Japan’s Prime Minister Takaichi is set to reveal an ambitious new government fiscal target aimed at safeguarding the nation’s financial future. This bold strategy strives to perfectly balance robust economic growth with sustainable debt management, paving the way for lasting prosperity

Browsing: fiscal policy

Canada is gearing up to boost budget deficits in a bold strategy designed to ignite economic growth amid global uncertainties. The government is set to turbocharge investments in infrastructure and social programs, fueling a dynamic and resilient post-pandemic recovery

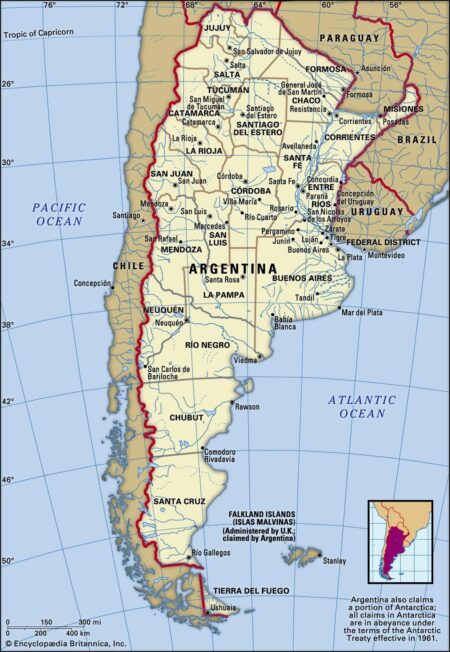

The Peterson Institute highlights Argentina’s credibility trap, where persistent economic turmoil and constant policy reversals chip away at investor confidence, making it ever harder to achieve stable growth and attract foreign investment

Italy’s credit outlook has been upgraded as Scope Ratings praises the Meloni government for its bold fiscal reforms and improved budget management, sparking renewed confidence in the nation’s economic stability

Despite recent policy improvements, Argentina’s economic challenges remain deeply entrenched. Persistent structural issues and relentless external pressures continue to stifle growth, proving that better policies alone aren’t enough to fully restore stability

France’s Socialists are championing the return of the wealth tax, aiming to bolster government finances amid challenging economic times. This ambitious move targets inequality directly and promises to increase funding for essential public services, sparking spirited debate as elections draw near

France’s ongoing economic struggles are driven by rigid labor laws, soaring public spending, and fierce political resistance to change. These challenges combine to choke growth and innovation, making it increasingly difficult for the country to maintain its edge in the global arena

Treasury official Bessent described the $20 billion lifeline to Argentina as a “mission-critical” move amid the U.S. government shutdown, emphasizing its crucial role in safeguarding global financial stability, CNN reports

Former President Trump’s ambitious $40 billion bailout proposal for Argentina has ignited fierce backlash from a leading MAGA ally, revealing sharp divisions within the movement over foreign aid and economic priorities

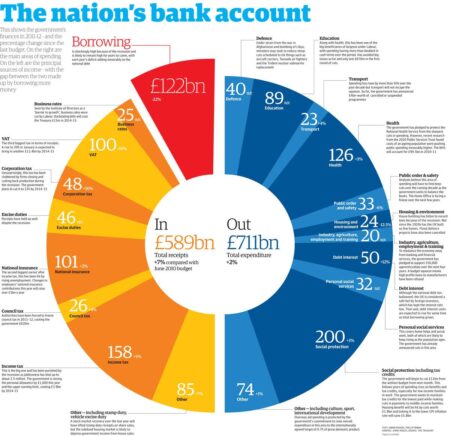

UK Chancellor Jeremy Reeves is gearing up to strengthen the budget buffer, aiming to enhance fiscal resilience amid economic uncertainties, Reuters reports. This bold strategy seeks to shield public finances from unexpected shocks and secure long-term stability

The fall of yet another French premier has thrown the nation into even deeper political chaos, complicating efforts to address the mounting debt crisis. Amid structural deficits, soaring public spending, and sluggish growth, France’s financial challenges are reaching a critical tipping point

Russia’s 2026 budget reveals steeper tax hikes designed to power an ambitious military expansion amid the ongoing conflict. Experts warn that this increased financial strain on citizens highlights the Kremlin’s unmistakable decision to put defense spending ahead of domestic needs

Argentina’s economy is battling soaring inflation, rising debt, and persistent policy uncertainty. These challenges are not only stalling growth but also rattling investor confidence, deepening the economic crisis and fueling urgent calls for reform

New rock-star economist Gabriel Zucman is electrifying France with his daring call for a wealth tax, sparking fiery debates as inequality reaches new heights. His bold ideas challenge the status quo and push for sweeping fiscal reforms that could reshape the nation’s future

Italy is firmly committed to keeping its budget deficit at 3% of GDP this year, showcasing a resolute dedication to fiscal discipline amid ongoing economic challenges. This goal aligns seamlessly with EU guidelines, carefully balancing the drive for growth with prudent debt management

Deutsche Bank calls on Germany to unleash its full fiscal strength to invigorate the economy during these uncertain times. Experts highlight that strategic government support is crucial to safeguard the bank’s stability and drive its growth forward

UK Labour leader Keir Starmer emphasized the need for “firm and fair” action to address the nation’s soaring debt. He called for balanced policies that not only secure economic stability but also protect essential public services, Reuters reports

Argentina’s economy is in turmoil, wrestling with a severe crisis sparked by harsh fiscal cuts and policy missteps. Now, the nation is urgently reaching out to the U.S. for financial aid to stabilize its shaky markets and restore confidence among investors

Finance Minister seals a groundbreaking bilateral debt restructuring agreement with the United Kingdom, set to ease repayment terms and strengthen economic ties. This transformative deal offers crucial fiscal relief, opening the door to a more resilient and prosperous financial future

Argentina’s President Milei faced a significant blow as the Senate approved a surge in government spending, directly opposing his drive for fiscal austerity. This move highlights the intensifying battle over economic policy unfolding in Congress