India is stealthily deploying a smart mix of market maneuvers and regulatory moves to stabilize the rupee, resolute in its mission to stop the sharp decline amid growing global economic pressures, Bloomberg reports

Browsing: financial markets

In Spain and Italy, banking stocks led a thrilling market comeback, reigniting investor confidence after months of decline. This sector’s remarkable rebound signals a surge of optimism as economic concerns start to fade

Global bonds plunged sharply following hawkish remarks from the Bank of Japan, signaling potential shifts in monetary policy. Investors reacted swiftly, driving yields higher as uncertainty surged

Japan’s two-year government bond yield has surged to its highest level since 2008, driven by growing market excitement over potential rate hikes. Investors are now closely watching the Bank of Japan, eagerly awaiting its next move in shaping monetary policy

Germany’s 10-year Bund yield edged higher, reflecting a wave of global risk aversion as investors grapple with escalating geopolitical tensions and ongoing inflation concerns, TradingView data shows

The Indian rupee teeters on the edge of sharp declines as upcoming liquidity and growth reports threaten to rattle market confidence. At the same time, bond yields are set to move, reflecting investors’ changing economic outlook

Spain’s budget deficit is set to fall below Germany’s for the first time in nearly 20 years, signaling a stunning shift in the Eurozone’s fiscal dynamics, reports the Financial Times

The UK financial regulator is gearing up to ease transaction reporting requirements, offering firms a much-needed break. This bold move aims to enhance market efficiency while maintaining full transparency, Reuters reports

Italy finds itself at a critical crossroads as Moody’s prepares to review its credit rating after seven intense years hovering on the edge of junk status. This vital decision has the power to transform borrowing costs and steer the future of the nation’s economic stability amid ongoing challenges

The dollar soared even higher against the yen on Tuesday, fueled by traders’ keen anticipation of the upcoming U.S. jobs report-a crucial indicator poised to influence Federal Reserve decisions and drive market movements, Reuters reports

India’s billionaire ranks have surged as Groww shares soared, propelling valuations to new heights and rewarding key stakeholders handsomely. This unexpected surge of market excitement highlights a growing wave of investor confidence in the fintech sector. Bloomberg.com reports

The Bank of Canada considered delaying its October rate cut, internal discussions reveal. Officials carefully weighed the timing amid economic uncertainty, signaling a cautious approach before their next monetary policy decision

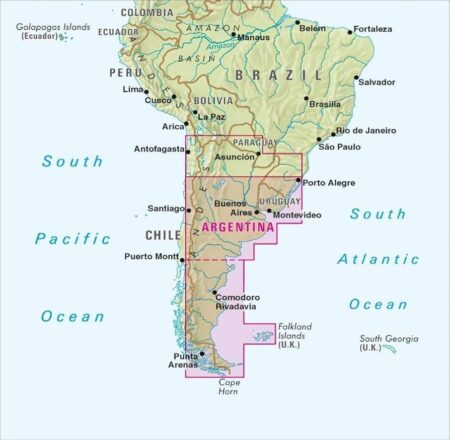

Argentina’s bonds, stocks, and currency surged dramatically following Javier Milei’s presidential victory, igniting a wave of excitement among investors eager for bold economic reforms and a fresh chapter of market-friendly policies, analysts reveal

Australia’s unexpected surge in inflation has ignited fresh concerns, as markets now brace for a possible interest rate hike looming ahead. Economists and consumers alike are preparing for the hurdles that tighter monetary policy could introduce

Argentina is pinning its hopes on the new sovereign bond, “RIGI,” to spark a fresh wave of investor confidence after years of economic upheaval. This ambitious government move aims to attract foreign investment and restore much-needed stability to the market

Brazilian mining company Bamin has captured the attention of three enthusiastic investors, the CEO revealed. This wave of interest underscores growing confidence in the company’s exciting growth prospects amid a thriving commodities market

Argentina’s markets skyrocketed following Javier Milei’s electrifying electoral victory, easing worries of a looming economic crisis. Investors enthusiastically backed Milei’s bold pro-market agenda, sparking a powerful surge in stocks and a robust rally for the peso on Bloomberg.com

The week ahead in FX and bonds is charged with excitement as the Federal Reserve prepares to unveil a long-anticipated rate cut, while pivotal U.S.-China trade talks take center stage. Investors are on high alert, hungry for clues on monetary policy changes and geopolitical developments that could reshape market dynamics

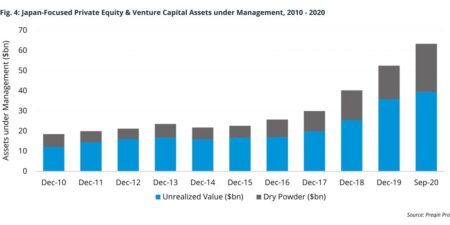

Japan is rapidly emerging as a prime destination for private equity firms, driven by an aging population and transformative corporate reforms. Investors are now setting their sights on this previously overlooked market, discovering thrilling new opportunities and heralding a promising surge of growth ahead

The U.S. and Argentina have just struck a landmark $20 billion currency swap deal ahead of the U.S. midterm elections, designed to enhance financial stability and supercharge their economic partnership, The Detroit News reports