An exciting new ruling from an Australian court has paved the way for a staggering $640 million in potential Bitcoin tax refunds! This landmark decision signals a major transformation in how cryptocurrencies are taxed, sparking intriguing discussions about future regulations and what this means for investors moving forward.

Browsing: taxation

Germany has made a significant revision to its tax revenue forecasts, dramatically cutting estimates for 2029 by more than 80 billion euros. This substantial downward adjustment highlights the persistent economic challenges the country faces, including escalating costs and uncertainty in global markets, which are all taking a toll on fiscal planning

Samsung is challenging a hefty $520 million tax demand from Indian authorities, asserting that its business practices are in line with those of its competitor, Reliance Industries. This case underscores the escalating tensions between multinational corporations and India’s tax regulations.

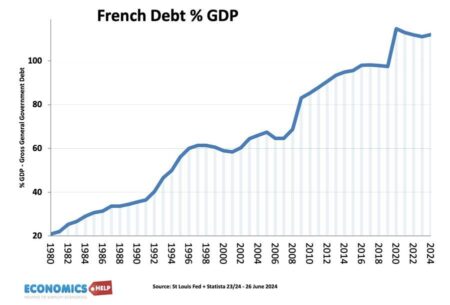

In a bold move, a recent proposal in France aims to scrap the 10% tax allowance for retirees, a change that could significantly affect the financial well-being of countless seniors. Supporters of the measure argue that it promotes fairness within the tax system, but critics warn it could add further strain on retirees who are already grappling with escalating living expenses.

Brazil has taken a significant step by raising its income tax exemption threshold, now in sync with the recent hike in the minimum wage. This strategic move is designed to ease the financial burden on lower-income households, showcasing the government’s commitment to enhancing economic support for its citizens.

In a recent meeting with Spain’s economy minister, the U.S. passionately urged Spain to ramp up its defense spending and take a fresh look at the contentious ‚ÄėGoogle tax‚Äô. This appeal highlights the pressing issues surrounding global security and the evolving landscape of digital economy policies

In a significant escalation of trade tensions, China has announced retaliatory tariffs on U.S. goods, raising duties to 125%. This move comes amid a declining dollar, signaling increased economic friction between the two nations. Continue following for live updates.

Germany has officially formed a new government, unveiling plans to reduce corporate taxes as part of its economic strategy. The move aims to boost investment and competitiveness amid global economic challenges, signaling a shift in fiscal policy.

France has identified digital services as a key target in the EU’s tariff response to U.S. trade policies. This move reflects rising tensions over tax structures and digital market regulations, signaling a strategic shift in Europe’s trade negotiations.

Canada has officially canceled its proposed increase in the capital gains tax, a decision met with mixed reactions. Critics argued it could stifle investment, while supporters claimed it was necessary for equitable taxation. The government aims to focus on economic stability.

Germany has reached a landmark agreement on a fiscal package that includes significant changes to its debt brake policy. This reform aims to enhance budget flexibility while ensuring fiscal stability, addressing both economic challenges and future investments.

Brazil’s Finance Minister has revised the estimated costs of a proposed tax exemption, lowering it to $4.75 billion. This adjustment aims to alleviate concerns over fiscal impact while stimulating economic growth, according to Reuters Canada.

Brazil is set to implement a new tax on overseas profits and high incomes as part of a strategy to balance a larger tax exemption. This move aims to enhance fiscal stability while addressing income inequality, according to sources close to the government.

The European Union has initiated legal action against Spain, accusing the country of implementing discriminatory tax policies that unfairly target non-residents. This move highlights ongoing tensions regarding tax equity within the bloc.

Spain has emerged as a ‘tax trap’ for British expats, with many reporting financial devastation due to unexpectedly high property taxes and complex regulations. Dozens claim their lives have been ruined as they navigate a web of bureaucracy and unforeseen expenses.

Shah Rukh Khan has emerged victorious in his ongoing tax dispute, as a tribunal ruled in his favor. The decision underscores the actor’s stance against tax claims, signaling a significant win in his legal battles. Details on the implications are still unfolding.

French Economy Minister Bruno Le Maire has proposed the introduction of a tax on the wealthy to support the nation’s military expansion efforts. This initiative aims to bolster France‚Äôs defense capabilities amid increasing geopolitical tensions in Europe.

In recent years, Spain has emerged as a ‚Äėtax trap‚Äô for British expats, as stringent fiscal policies and evolving regulations lead to unexpected financial burdens. Brits must navigate complex tax laws, risking hefty penalties and diminished retirement savings.

Brazil is considering the reduction of its ethanol import tax, a move reportedly aimed at fostering closer ties with the U.S. under President Trump. This potential policy shift reflects ongoing discussions about trade relations and energy cooperation.

Former President Trump announced that tariffs on imports from Canada and Mexico will proceed, indicating potential for additional taxes in the future. The announcement underscores ongoing trade tensions as negotiations continue between the nations.