Argentina is in a high-stakes race against the clock to secure new funding amid a sharp market plunge, driven by a fierce determination to stabilize its economy and win back investor confidence. This critical push comes as regional financial turmoil intensifies, challenging the country’s recovery plans like never before

Browsing: financial markets

The WisdomTree India Earnings ETF (EPI) is drawing strong investor attention as India’s economy accelerates, offering a compelling chance to invest in some of the nation’s most lucrative companies. Yet, potential investors should remain mindful of ongoing market volatility and valuation challenges when weighing this opportunity

Brazil’s central bank decided to hold interest rates steady, signaling a strategic pause designed to fuel economic recovery as inflation eases. This choice reflects cautious optimism amid persistent global uncertainties

France is caught in a whirlwind of political upheaval, with recent government shake-ups sending shockwaves through the markets. Investors are on high alert, preparing for continued uncertainty as key indices highlight growing concerns about the economic outlook, reports Macrobond

Argentina let the peso plunge sharply in early trading before stepping in to halt further losses, the Buenos Aires Times reports. This decisive action aims to stabilize a currency battling growing economic uncertainty

China’s staggering $4.5 trillion influx of foreign capital marks a groundbreaking milestone in its market opening, Bloomberg reveals. This remarkable surge highlights soaring global confidence fueled by regulatory relaxations and expanded investor access

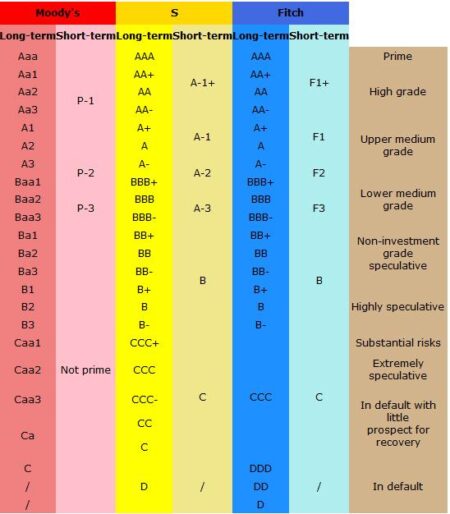

France is facing a pivotal moment in its credit rating journey, as ongoing political unrest fuels growing concerns about the country’s economic future. Investors and rating agencies remain on edge, scrutinizing every government decision amid escalating uncertainty

Argentina’s assets plunged sharply as President Javier Milei convened an urgent cabinet meeting following a significant electoral setback. Market nerves are mounting, with investors on edge, eagerly watching for the government’s next move, Bloomberg reports

French government bond yields skyrocketed, climbing to the same perilous levels as Italy’s in the wake of France’s government collapse. Investor fears over looming instability ignited fierce market turbulence, sending borrowing costs soaring dramatically

The Indian derivatives market is buzzing with excitement as global trading giant Jane Street faces off against SEBI in a high-stakes legal battle, spotlighting the challenges of regulation and evolving market dynamics. Bloomberg.com reports

Argentina’s markets tumbled sharply following Javier Milei’s defeat in the Buenos Aires election, sparking investor concerns over political uncertainty and the fate of crucial economic reforms, Reuters reports via Investing.com

UK government bonds plunged sharply as uncertainty swirled around Chancellor Rachel Reeves’ future, igniting a surge of market anxiety. Investors reacted quickly, shaken by fears of political upheaval and looming shifts in economic policy

China’s central bank has subtly boosted the yuan, riding a surge of economic optimism and signaling robust confidence in the country’s growth prospects. This calculated step aims to stabilize the currency and attract foreign investment, Bloomberg reports

Chinese households have amassed unprecedented savings despite economic uncertainty. This surge in household wealth is now sparking an extraordinary boom in China’s stock market, as investors eagerly pursue bigger returns, CNBC reports

Japanese banks are boldly extending their footprint in global asset management, seizing exciting growth opportunities far beyond their domestic borders. This dynamic expansion aims to capitalize on the skyrocketing demand for diverse and innovative investment solutions worldwide

The U.S. dollar exchange rate in Argentina has soared to an unprecedented AR$1,380, underscoring the nation’s escalating economic crisis. This sharp plunge in the peso’s value is fueling soaring inflation and putting immense pressure on everyday budgets, reports the Buenos Aires Herald

Brazil finds itself at a pivotal moment, balancing soaring crypto taxes with exciting plans to launch a national Bitcoin reserve. Navigating a complex and fragmented global market, this daring move could revolutionize Latin America’s digital economy

A U.S. appeals court has handed a significant victory to Argentina, blocking the sale of shares in YPF, the state-backed oil powerhouse. This ruling puts a temporary stop to any shifts in ownership as the fierce legal battles over control of YPF continue to escalate

Germany’s economy is contracting more rapidly than expected, sending shockwaves through global investors. A steep drop in industrial production, coupled with weak exports, signals potential ripple effects that could impact markets worldwide

France now faces the startling prospect of borrowing costs overtaking those of Italy, highlighting growing investor concerns about its fiscal outlook. This surprising development reveals changing tides in the Eurozone debt markets, reports Le Monde.fr