Japan has launched an ambitious economic policy roadmap aimed at boosting domestic ownership of Japanese Government Bonds (JGBs). This bold move seeks to enhance financial stability and reduce reliance on foreign investors, Reuters reports

Browsing: financial markets

Argentina has unveiled plans to launch a new government bond, navigating through persistent economic uncertainty. This bold step comes as officials stand firm against buying U.S. dollars, determined to strengthen and stabilize the peso

ETFGI reveals that assets in Japan’s ETF industry soared to a record-breaking US$614.26 billion by the end of April, showcasing remarkable growth and strong investor confidence in the market

The appeals court has upheld crucial Trump-era tariffs on China, sending ripples through Apple and global markets alike. This ruling brought a wave of relief to investors, propelling the S&P 500 higher as trade tensions begin to ease

In a surprising turn of events, Japan has relinquished its title as the world’s top creditor nation to Germany, marking the end of a remarkable 34-year reign. This significant shift highlights Japan’s mounting debts and sluggish economic growth, while Germany’s thriving exports continue to strengthen its financial prowess on the global stage.

According to a recent report by the Taipei Times, an astonishing 250 exchanges have been recorded in China over the past month, showcasing a remarkable surge in trade activity amidst escalating geopolitical tensions. Analysts are raising alarms about the potential repercussions for regional markets and overall economic stability.

In Italy, the spotlight on “lo spread”—the interest rate gap between Italian and German bonds—has started to fade as fresh priorities take center stage. Analysts suggest that this change signals deeper worries, emphasizing the importance of stability that goes beyond just figures

Germany’s May flash manufacturing PMI registered at 48.8, just shy of the anticipated 48.9, highlighting a persistent contraction in the sector. This data underscores the ongoing hurdles faced amid economic uncertainties, suggesting that policymakers may need to consider adjustments to navigate these challenges effectively

The U.S. dollar may be on the brink of a further decline as enthusiasm for ‘Brand USA’ wanes. Analysts suggest that changing global perceptions and various economic factors could weaken the currency’s position in the months ahead.

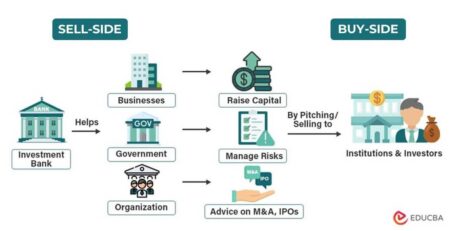

Investment banks are buzzing with optimism as they have upgraded their growth forecasts for China, thanks to an unexpected trade deal with the U.S. This landmark agreement is set to invigorate economic confidence and enhance trade flows, hinting at a promising recovery in bilateral relations and paving the way for greater market stability.

Investors greeted the US-China tariff truce with enthusiasm, as the easing of trade tensions sparked a wave of optimism across global markets. Yet, analysts are sounding a note of caution, highlighting that the journey toward a comprehensive agreement is riddled with uncertainties. The ultimate outcome remains closely watched and open to interpretation.

Private equity firms are buzzing with excitement about Spain, driven by its impressive economic growth and the country’s growing allure as a top tourist hotspot. This upbeat outlook signals a dynamic shift in the investment scene, positioning Spain as an irresistible destination for savvy investors.

Foreign investment in Japan’s stock market has skyrocketed, sparking a wave of enthusiasm among local authorities to rally domestic participation. With global investors fueling the market’s momentum, exciting initiatives are being launched to enhance awareness and accessibility for Japanese citizens. This effort is set to cultivate a more vibrant and resilient economic landscape.

Dow Jones futures surged as investors eagerly anticipated fresh U.S.-China trade discussions. Excitement is in the air as all eyes turn to Federal Reserve Chairman Jerome Powell, whose forthcoming remarks could sway market sentiment amidst the backdrop of ongoing economic uncertainty.

In April, German inflation dipped to 2.2%, just shy of what analysts had anticipated. This decrease offers a glimmer of hope in easing price pressures, yet it also underscores the ongoing hurdles facing the economy as policymakers strive to steer recovery through a landscape marked by persistent volatility.

China is making a strategic move to lessen its dependence on US Treasuries, redirecting its investments towards more dynamic options like commodities and emerging markets. This shift not only showcases a savvy financial strategy but also underscores China’s commitment to bolstering its financial stability in the face of rising geopolitical tensions

In a significant policy shift, President Javier Milei has lifted tight currency and capital controls in Argentina, aiming to stimulate economic growth. This move is expected to increase market confidence but may also raise concerns about inflation and financial stability.

Wall Street stocks surged as strong economic data ignited investor enthusiasm, sparking optimism for a revival in U.S.-China trade discussions. Analysts highlighted that this upbeat sentiment could drive market momentum in the weeks ahead, even as global uncertainties linger.

In a defining moment for Canadian economic leadership, Mark Carney steps into the spotlight with the ambitious mission of transforming the nation’s economy. His appointment marks a significant turning point as Canada embarks on a journey through intricate fiscal landscapes, all while striving for sustainable growth.

The Bank of Canada’s governing council recently explored the idea of slashing interest rates once more in April, highlighting their persistent worries about economic growth. This discussion is part of a larger strategy aimed at tackling inflation while bolstering the Canadian economy.