India finds itself in the spotlight of U.S. scrutiny, despite its crude oil imports remaining unsanctioned. Washington is sharply focused on New Delhi’s energy ties with Russia, underscoring the intricate geopolitical tensions that go well beyond simple oil trade

Browsing: global markets

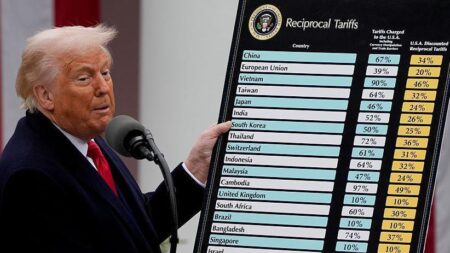

Former President Donald Trump reportedly hit Indian goods with a hefty 50% tariff, striking back fiercely at India’s continued purchases of Russian oil and escalating the trade tensions between the two nations, CNBC reports

Japan’s stocks are poised to slip as disappointing U.S. economic data reignites concerns over global growth. Investors remain cautious, bracing for potential ripple effects throughout Asian markets, Bloomberg reports

US tariffs imposed during the Trump era now cast a shadow over Brazil’s export-driven economy, endangering key industries like steel and agriculture. Experts warn that these measures could ignite trade disputes and stall growth in Latin America’s largest market

In his latest Substack post, Paul Krugman delivers a compelling analysis of the recent Japan trade deal, diving deep into its economic consequences and questioning whether it genuinely benefits American workers and industries

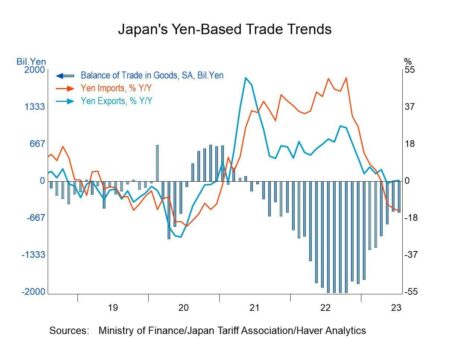

Japan’s exports plunged dramatically after new US tariffs targeted key goods, igniting concerns of a global trade slowdown. This steep drop deepens fears of an impending recession amid escalating trade tensions, Bloomberg reports

Nvidia’s shares soared to new heights following a groundbreaking win in China, sparking a surge of investor enthusiasm. This pivotal deal paves the way for the chipmaker to rocket toward a $5 trillion market cap-and potentially beyond!

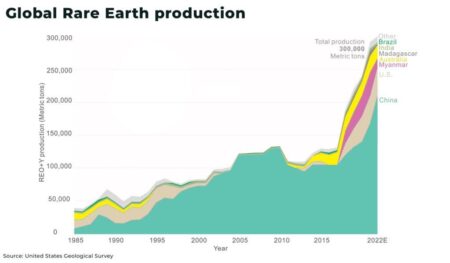

China’s rare earth export controls are doing more than just tightening Beijing’s hold on a vital resource-they’re disrupting global supply chains and pushing manufacturing costs higher worldwide. This bold strategy is intensifying trade tensions, Reuters reports

Japan navigates economic uncertainty as US tariffs climb under Trump, expertly balancing the looming threat of recession with savvy trade strategies. The government is resolute in protecting exports while avoiding a deeper market crisis

Mexico and Brazil are gearing up to supercharge their trade relationship, aiming to expand their reach beyond the US and China. By boosting collaboration, both countries aspire to unlock fresh growth opportunities and reduce dependence on these dominant markets, insiders reveal

Xiaomi is set to electrify the global market, with CEO Lei Jun announcing plans to start selling its electric vehicles beyond China as early as 2027. This exciting step marks the tech giant’s bold ambition to become a leading force in the international EV arena

Indian shares dipped on Monday, dragged down by escalating tensions in the Middle East and cautious investor sentiment as all eyes focus on the Federal Reserve’s upcoming policy decision. Traders are on high alert, searching for clear signals amid a storm of global uncertainties

China has dramatically tightened export controls on rare earth minerals-crucial building blocks for the electronics and defense industries. This bold strategy highlights Beijing’s growing influence amid rising global trade tensions, sending shockwaves through supply chains worldwide, Reuters reports

President Trump intensifies his drive for fresh trade agreements amid rising concerns that tariffs could disrupt the global economy. Stay with Yahoo Finance for the latest updates on unfolding negotiations and market reactions

Exclusive: Indian billionaire Gautam Adani is facing intensified scrutiny from U.S. prosecutors, who are escalating their investigations into his vast business empire, the Wall Street Journal reveals. These mounting legal challenges could dramatically impact his global ventures

Toto’s cutting-edge toilets, adored in Japan for their remarkable features, are now on a mission to charm American consumers. As they unveil their state-of-the-art models in the U.S. market, the big question remains: will these luxurious bathroom innovations win over American hearts just as they have across the Pacific?

German Finance Minister Christian Lindner emphasized the urgent need for the United States to swiftly address tariff issues, highlighting their crucial role in fostering global trade stability. His comments arrive at a pivotal moment as discussions continue around trade policies that significantly impact the economies of both nations.

Asia’s stock markets showcased a patchwork of performances as the shadow of Trump’s tariffs casts uncertainty over global trade. In a bright spot, Japan’s indices surged ahead, fueled by robust economic data, while other regional markets grappled with a wave of cautious investor sentiment.

In an intriguing cultural shift, Bloomberg highlights the blossoming fascination with Greek culture in Japan. Although historical ties may be sparse, a vibrant enthusiasm for Greek cuisine, philosophy, and art reveals an unexpected bond forming between these two nations.

Today, Spain’s benchmark IBEX 35 index took a dip, closing down by 0.30%. This decline highlights the growing concerns among investors as market sentiment remains shaky. With uncertainties looming over European markets, traders are treading carefully in anticipation of crucial economic data on the horizon.