As March 2025 approaches, investors are eyeing top UK dividend stocks for reliable income. Companies such as BP, Unilever, and GlaxoSmithKline stand out, offering attractive yields and stability amid market fluctuations. Consider these options for a robust portfolio.

Browsing: investment strategies

In the ever-evolving landscape of investment, small-cap stocks often offer hidden potential. This article explores three promising UK-based small-cap stocks that could become undiscovered gems, attracting savvy investors seeking growth opportunities.

In a rare meeting with global CEOs, Chinese President Xi Jinping urged leaders to defend international trade against rising protectionism. Xi emphasized collaboration, signaling China’s commitment to open markets amid escalating economic tensions worldwide.

UK stocks remained largely unchanged amid ongoing concerns over tariffs, prompting a cautious approach from investors. As trade tensions escalate, market participants are closely monitoring developments that could impact economic stability.

Oil prices remain steady as market participants monitor rising demand from China amid ongoing geopolitical tensions. This delicate balance between supply concerns and economic recovery signals a pivotal moment for energy markets.

U.K. stocks closed lower today, with the Investing.com United Kingdom 100 index declining by 1.25%. The downturn reflects broader market concerns amid economic uncertainty, prompting investors to reassess their strategies as volatility persists.

Blackstone Group has announced its acquisition of a 40% stake in Indian real estate firm Kolte-Patil Developers for $134 million. This strategic investment underscores Blackstone’s ongoing commitment to the expanding Indian property market.

U.K. stocks closed higher as the trading session wrapped up, with the Investing.com United Kingdom 100 index advancing by 0.02%. Investors remained cautious, reflecting broader economic concerns while seeking growth opportunities in key sectors.

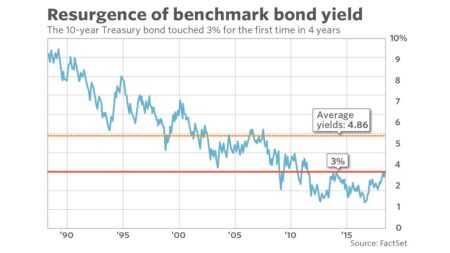

Germany’s recent spending plans have sparked concerns in global markets, leading to a decline in the 10-year Treasury note and the dollar. Analysts fear increased fiscal stimulus in Europe could draw investment away from U.S. assets, heightening volatility.

As trade tensions escalate under Trump’s tariff threats, Brazil’s bond market emerges as a potential haven for investors. With attractive yields and relative stability, it offers a compelling alternative amidst global economic uncertainty.

Amidst economic uncertainties, Germany’s Finance Minister Christian Merz has initiated a fiscal awakening aimed at revitalizing the nation’s economy. His strategic policies may steer Germany back on track, fostering growth and stability in the Eurozone.

In a recent statement, Bessent urged Canada to adopt a stance similar to Mexico’s regarding tariffs on Chinese imports. He emphasized the need for a unified approach to address competitive imbalances and protect national interests in trade.

If the U.S. withdraws from the World Bank, the China-led Asian Infrastructure Investment Bank (AIIB) could fill the void. As nations seek alternative funding sources, AIIB’s collaborative model may reshape global finance and enhance international cooperation.