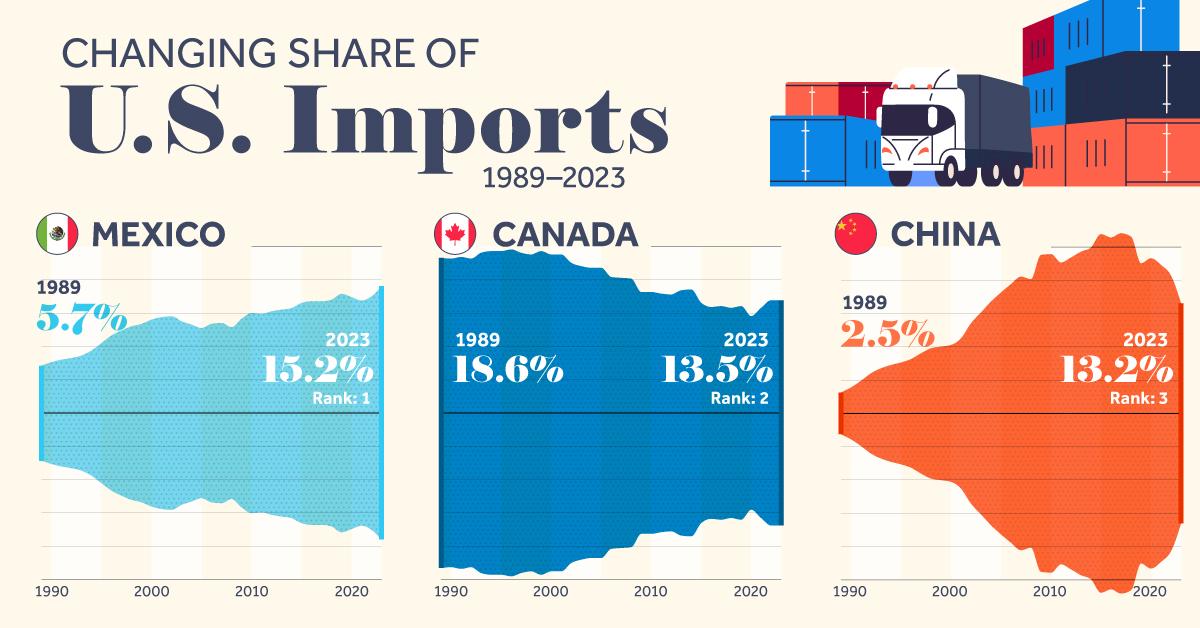

In recent months, the narrative surrounding U.S. imports from China has painted a picture of significant decline, prompting concerns about the implications for trade relationships and the broader economy. However, a closer examination of the data reveals a more nuanced reality. According to a recent analysis by Liberty Street Economics, the actual decrease in imports from China may not be as pronounced as official statistics suggest. This discrepancy raises critical questions about the accuracy of trade metrics and the factors influencing import patterns. As policymakers and economists grapple with these findings, understanding the intricacies behind the numbers becomes essential to navigating the evolving landscape of U.S.-China trade relations. In this article, we delve into the analytical work by Liberty Street Economics, exploring the methodologies employed and the broader implications of their conclusions.

Understanding the Discrepancy in U.S.Import Data from China

The recent analysis of U.S. import statistics reveals a noteworthy divergence between reported data and the actual decline in imports from China. While the trade figures suggest a significant slump, a more granular examination indicates that the decrease might not be as pronounced as initially reported. Contributing factors to this discrepancy include:

- Reporting Lag: Variations in data collection timelines can lead to transient anomalies in import statistics.

- Valuation Fluctuations: Changes in the valuation of goods and shifts in currency exchange rates complicate the interpretation of volume versus value.

- Substitution Effects: Some importers may be sourcing products from alternative markets, affecting the comparative data.

Furthermore, discrepancies can arise from differences in how data is categorized and reported between agencies.A close look at how tariffs and trade policies impact importer decisions unveils underlying trends that often go unnoticed. The following table illustrates key factors influencing trade data accuracy:

| Factor | Impact on Data |

|---|---|

| Import Volume | May not directly correlate with dollar value due to price variations. |

| Tariffs | Possibly increase costs, leading to reduced quantities reported. |

| Supply Chain Adjustments | Shifts in sourcing can alter expected trade patterns. |

Analyzing the Impact of Trade Policy on Import Volumes

The assessment of trade policy shifts is critical in understanding their tangible effects on import volumes. Recent data suggests that while headline figures indicate a significant dip in U.S. imports from China, the reality beneath these numbers paints a more nuanced picture. Factors that contribute to this discrepancy include cross-border trade dynamics, logistical challenges, and evolving consumer preferences. Additionally,tariff structures and trade agreements play a pivotal role in shaping these figures. It’s essential to consider the broader economic context, including inflationary pressures and supply chain disruptions, which can affect both the quantity and value of imports.

To grasp the full impact of trade policy,it’s beneficial to look at key elements influencing the import landscape:

- Tariffs and Duties: Adjustments in imposed tariffs can considerably alter purchasing decisions for businesses.

- Compliance Costs: Increased regulatory compliance may deter smaller importers from engaging with Chinese manufacturers.

- Consumer Shifts: Changing consumer preferences towards domestic or alternative sources can disrupt previous import trends.

moreover, a table summarizing the year-on-year import volume changes can aid in visualizing these complex interactions:

| Year | Import Volume (in billions) | Year-on-Year Change (%) |

|---|---|---|

| 2020 | 450 | -2% |

| 2021 | 420 | -7% |

| 2022 | 380 | -10% |

| 2023 | 400 | 5% |

Exploring the Economic Implications of Stabilizing Import Trends

As trade dynamics evolve, understanding the nuances of import trends becomes crucial for economic forecasting. The recent data suggests that while the volume of imports may have dropped, the implications are multifaceted. Stabilizing import trends can lead to a more predictable economic landscape, impacting everything from consumer prices to domestic production. notably, industries reliant on imported goods face both challenges and opportunities that merit attention.

Among the most significant economic implications are variations in supply chain logistics and local employment rates. A stabilization may result in a more competitive domestic market, as local manufacturers can capitalize on reduced reliance on foreign goods. Likewise, businesses may reevaluate their sourcing strategies, promoting a shift towards local suppliers. The following factors highlight potential outcomes of stabilizing import trends:

- Supply Chain Resilience: A lesser dependency on imports could foster more robust local supply chains.

- Price Stability: Reduced volatility in import prices may lead to greater predictability for consumers.

- Job Creation: An uptick in domestic production frequently enough correlates with increased job opportunities.

| Year | U.S. Imports from china (in billion $) | Percentage Change |

|---|---|---|

| 2021 | 450 | – |

| 2022 | 415 | -7.78% |

| 2023 | 400 | -3.61% |

the ongoing evaluation of import behaviour reveals essential insights into the health of the U.S. economy. Policymakers and businesses alike must consider these trends and the resultant shifts in the economic landscape, emphasizing the need for adaptive strategies to harness the benefits brought about by a stabilized import environment.

Recommendations for Future Trade strategies and Data Analytics

As U.S. imports from China exhibit a more complex trend than suggested by raw data, businesses must adopt agile trade strategies that account for evolving market conditions. Implementing real-time analytics can provide deeper insights into the fluctuating demand and supply dynamics, thereby refining forecasting accuracy. Companies shoudl consider leveraging tools like Machine Learning and Artificial Intelligence to analyze historic import patterns alongside current economic indicators, enabling them to adjust their procurement strategies proactively. By focusing on supply chain openness, firms can identify potential bottlenecks and mitigate risks associated with unexpected shifts in trade volumes.

Moreover, collaboration with trade economists and data scientists will enhance the robustness of trade-related decision-making. Organizations may benefit from building cross-functional teams that combine expertise from various domains. This should include dashboards that visualize trade data, allowing swift changes based on reliable metrics.Key considerations for future strategies include:

- Adopting flexible sourcing strategies to diversify supply chains.

- Investing in predictive analytics to anticipate market shifts.

- Fostering partnerships with tech firms specializing in data analytics.

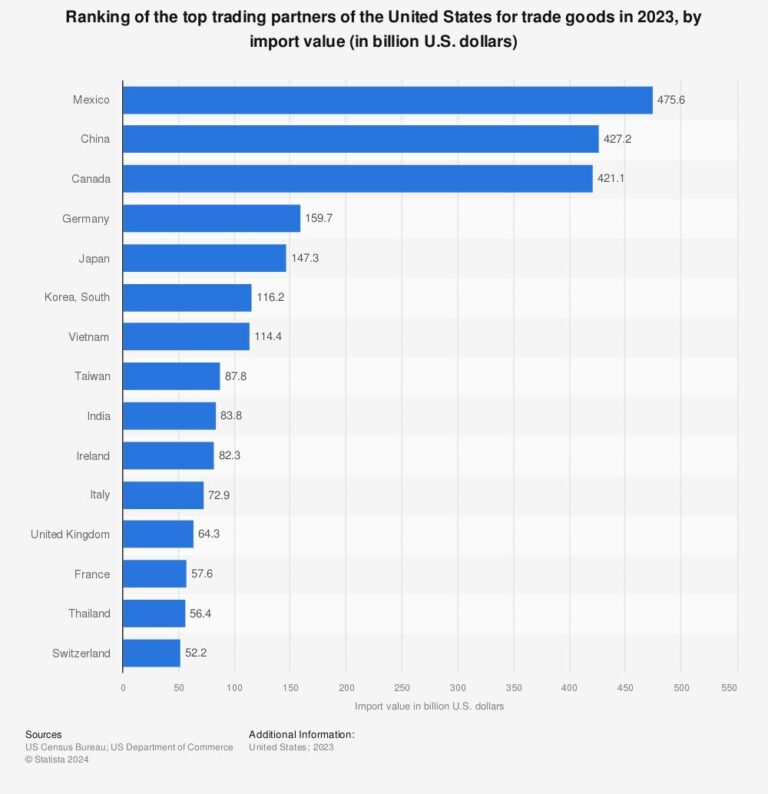

Below is a simple depiction of U.S. imports from China over the past few years:

| Year | Import Value (Billion USD) | Growth Rate (%) |

|---|---|---|

| 2021 | 450 | 5 |

| 2022 | 430 | -4.4 |

| 2023 | 410 | -4.7 |

In Conclusion

the recent analysis from Liberty Street Economics sheds light on the complexities surrounding U.S. imports from China, revealing that the decline in import figures may not be as pronounced as official data suggests.As policymakers and economists assess the shifting dynamics of U.S.-China trade relations, it is crucial to interpret these numbers with caution. The nuanced understanding of this economic relationship underscores the importance of comprehensive data analysis in guiding decision-making and strategic planning. As both nations navigate the challenges of a rapidly changing global economic landscape, closer scrutiny of trade statistics will be essential for stakeholders aiming to adapt and thrive amidst uncertainty.