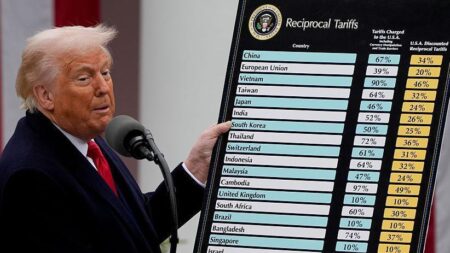

In a groundbreaking move, former President Donald Trump has unveiled an exciting new trade agreement with Japan aimed at boosting economic ties and tearing down trade barriers. Stay tuned for the full details, coming soon!

Browsing: international trade

Trump’s tariff threat against Brazil has unexpectedly propelled Lula’s popularity, igniting a wave of nationalist support rallying behind him. Meanwhile, Bolsonaro is on the back foot, grappling with growing criticism over his handling of trade relations amid rising economic tensions

India and the UK are on the brink of sealing a groundbreaking free trade agreement during Prime Minister Modi’s visit, set to dramatically cut tariffs on beloved products such as whisky and garments. This exciting deal is poised to turbocharge bilateral trade and deepen economic ties, Reuters reports

Japan’s new trade deal, emerging amid Trump’s tariff regime, has surprisingly delighted markets, analysts reveal. This breakthrough not only cools tensions but also unlocks thrilling trade opportunities, signaling a bright and promising new chapter in U.S.-Japan economic relations

A surprise trade deal with Japan has sparked a wave of excitement across the globe, igniting hopes for wider and more powerful economic alliances. This unexpected agreement signals major changes on the horizon for regional trade dynamics

Japan’s top tariff negotiator recently sat down with former President Donald Trump at the White House, Asahi reports. Their conversation focused on easing trade tensions and exploring solutions to the ongoing tariff disputes between the two nations

Brazil has admitted that sealing a trade deal with the United States by the August 1 deadline may not be possible, Reuters reports. Officials stress that talks are ongoing, with significant issues still up in the air

The US trade team is gearing up for an exciting visit to India this August, launching a pivotal round of talks aimed at securing a landmark trade deal. These high-stakes discussions will dive into key issues, including the tariffs implemented during the Trump administration

An orange juice importer warns that tariffs imposed by Trump on Brazilian imports could drive U.S. prices up, potentially raising costs for consumers and disrupting the market, Bloomberg reports

Canadian Prime Minister Carney has reignited trade discussions with the US after Canada decided to withdraw its controversial tech tax. This bold move aims to ease tensions and accelerate progress in bilateral trade talks – AP News

Argentina is inviting businesses to join an exciting trade mission to Morocco, aimed at discovering vibrant growth opportunities, expanding bilateral trade, and deepening the economic partnership between the two countries

Former President Donald Trump has kicked off a bold investigation into Brazil’s trade practices, calling them “unfair.” This move zeroes in on barriers blocking U.S. exports, ramping up the trade tensions between the two nations

China is intensifying its push to rein in the yuan’s surge, a daring move designed to protect its export advantage amid a storm of global economic uncertainties, reports the Council on Foreign Relations

Brazil is intensifying its push to resolve the ongoing US tariff dispute ahead of a crucial deadline, driven by a strong commitment to protect key exports and boost trade relations, sources told Reuters

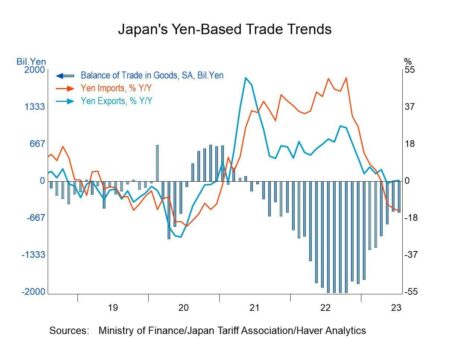

Japan’s exports plunged dramatically after new US tariffs targeted key goods, igniting concerns of a global trade slowdown. This steep drop deepens fears of an impending recession amid escalating trade tensions, Bloomberg reports

Tensions are soaring as the US and Canada clash over lumber tariffs, shaking up trade and housing markets on both sides. At the core of this heated dispute are fierce battles over pricing and supply fairness, deepening diplomatic strains between these longtime neighbors

India’s exports to the US have soared dramatically, catapulting America to the top spot as the biggest buyer of Indian electronics, seafood, and apparel, reports the Times of India. This remarkable growth highlights the strengthening trade ties between the two nations

The Trump administration has launched a high-stakes trade investigation into Brazil, shining a spotlight on concerns over unfair practices and their potential impact on U.S. industries. This decisive action marks a significant escalation in the growing trade tensions between the two nations

China’s commerce minister recently met with Nvidia’s CEO to explore thrilling opportunities for boosting foreign investment and deepening collaboration in artificial intelligence. This high-stakes meeting seeks to supercharge tech partnerships amid intensifying global competition, Yahoo reports

President Trump has unleashed a bombshell threat to slap an eye-popping 35% tariff on Canadian goods-potentially doubling the fees compared to other countries-and intensifying the trade showdown between the U.S. and Canada, CNN reports