Former President Trump announced that the U.S. and China have struck a groundbreaking trade deal, igniting a powerful rally in Chinese stock markets. This landmark agreement marks a major step forward in easing years of economic tensions between the two global powers

Browsing: U.S. economy

Exclusive: Treasury Secretary tells “Pod Force One” that China’s 30% share of global manufacturing is “too high” and warns it “can’t go any higher,” underscoring rising U.S. concerns over supply chain dependence, the New York Post reports

Trump’s latest trade deal with China throws a spotlight on a persistent U.S. challenge: limited leverage in negotiations. Despite new agreements, experts caution that the fundamental structural issues in the trade relationship remain stubbornly unresolved

TACO trade” is a memorable Trump-era term for tariffs aimed at turbocharging American manufacturing and protecting domestic jobs. This bold trade strategy sparked spirited debates about its impact on the economy and global relations throughout his administration

The appeals court has upheld crucial Trump-era tariffs on China, sending ripples through Apple and global markets alike. This ruling brought a wave of relief to investors, propelling the S&P 500 higher as trade tensions begin to ease

New tariffs aimed at revitalizing American manufacturing are unexpectedly pushing businesses to seek opportunities in Canada. Companies are highlighting the allure of lower production costs and more favorable trade conditions as major reasons for their move, posing a significant challenge to U.S. policy objectives.

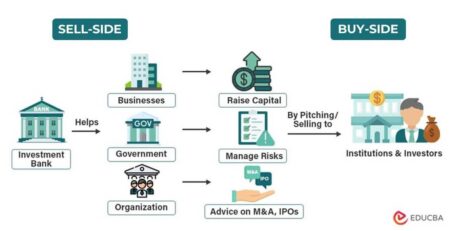

Investment banks are buzzing with optimism as they have upgraded their growth forecasts for China, thanks to an unexpected trade deal with the U.S. This landmark agreement is set to invigorate economic confidence and enhance trade flows, hinting at a promising recovery in bilateral relations and paving the way for greater market stability.

As conversations heat up, the U.S. and U.K. are moving closer to sealing a robust trade deal. Central to these discussions are tariffs, digital trade, and agricultural standards—critical elements that both nations are eager to enhance in order to fortify their economic partnership in the wake of Brexit.

France has raised a red flag, cautioning that dismissing Federal Reserve Chair Jerome Powell could spell trouble for the U.S. dollar and shake up the economy. French economic officials warn that this drastic step might undermine market confidence and trigger financial upheaval.

America’s wine industry is grappling with significant hurdles as global tariffs tighten their grip on profits. In a bold retaliatory action, Canada has slapped extra duties on U.S. wines, intensifying a crisis that puts small vineyards and the entire sector at risk.

In response to plummeting stock markets and escalating trade tensions, former President Donald Trump asserted that his tariff policies “WILL NEVER CHANGE.” This statement comes amid increased scrutiny from China, which is adjusting its strategies in light of U.S. tariffs.

U.S. farmers and ocean carriers warn of the nation’s unpreparedness in facing an economic war against China’s dominance in containership production. With China’s shipping capacity growing, concerns mount over the competitive strain on American industries.

In a recent address, former President Donald Trump highlighted April 2 as “Liberation Day,” signaling the launch of a new round of tariffs. This announcement comes amidst ongoing trade tensions and aims to reshape economic strategies. Live updates will follow.

Recent analyses from Liberty Street Economics reveal that the decline in U.S. imports from China may not be as significant as official data suggests. The discrepancy highlights the complexities of trade metrics and their impact on economic assessments.

In a bold economic move, former President Trump announced plans to impose tariffs on Mexico and Canada starting March 4, alongside an additional 10% tariff on imports from China. This decision aims to combat the ongoing fentanyl crisis impacting the U.S.