China’s economy is under the microscope as vital data becomes increasingly elusive, sparking worries among analysts. The Wall Street Journal emphasizes the difficulties in gauging economic vitality when key statistics are disappearing, making it harder to predict trends and formulate effective policies

Browsing: financial analysis

Amid rising trade tensions, India faces a crucial moment to champion equity by establishing strong safeguards for its most vulnerable sectors. As Trump’s trade war transforms the landscape of global markets, it becomes imperative to craft targeted policies that create fair opportunities for everyone.

UK equities are on the rise, fueled by a remarkable surge in bank stocks thanks to encouraging earnings reports. Investors are keenly watching the unfolding tariff discussions, carefully assessing their potential effects on trade and market stability. Across various sectors, stocks are showcasing a sense of cautious optimism as global tensions continue to simmer.

As we step into January 2025, the UK’s private capital market is navigating a vibrant and challenging macroeconomic landscape. With interest rates on the rise and inflation making its presence felt, investors are rethinking their strategies. They are on a quest for resilience in the face of market fluctuations while skillfully adapting to evolving regulatory changes.

Morningstar, a premier investment research firm, delivers in-depth financial analysis, data, and news that empower investors to navigate the ever-changing market landscape. With its powerful tools and resources at your fingertips, you can uncover valuable insights into market trends and fund performances, enabling you to make savvy investment choices.

Analysts at Desjardins predict a modest decline in the Bank of Canada’s interest rate. This careful strategy highlights the persistent economic hurdles we face, all while striving to uphold stability within our financial system.

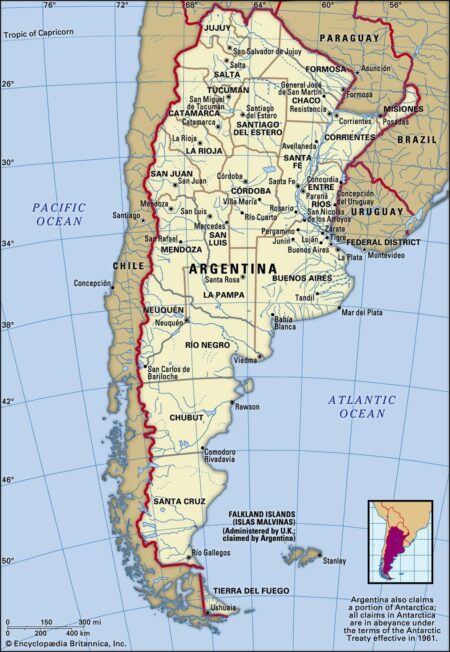

has made a bold move by acquiring , significantly strengthening its foothold in the vibrant South American energy market. This strategic acquisition not only reflects Vista’s ambitious growth plans but also enriches its portfolio and operational prowess in the region, setting the stage for exciting new opportunities ahead

Shares of India’s IndusInd Bank surged as investors reacted positively to news that the impact of a recent accounting lapse was less severe than anticipated. What initially sparked concern has now been largely addressed, calming investor anxieties and restoring confidence in the market.

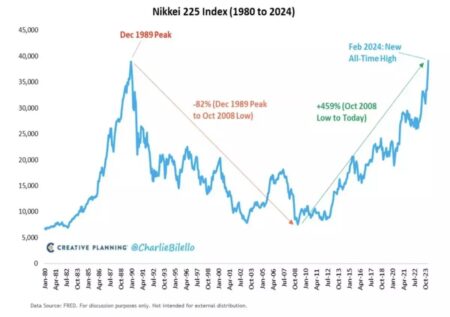

Value investors are increasingly turning their attention to Japan, Korea, and Brazil, drawn by attractive valuations and growth potential. With economic reforms and favorable market conditions, these countries present promising opportunities for savvy investors.

Argentina’s state-controlled oil company YPF may face a decline in earnings as crude prices continue to drop. Analysts warn that the decrease in global oil prices could impact YPF’s profitability, raising concerns about its financial stability in the coming quarters.

Japan’s Nikkei surged 6% as investors rallied on hopes of a market recovery. Positive economic signals and easing global concerns fueled buying interest, propelling the index to a strong close, reflecting renewed confidence in the Japanese economy.

A steep decline in oil prices poses a significant challenge for Russia, jeopardizing its extensive funding for the ongoing war in Ukraine. As revenues dip, analysts warn that Moscow may face increased pressure to scale back military operations.

In a market where insider ownership can signal confidence, three UK growth companies stand out. These firms, highlighted by Yahoo Finance, showcase substantial insider stakes, suggesting robust faith in their future prospects as they pursue ambitious growth strategies.

Starbucks is slowing its expansion plans in India as rising inflation and economic concerns lead consumers to cut discretionary spending. The decision reflects shifting market dynamics, prompting the coffee giant to reevaluate growth strategies in a challenging environment.

Bakkavor Group emerges as a standout in the UK penny stock landscape, offering potential for savvy investors. In our latest analysis, we explore three promising penny stock opportunities that align with Bakkavor’s growth strategy, highlighting their market potential.

Canada’s budget deficit for the first ten months of the 2024/25 fiscal year has risen to C$26.85 billion, highlighting ongoing financial challenges. This increase reflects higher expenditures amid economic pressures, as reported by Reuters.

Indian stock markets closed lower in the final session of the fiscal year, influenced by concerns over potential U.S. tariffs. Investors remained cautious as trade tensions continued to weigh on market sentiment, prompting a decline in key indices.

Brazil’s Finance Minister has revised the estimated costs of a proposed tax exemption, lowering it to $4.75 billion. This adjustment aims to alleviate concerns over fiscal impact while stimulating economic growth, according to Reuters Canada.

Loma Negra (NYSE: LOMA) faces significant challenges in Argentina’s struggling cement market, marked by overcapacity and economic volatility. As demand dwindles, analysts predict further strain on profitability, raising concerns for investors and stakeholders.

In an exclusive report, analyst Mary Meeker raises alarms for “USA Inc.” regarding economic vulnerabilities and fiscal challenges. Her insights emphasize the need for strategic reforms to bolster resilience against potential downturns.