Lululemon’s strategic sourcing and production practices position it to sidestep potential tariffs from Trump’s trade policies, while Canada Goose, reliant on U.S.-manufactured materials, may face rising costs. The differing approaches highlight contrasting challenges in today’s trade landscape.

Browsing: market analysis

As trade tensions escalate under Trump’s tariff threats, Brazil’s bond market emerges as a potential haven for investors. With attractive yields and relative stability, it offers a compelling alternative amidst global economic uncertainty.

India may avoid the Trump administration’s tariffs set to begin on April 2, according to sources. Negotiations are ongoing, focusing on trade imbalances and tariffs on Indian goods, potentially allowing for exemptions or reduced rates.

Japan’s bike rental market for tourism is set for significant growth, projected to reach $27.90 million by 2033 with a robust 15.41% CAGR. This surge highlights the rise of cycling as a preferred mode of exploration for travelers in the nation.

In light of recent statements by Lutnick, speculation is mounting around a potential tariff deal between Canada and Mexico. Market analysts will keenly monitor financial markets for reactions, particularly in sectors heavily reliant on cross-border trade.

Eurasia Mining, a UK-based resource company, is gaining attention for its growth potential amid rising commodity prices. Alongside this, two other penny stocks show promise, reflecting investor optimism in the UK’s emerging market landscape.

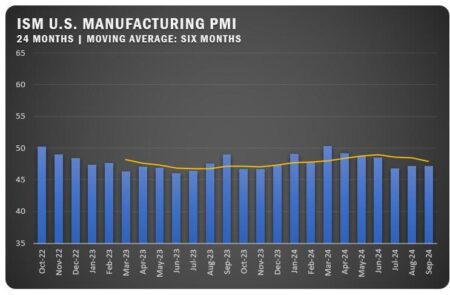

Italy’s manufacturing PMI for February came in at 47.4, exceeding expectations of 46.8, indicating a slight improvement in economic activity. Despite remaining below the critical 50 threshold, this uptick suggests resilience in the sector amidst ongoing challenges.

Recent analyses from Liberty Street Economics reveal that the decline in U.S. imports from China may not be as significant as official data suggests. The discrepancy highlights the complexities of trade metrics and their impact on economic assessments.

In a recent statement, Bessent urged Canada to adopt a stance similar to Mexico’s regarding tariffs on Chinese imports. He emphasized the need for a unified approach to address competitive imbalances and protect national interests in trade.

Argentina’s economic analysts are expressing renewed optimism regarding inflation and growth projections for 2025. Recent assessments indicate a potential stabilization in the economy, suggesting improving conditions following years of volatility.

Argentina’s Economy Minister Javier Milei will review Telefonica’s $1.25 billion sale of its local operations, as part of a broader strategy to reassess foreign investments. This move underscores the administration’s focus on economic sovereignty and regulatory scrutiny.

India’s Nifty Index has recorded its longest monthly losing streak since 1996, signaling a concerning trend for investors. Meanwhile, midcap stocks have confirmed a bear market, reflecting broader economic challenges as market volatility continues to rise.

Brazil’s Ambev reported a higher profit for Q4, driven by strong sales growth in its beverage portfolio. However, the company anticipates market volatility ahead, citing economic uncertainties that could impact consumer behavior and operational performance.

Japan’s Nikkei index fell to a four-month low, driven by concerns over the U.S. economic outlook and a strengthening yen. Investors are wary of potential impacts on export competitiveness, prompting a cautious approach in the market.

In a significant move, Telefonica has secured a $1.25 billion deal with Telecom Argentina, marking a pivotal moment in the telecommunications sector. This agreement, amidst the backdrop of Milei’s economic reforms, aims to enhance service capabilities and expand market presence.

Warren Buffett highlighted his confidence in U.S. stock holdings during a recent investment overview while also expressing optimism about his ventures in Japan. The billionaire’s insights reflect a strategic approach amid global economic fluctuations.

India’s GDP growth is projected to have rebounded in the October-December quarter, fueled by increased government spending, according to a Reuters poll. Analysts expect this fiscal boost to enhance economic resilience amid global challenges.

Australia’s Consumer Price Index (CPI) inflation held steady at 2.5% year-on-year in January, slightly below the expected 2.6%. This stability suggests a controlled inflation environment, providing insight into the nation’s economic health moving forward.

Argentina’s monthly inflation rate slowed in January to its lowest level in over four years, providing a glimmer of hope for an economy plagued by soaring prices. Analysts view this development as a potential turning point amid ongoing economic challenges.

UK services inflation has unexpectedly declined, offering a positive signal for the Bank of England as it navigates economic challenges. This shift may ease pressure on policymakers, potentially influencing future interest rate decisions.