Intel has just secured a groundbreaking $2 billion investment from Japan’s SoftBank, igniting a surge of market enthusiasm. Following the announcement, Intel shares skyrocketed in after-hours trading, reflecting robust investor confidence. (INTC:NASDAQ)

Browsing: financial markets

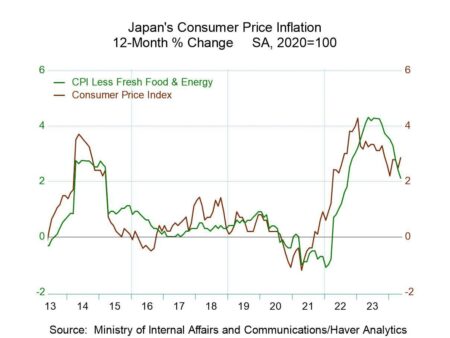

Japan’s government has strongly dismissed allegations that the U.S. is pressuring the Bank of Japan to raise interest rates. Yet, as global inflation concerns intensify, investors remain on high alert, scrutinizing every decision from the BOJ and keeping markets tense

Scott Bessent, a renowned investor, raises a red flag, warning that Japan is dangerously “behind the curve” on interest rates. As global central banks accelerate their monetary tightening, he shines a spotlight on the growing risks tied to Japan’s slow pace in raising rates

S&P Global has just boosted India’s sovereign credit rating to BBB-the first upgrade since 2007! This exciting milestone reflects stronger economic fundamentals and powerful fiscal reforms, sparking increased investor confidence even amid global uncertainties

Japan’s 10-year government bond yield soared, driven by the Bank of Japan’s surprisingly hawkish signals. This unexpected shift toward tightening has sparked a surge of market excitement on TradingView

China’s economy is caught in a relentless downward spiral, weighed down by slowing growth, soaring debt, and weakening global demand. Experts warn that this dangerous cycle could destabilize the nation and erode China’s power on the world stage

Rising excitement around a popular options trade is sparking Japan’s bourse to roll out new ETF listings, aiming to boost market liquidity and attract a wave of eager traders, Bloomberg reports

Exclusive: China Galaxy and CICC are set to unveil investment funds exceeding $1 billion, targeting the vibrant markets of Southeast Asia. This ambitious initiative seeks to deepen regional economic ties and capitalize on exciting growth prospects in emerging economies, Reuters reports

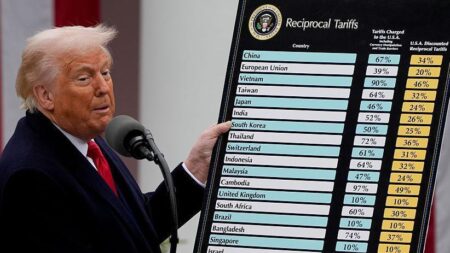

Japan’s new trade deal, emerging amid Trump’s tariff regime, has surprisingly delighted markets, analysts reveal. This breakthrough not only cools tensions but also unlocks thrilling trade opportunities, signaling a bright and promising new chapter in U.S.-Japan economic relations

Italy’s markets seize the spotlight on July 23, with investors keenly awaiting key economic data, political developments, and the far-reaching impact of EU policy moves. Get ready for a wave of volatility as eurozone uncertainties continue to loom large

Argentina’s Economy Minister Milei is taking bold action to rein in the currency market as the peso supply surges, aiming to stabilize the fragile economy amid soaring inflation and a sharp rise in capital flight, Bloomberg reports

China held its benchmark lending rates steady on Wednesday, exactly as markets anticipated. This move highlights Beijing’s cautious approach amid economic uncertainties, aiming to fuel growth while keeping inflation under control

The Indian rupee is set to ride the wave of the US dollar’s impressive rebound amid dramatic shifts in global markets. Meanwhile, bond investors are closely tracking evolving rate cut forecasts, which are reshaping yields and steering market sentiment in new directions

China is intensifying its push to rein in the yuan’s surge, a daring move designed to protect its export advantage amid a storm of global economic uncertainties, reports the Council on Foreign Relations

Japan’s core inflation slipped slightly but remained above the Bank of Japan’s 2% target, sparking market excitement over a potential rate hike as policymakers navigate the delicate balance between inflation pressures and economic growth

The Russian rouble and Moscow stock market surged dramatically after former U.S. President Trump shared optimistic remarks about Russia, Reuters reports. Investors eagerly seized the opportunity, igniting a fresh wave of confidence amid persistent geopolitical tensions

China’s deflationary pressures are intensifying as companies plunge into fierce price wars, spotlighting mounting economic challenges. This cutthroat competition is squeezing profit margins and clouding growth prospects, CNBC reports

Argentina’s Finance Minister Javier Milei is staking his political future on a strong peso, fiercely committed to curbing inflation and reigniting investor confidence amid economic chaos-though this daring strategy could send shockwaves through the markets

Germany’s stock market closed the day in the red, with the DAX index falling 0.89% by the final bell. Investors remained cautious, navigating ongoing economic uncertainties and a flood of mixed corporate earnings that dampened market sentiment

Australia’s central bank is set to transform financial infrastructure by exploring the launch of wholesale tokenized asset markets, promising faster settlements and greater efficiency, CoinDesk reports