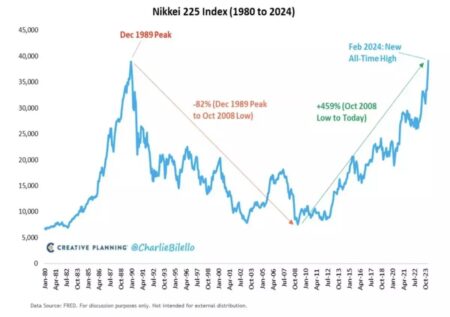

Japan’s Nikkei surged 6% as investors rallied on hopes of a market recovery. Positive economic signals and easing global concerns fueled buying interest, propelling the index to a strong close, reflecting renewed confidence in the Japanese economy.

Browsing: global markets

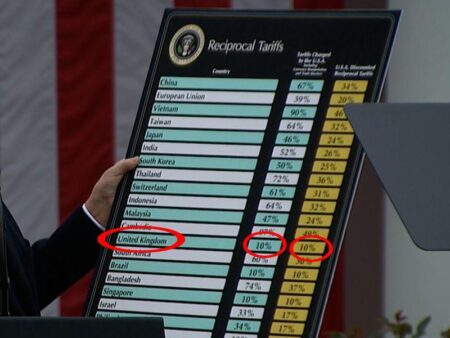

The Biden administration announced that tariffs on Chinese imports have reached a staggering 145%, a significant escalation in trade tensions between the two nations. This move aims to address ongoing concerns over China’s trade practices and economic policies.

In a surprising move, President Trump announced a temporary pause on escalating tariffs, allowing for a 90-day window for negotiations. However, he simultaneously raised China’s levy to an unprecedented 125%, intensifying ongoing trade tensions.

In a significant development, Bessent has been appointed to spearhead trade negotiations with Japan, as reported by the Wall Street Journal. This move aims to strengthen economic ties and address key trade issues between the two nations.

Japanese stocks are poised for a significant rise following former President Trump’s decision to pause higher tariffs. Investors are optimistic, anticipating a boost in trade relations and economic stability, as markets react positively to this unexpected development.

The Kremlin is experiencing heightened concern as the price of Russian Urals crude oil approaches the critical $50 threshold. This significant drop could hamper state revenues, further exacerbating the economic challenges faced amid ongoing sanctions.

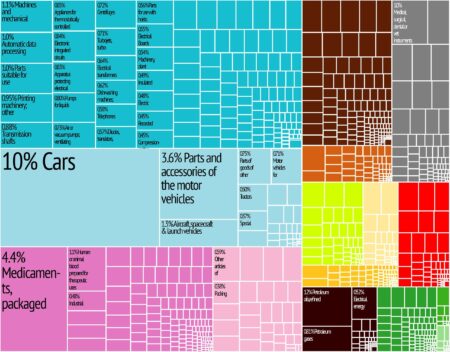

Brazil could emerge as a significant beneficiary of the U.S. tariffs on imports, economists suggest. As American companies seek alternative suppliers, Brazilian exports in agriculture and manufacturing may see a substantial boost.

“Views From The Ground: Why Brazil And Why BRAZ? 2025” on Seeking Alpha explores Brazil’s economic landscape and the potential of the BRAZ ETF. Analysts emphasize Brazil’s growth opportunities amid global market shifts, making it a focal point for investors.

In the latest edition of Project Bulletin, key developments emerge from Ontario, Canada, Newport, South Wales, and Lviv, Ukraine. Each region showcases promising initiatives aimed at enhancing economic growth and attracting investment. Stay tuned for detailed insights.

After years of navigating sanctions and market challenges, Huawei has reported a rebound in revenue, returning to its peak performance. The company’s strategic shifts and innovation initiatives have bolstered its standing in the competitive telecom landscape.

In a rare meeting with global CEOs, Chinese President Xi Jinping urged leaders to defend international trade against rising protectionism. Xi emphasized collaboration, signaling China’s commitment to open markets amid escalating economic tensions worldwide.

In the face of growing U.S. tariffs under Trump, Germany’s export-driven economy faces uncertainty. As trade tensions escalate, German manufacturers express concern over potential impacts on their competitive advantage in the global market.

China’s criticism of the Hutchison deal escalates the stakes for the potential sale of TikTok to US investors. Beijing’s concerns highlight the geopolitical tensions surrounding tech ownership, complicating negotiations and raising questions about future regulations.

Elon Musk’s recent cuts to Dogecoin’s support have left a significant gap in the cryptocurrency market, creating an opportunity for China to assert its influence. As regulatory frameworks shift, Chinese digital currencies may rise to capture the attention of investors.

Asia-Pacific markets opened mixed following the decision of both China and the U.S. to maintain steady interest rates. Investors are closely monitoring economic indicators and global trends as they navigate uncertainties in the financial landscape.

Tesla stock faced further declines following recent developments in China, raising investor concerns. Reports suggest increased regulatory scrutiny and competitive pressures in the electric vehicle market, prompting analysts to reassess the company’s growth outlook.

Oil prices remain steady as market participants monitor rising demand from China amid ongoing geopolitical tensions. This delicate balance between supply concerns and economic recovery signals a pivotal moment for energy markets.

Tesla’s sales face significant risks across three key markets: China, where geopolitical tensions and local competition intensify; the USA, with potential regulatory changes; and Europe, where strict emissions targets and emerging rivals challenge its dominance. Each region presents unique hurdles for the electric vehicle leader.

As the Federal Reserve prepares to announce its latest policy decision, analysts predict significant implications for the Indian rupee and bond markets. Investors will closely monitor Fed commentary for cues on interest rates and economic outlook, impacting currency stability.

Italy is set to unveil a strategic plan aimed at integrating its automotive and defence sectors, as announced by the Minister of Economic Development. This initiative seeks to enhance technological collaboration and bolster national security through innovative manufacturing practices.