In a bold recent statement, former President Donald Trump pointed the finger at his successor, President Joe Biden, for the current economic slowdown. He passionately defended the tariffs he put in place during his administration, arguing that these measures were crafted to empower American workers in the face of persistent economic hurdles.

Browsing: inflation

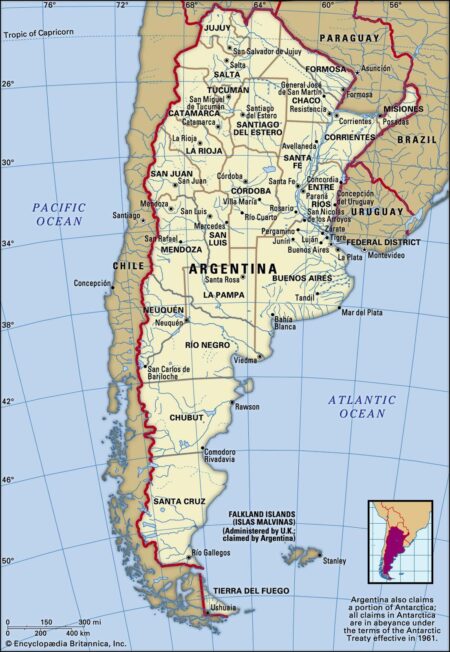

In a daring initiative, Argentina’s President Javier Milei has unveiled a clear timeline to eliminate inflation, igniting a wave of optimism and unrest among unions. As protests erupt across the nation, Milei’s ambitious economic reforms are under intense scrutiny in a country wrestling with skyrocketing prices.

In a recent announcement, the Bank of Japan (BOJ) has chosen to keep its interest rates steady, highlighting the current economic stability. However, officials voiced their worries about looming risks from US tariffs that could pose challenges to Japan’s export-driven economy.

As new tariffs roll out, homeowners might find themselves grappling with higher renovation costs. Prices for essential materials such as tile and plumbing fixtures are expected to climb, leaving many to reconsider their budgets for upcoming home improvement projects. Industry experts caution that these shifts could significantly affect your plans, so it’s wise to stay informed and adjust accordingly!

France has raised a red flag, cautioning that dismissing Federal Reserve Chair Jerome Powell could spell trouble for the U.S. dollar and shake up the economy. French economic officials warn that this drastic step might undermine market confidence and trigger financial upheaval.

Germany is grappling with a pressing dilemma as consumer spending struggles to keep pace with soaring savings. Amidst economic uncertainty and persistent high inflation, many Germans are choosing to prioritize their financial security over splurging on non-essential items. This shift in mindset is casting a shadow over retail growth and complicating recovery efforts across the nation.

The Bank of Canada has chosen to keep its interest rates steady as it carefully evaluates the effects of recent tariffs on the economy. This decision highlights the central bank’s commitment to striking a balance while addressing new economic hurdles.

Analysts at Desjardins predict a modest decline in the Bank of Canada’s interest rate. This careful strategy highlights the persistent economic hurdles we face, all while striving to uphold stability within our financial system.

The Bank of Canada has decided to maintain its key interest rate at 2.75%, citing concerns that escalating trade tensions could lead to a potential recession. The decision reflects ongoing economic uncertainty amid global trade disputes.

In a surprising turn of events, India’s inflation rate plummeted to an impressive 3.34% in March, far surpassing analysts’ predictions. This notable drop could potentially reshape economic policies as decision-makers evaluate its effects on consumer spending and overall growth.

Inflation in Canada eased to 2.3% in March, largely due to a decline in gas prices, according to recent data. This marks a slight improvement, offering some relief to consumers as the cost of living remains a key concern nationwide.

A recent Reuters poll indicates that Canada’s growing recession risk could prompt the Bank of Canada to implement at least two additional interest rate cuts this year. Economic concerns are mounting as policymakers seek to stabilize the slowing economy.

Argentina’s recent overhaul of its foreign exchange regime has sparked widespread speculation about the future of the peso. As the government aims to stabilize the currency amid soaring inflation, analysts are closely watching how these changes influence economic recovery.

In “Opinion | Argentina Needs the Dollar More Than Ever,” the Wall Street Journal explores the nation‚Äôs escalating economic crisis, highlighting the urgent need for dollarization. As inflation spirals, many Argentines seek stability through the U.S. currency.

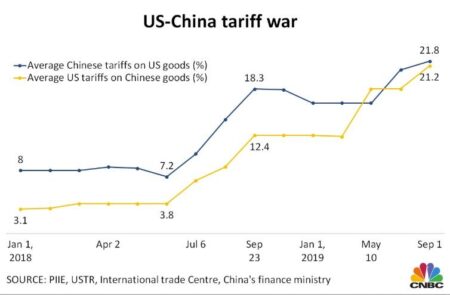

As the U.S.-China tariff war intensifies, Canadian consumers may face rising online shopping prices. Experts warn that increased tariffs on Chinese goods could lead to higher costs for retailers, which might be passed on to Canadian shoppers.

Japan’s government is contemplating cash handouts to help citizens cope with escalating living costs and the impact of U.S. tariffs. The proposed measures aim to alleviate financial pressure on households amid growing economic uncertainties.

Tens of thousands across Spain took to the streets in a massive protest against the escalating housing crisis. Demonstrators demanded affordable housing solutions, highlighting the urgent need for government action to address soaring rents and homelessness.

In a bold move, former President Donald Trump has threatened to impose an additional 50% tariff on Chinese imports, potentially driving total tariffs beyond the 100% mark. This escalation raises concerns about the impact on U.S.-China trade relations and global markets.

Japan’s real wages fell for the second consecutive month in February, signaling growing financial pressures on households as inflation continues to outpace earnings. This trend raises concerns over consumer spending and overall economic stability.

The UK’s FTSE 100 experienced its largest daily decline since the onset of the pandemic, driven by renewed concerns over Trump’s tariffs. Market analysts warn that the tariffs could disrupt global trade and economic recovery efforts.