U.S. officials, led by Bessent, are actively negotiating a $20 billion aid package with Argentina aimed at strengthening economic stability and fueling vital reforms during ongoing financial challenges, The Wall Street Journal reports

Browsing: international finance

Finance Minister seals a groundbreaking bilateral debt restructuring agreement with the United Kingdom, set to ease repayment terms and strengthen economic ties. This transformative deal offers crucial fiscal relief, opening the door to a more resilient and prosperous financial future

U.S. Treasury Secretary signals potential financial aid for Argentina as it faces economic hurdles, emphasizing a strong commitment to collaborate on stabilizing the nation’s debt and accelerating its recovery, The Wall Street Journal reports

The US has extended a vital financial lifeline to Argentina’s far-right presidential contender, Javier Milei, showcasing robust support amid the nation’s escalating economic turmoil. This bold move aims to stabilize the markets as Argentina nears its critical elections

Exclusive: Jefferies is strengthening its partnership with Japan’s Sumitomo Mitsui Financial Group, paving the way for an ambitious expansion throughout Asia. This bold alliance underscores the growing synergy between leading Western and Japanese financial giants

The U.S. will share profits with Tokyo from Japan-funded projects until the entire $550 billion investment is fully recouped, Lutnick reveals. This landmark deal marks a bold new chapter in the economic partnership between the two countries, CNBC reports

Kenya is poised for a surge in economic growth in 2025, fueled by a significant yen-denominated loan secured from Japan, Reuters reports. This vital funding will drive major infrastructure and development initiatives, strengthening the dynamic partnership between the two countries like never before

The IMF has eased Argentina’s reserves accumulation targets, signaling a more flexible stance ahead of the crucial review following October’s local elections. This shift arrives as the nation grapples with persistent economic hurdles and political uncertainties

The IMF has raised India’s growth forecast for 2024 to an impressive 6.4%, spotlighting strong domestic demand and a resilient economy, Reuters reports. This upbeat revision points to a more promising future despite persistent global challenges

China is accelerating its drive to transform the renminbi into a global powerhouse, expanding its influence across international trade and finance. This ambitious move aims to challenge the dominance of the US dollar and boost China’s economic impact worldwide

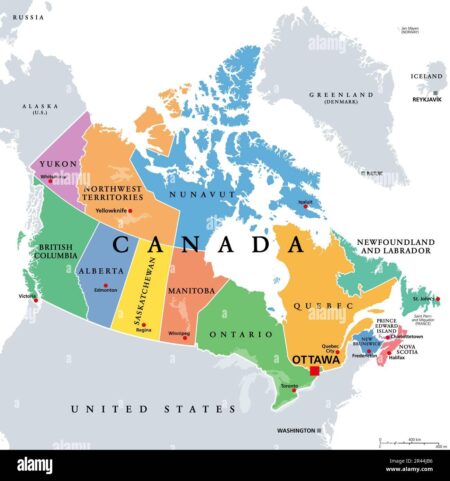

Canada has just unleashed a massive US$1.7 billion from frozen Russian assets to fuel Ukraine’s fight, delivering vital support to Kyiv amid ongoing conflict. This bold move highlights the growing global determination to strengthen Ukraine’s defense and help rebuild its future

Argentina, often dubbed the IMF’s wild child, has missed its foreign exchange reserve targets but is on the brink of securing a vital waiver. This crucial move aims to propel debt relief talks forward, providing a much-needed lifeline to ease mounting financial pressures

China is gearing up to turbocharge the yuan’s global reach with an exciting new operations centre, unveiled by the People’s Bank of China. This ambitious move aims to boost the currency’s international clout and speed up cross-border transactions like never before

The IMF has applauded Argentina’s recent reform efforts, calling them a promising sign as the much-anticipated visit at the end of June approaches. These bold moves showcase the country’s strong commitment to meeting the vital economic targets set out in the bailout agreement

UK Finance Minister Bridget Phillipson is gearing up to meet China’s Vice Premier during her London visit, aiming to strengthen economic ties and unlock exciting new opportunities in bilateral trade, Reuters reports

Brazil has just secured an impressive $2.75 billion in its second dollar bond offering of 2025, Reuters reports. This robust demand reflects a surge in investor confidence, as the country’s credit default swaps (CDS) have fallen to their lowest level in a year, signaling optimism about Brazil’s financial future

The International Monetary Fund is urging Germany to take bold action by rolling out reforms that will turbocharge productivity and ignite fresh investment. By championing innovation and creating a more flexible labor market, Germany can unleash sustained economic growth and cement its status as Europe’s economic powerhouse

Former U.S. President Trump’s recent remarks have ignited fresh concerns about the safety of Germany’s gold reserves held in New York, sparking intense debates over repatriation and the protection of overseas assets, Reuters reports

India is gearing up to champion international financial measures targeting Pakistan, as revealed by a reliable source. This strategic move underscores the rising tensions between the two nations, with India actively seeking global backing to tackle pressing issues related to terrorism financing.

In a bold move, Brazil has scrapped its contentious offshore tax on investment funds after facing intense pushback from investors. This pivotal decision is set to rejuvenate confidence in the financial sector and draw in foreign capital, signaling a transformative shift in the government’s fiscal strategy.