sudden shift that has negatively impacted Indian pharma stocks. Investors reacted swiftly, reversing the brief respite enjoyed by the sector.

China’s Luxshare Precision Industry is reportedly considering a potential listing on the Hong Kong Stock Exchange this year, according to sources. This move could enhance its funding capabilities amid the growing demand for electronic components globally.

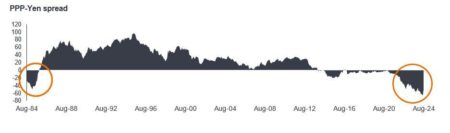

In a recent statement, a Japanese lawmaker highlighted concerns over the yen’s undervaluation, indicating potential measures to counter capital outflows. This move underscores the government’s intent to stabilize the currency and foster economic resilience amid global market fluctuations.

Spain is experiencing an economic boom, driven by a resurgence in tourism, robust exports, and increased foreign investment. As the country capitalizes on its diverse sectors, experts predict sustained growth, boosting employment and national confidence.

Beazer Homes USA (BZH) is generating buzz as analysts predict potential growth amid a recovering housing market. With recent financial reports signaling stability and strategic land acquisitions, investors are keenly watching for signs of an upswing.

In the ever-evolving landscape of investment, small-cap stocks often offer hidden potential. This article explores three promising UK-based small-cap stocks that could become undiscovered gems, attracting savvy investors seeking growth opportunities.

In a recent statement, Deutsche Bank Chairman revealed that Germany received approximately $1 trillion in financial support without cost. This significant figure highlights the country’s economic strategies and the ongoing impact of fiscal policies in Europe.

French stocks closed lower on Tuesday, with the CAC 40 index declining by 0.96%. Investor sentiment was dampened by global economic concerns, leading to a broad sell-off across major sectors, highlighting ongoing market volatility.

UK Shadow Chancellor Rachel Reeves is poised to announce ¬£2 billion in civil service spending cuts as part of the Labour Party’s economic strategy. The move aims to streamline government operations and address budget deficits amid rising public demand for fiscal accountability.

In March 2025, numerous UK stocks are trading below their estimated valuations, signaling potential investment opportunities. Analysts attribute this trend to market volatility and economic uncertainty, highlighting sectors poised for recovery amid evolving conditions.

India’s central bank has revised its priority sector lending guidelines to enhance credit accessibility for various sectors, including agriculture and microenterprises. The updates aim to bolster economic growth and support sustainable development across the nation.

Elon Musk’s recent cuts to Dogecoin’s support have left a significant gap in the cryptocurrency market, creating an opportunity for China to assert its influence. As regulatory frameworks shift, Chinese digital currencies may rise to capture the attention of investors.