Argentina’s bullish investor sentiment faces a crucial test as uncertainty builds ahead of the midterm elections, despite strong backing from the US. Market experts warn that political risks could derail economic reforms and stall the surge in investment momentum

Browsing: financial markets

Dow Jones futures soared as President Trump signaled an “eternity” stance before imposing a staggering 100% tariff on Chinese goods, igniting fierce trade tensions and sending shockwaves through the markets

Stocks slipped as global investors reacted to the twists and turns in U.S. Treasury yields, while the Argentine peso surged on a fresh wave of market optimism. This Treasury shake-up sparked a cautious atmosphere across emerging markets

Europe is on edge as France faces economic uncertainty, eagerly awaiting decisive policies and renewed stability. ING Monthly highlights the high stakes for the continent as France battles to maintain growth and preserve investor confidence

OranjeBTC has officially launched on Brazil’s B3 stock exchange, ushering in a thrilling new era for Bitcoin adoption throughout Latin America. This landmark event is poised to spark increased excitement and attract a wave of fresh investment into the region’s booming cryptocurrency markets

India’s Nifty and Sensex soared on Monday, driven by strong rallies in IT stocks and Titan shares. Boosted by solid corporate earnings and rising investor confidence, the market was alive with excitement, Reuters reported

Brazil has unleashed a powerful political “task force” to fast-track the approval of a tax increase on bets and financial investments, aiming to boost government revenue amid growing regulatory focus on the iGaming sector

Australia’s consumer sentiment plunged to its lowest level in six months this October, as soaring inflation concerns take the spotlight, Westpac revealed. This decline underscores growing unease among households about the economy and their upcoming spending decisions

Bessent emphasizes currency swaps as the smarter choice over direct cash aid, as Argentina works to stabilize the peso amid persistent economic challenges. This strategy aims to bolster reserves without increasing debt, signaling a savvy new approach to managing the crisis

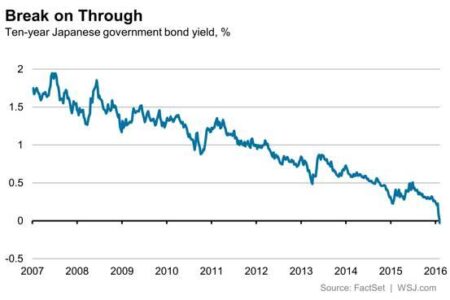

Japan’s rubber futures plunged sharply, hammered by a soaring yen and sluggish demand. Traders highlight the currency’s rally and weak global consumption as key factors driving prices lower, reports Finimize

Argentina’s bonds surged in a thrilling trading session as investors reacted to a measured U.S. pledge of support. Market watchers remain on high alert, navigating persistent economic uncertainty and growing demands for further assistance

The Bank of Canada caught markets off guard by slashing interest rates, despite ongoing uncertainty surrounding the inflation outlook, according to minutes from the latest meeting. Officials weighed economic risks with caution before deciding to ease monetary policy

Brazil’s debt stability has surged ahead, surprising analysts and boosting market confidence. According to TipRanks, robust fiscal indicators and prudent management showcase a more resilient economy poised to tackle future challenges with strength

Japan’s bond yields have surged to a 16-year high, igniting a wave of speculation about a potential interest rate hike. Investors are on edge, closely watching the Bank of Japan’s next move as inflation pressures steadily mount

The Bank of Japan is gearing up for a pivotal rate hike as inflationary pressures intensify. Markets are buzzing with anticipation, bracing for a landmark policy shift that could finally bring an end to decades of ultra-loose monetary easing

UK shares soared as banks and consumer stocks led a powerful rally, confidently shrugging off fresh tariff threats. Investors remained optimistic, focusing on strong corporate earnings and promising economic data instead of trade worries

Argentina’s Javier Milei, once hailed by markets for his daring free-market vision, is now facing a sharp decline in investor confidence. Confronted with growing economic hurdles, he has turned to Donald Trump’s populist playbook in a desperate effort to regain support

The U.S. is ramping up financial support for Argentina, signaling that this focused aid is a strategic move-not an indication of widespread economic issues in the region, reports MarketWatch

In the past year, Italy has seen a remarkable surge with 18 major banking deals, highlighting a dynamic wave of consolidation and ambitious strategic growth in the sector, according to Reuters. These transactions are driving an exciting transformation that is reshaping the Italian financial landscape

The Bank of Japan is preparing to accelerate the sale of its asset holdings, signaling a decisive shift away from its ultra-loose monetary policy amid rising inflationary pressures, The Wall Street Journal reports