Brazil and China are embarking on exciting trade discussions focused on boosting sustainability. By harnessing their agricultural prowess and cutting-edge technological innovations, these two nations are poised to harmonize economic growth with environmental objectives, paving the way for a new era of global cooperation.

Browsing: global markets

Amid rising trade tensions with the U.S., China is encouraging its exporters to explore new markets beyond their traditional boundaries. Although this shift to alternative regions appears simple on the surface, experts warn that navigating logistical hurdles and regulatory complexities could pose significant challenges for a seamless transition.

Spain’s sales agents are buzzing with optimism as the film industry makes a vibrant comeback after the pandemic. With a surge in international interest and an exciting lineup of new productions, industry leaders are eagerly anticipating a revitalized market that positions Spain as a dynamic force in global cinema.

Australian beef exports are experiencing a remarkable surge, particularly in China and the United States, as they take advantage of ongoing trade tensions. This impressive growth highlights a savvy shift by Australian producers who are actively exploring new markets in response to global trade uncertainties.

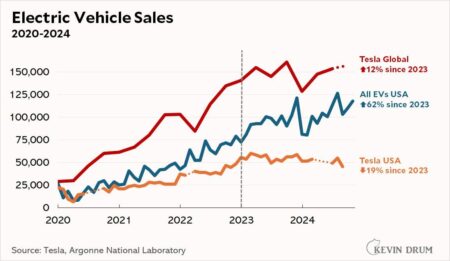

Tesla’s sales have taken another hit in France and Denmark, as recent reports reveal. This decline coincides with escalating protests against CEO Elon Musk, shedding light on the rising dissatisfaction among consumers in these regions as their sentiments evolve

European markets are experiencing a surge of volatility as political unrest in France and Germany sends ripples of concern through the investment community. With proposed reforms hanging in the balance and government stability under scrutiny, traders across the continent are adopting a more cautious approach.

Japanese and Australian markets bounced back with a surge of positive momentum after a rollercoaster session on Wall Street, as investors embraced a sense of cautious optimism. Meanwhile, most Asian markets took a breather for the holiday, resulting in limited trading activity across the broader region.

China has skillfully navigated the challenges posed by U.S. tariffs implemented during former President Trump’s administration, ensuring that its economic recovery remains robust. Officials assert that a combination of strong domestic resilience and surging global demand is fueling this growth, even as trade tensions persist and continue to influence the economic landscape

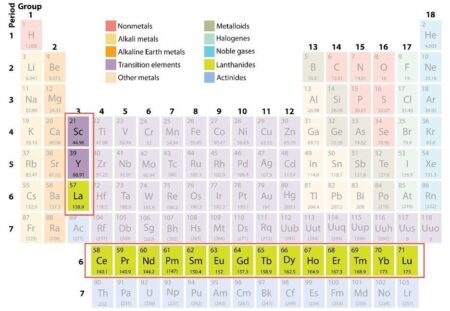

Gina Rinehart, Australia’s wealthiest woman, has built a staggering $800 million portfolio in rare earths. This savvy investment places her at the cutting edge of a rapidly expanding industry that is crucial for technology and green energy. It highlights the surging demand for these indispensable minerals!

In a surprising twist, China has quietly lifted tariffs on select U.S.-made semiconductors, a strategic decision that may help to cool the simmering tensions between the two countries amidst ongoing trade disputes. The potential impact on the tech industry and the future of bilateral relations is yet to unfold.

As pivotal trade discussions with the U.S. loom, UK Treasury chief James Reeves has taken a moment to address the concerns voiced by former President Trump about the state of the global economy. Reeves underscored that working together is essential to tackle our shared economic hurdles.

Amid the rising tensions of the US trade war, China is doubling down on its dedication to maintaining domestic stability. Beijing is not just focusing on economic support; it’s actively championing resilience in the face of external challenges, all while striving to boost public confidence in its future.

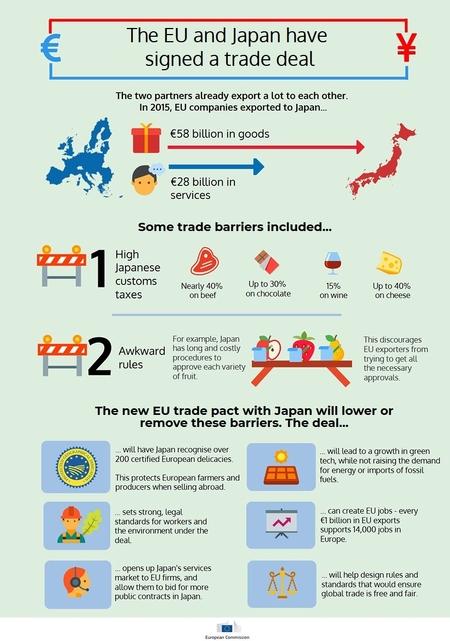

Bessent has identified Japan, the U.K., Australia, and South Korea as key priorities for future trade agreements, aiming to strengthen economic ties and enhance market access. This strategic focus signals a commitment to expanding international trade relations.

India’s foreign exchange reserves have surged to $676.3 billion, according to the central bank governor, reflecting a robust external position. This increase highlights the country’s resilience amid global economic uncertainties, bolstering confidence in the Indian economy.

In a strategic move, Bessent has unveiled a ‚ÄėGrand Encirclement‚Äô plan aimed at countering China’s influence. This ambitious initiative seeks to strengthen alliances and enhance regional stability, reflecting growing concerns over geopolitical tensions.

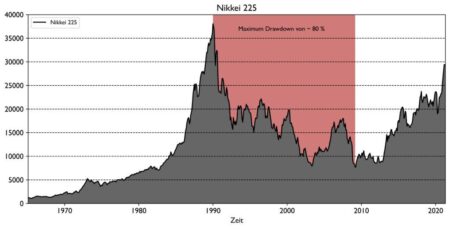

Japan’s Nikkei index fell significantly as escalating trade war concerns and a strengthening yen dampened investor sentiment. Market analysts highlight the negative impact of ongoing U.S.-China tensions on Japanese exports and economic stability.

Value investors are increasingly turning their attention to Japan, Korea, and Brazil, drawn by attractive valuations and growth potential. With economic reforms and favorable market conditions, these countries present promising opportunities for savvy investors.

As tensions escalate in the ongoing trade conflict, experts weigh in on whether China can withstand a prolonged U.S. tariff war. With its vast manufacturing base and strategic economic measures, Beijing may have tools to mitigate the impact.

In response to escalating tariffs imposed by the Trump administration, Apple is shifting its production focus to India. This strategic move aims to mitigate supply chain disruptions and reduce reliance on China, demonstrating the company’s adaptability in a volatile trade landscape.

In a significant escalation of trade tensions, China has announced retaliatory tariffs on U.S. goods, raising duties to 125%. This move comes amid a declining dollar, signaling increased economic friction between the two nations. Continue following for live updates.