Understanding the Recent Surge in UK Inflation: Implications and Insights

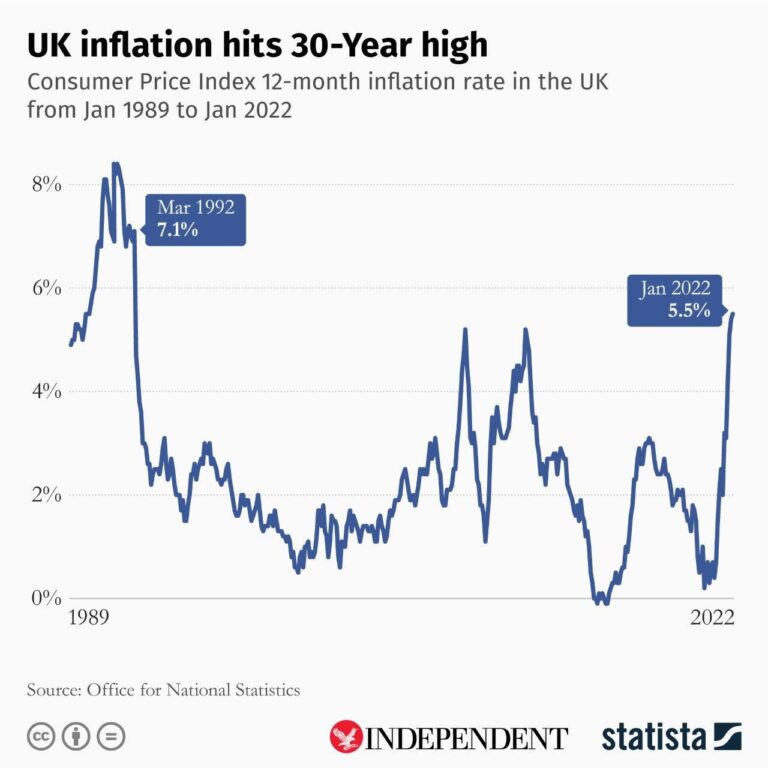

In recent times, the United Kingdom has experienced a troubling increase in inflation rates, igniting discussions among economists, government officials, and everyday consumers. As prices escalate at an unprecedented pace, the financial burden on families and businesses is becoming more evident. This article explores the complexities of the current inflation scenario in the UK, analyzing how swiftly prices are rising, identifying key factors behind this trend, and assessing its impact on ordinary citizens. With living costs dominating public conversations, grasping inflation’s trajectory is more critical than ever. Join us as we break down recent statistics and forecasts to provide a thorough understanding of what lies ahead for the nation’s economy.

Impact of Inflation on Household Finances

The most recent statistics regarding inflation trends in the UK highlight important pressure on household budgets. With price increases across various sectors—especially essentials—families are facing challenges as costs for food readiness, energy consumption, and transportation outstrip wage growth significantly. Recent analyses show a sharp rise in prices for basic necessities that have forced many households to tighten their budgets considerably.

- Energy Costs: Volatile global energy markets have led to soaring electricity and gas bills that weigh heavily on consumers.

- Food Prices: Disruptions within agricultural supply chains have caused essential food items to become increasingly expensive.

- Transportation Costs: Rising petrol prices alongside increased public transport fares have made commuting financially burdensome for many families.

The ongoing rise in inflation has prompted households to modify their spending habits significantly. Many are now prioritizing necessary expenses over discretionary purchases—a shift that reverberates through various economic sectors. The table below illustrates year-over-year price changes across key categories:

| Category | % Change in Price |

|---|---|

| Energy | +35% |

| Food | +20% |

| Transport |

+15% As policymakers focus intently on managing inflationary pressures , it’s crucial for households to remain proactive with their budgeting approaches . Keeping an eye on price fluctuations will be vital for families striving to maintain financial stability during these unpredictable economic times . Key Factors Driving Price Increases of Essential GoodsThe escalating inflation rate within the UK has emerged as a significant concern , particularly with essential goods experiencing ample price hikes . A primary contributor to this phenomenon issupply chain disruptions , which continue to be aggravated by global events . Labor shortages coupled with shipping delays hinder retailers’ ability  to keep adequate stock levels , resulting in higher consumer prices . Furthermore ,energy expenses have surged dramatically , affecting production costs across numerous essential goods . Consequently , manufacturers are compelled to transfer these increased costs onto consumers , further exacerbating inflationary trends .  Another influential factor driving up prices isa shift in consumer demand . As spending patterns evolve post-pandemic ,certain categories of essential products see heightened demand leading directly into rising costs . The pandemic’s lingering effects have shifted shopping behaviors towards hygiene products and cleaning supplies specifically.Additionally,government policies related  to imports or tariffs can also influence pricing dynamics by impacting how much goods cost when they enter local markets. Practical Strategies for Consumers Facing Rising CostsWith ongoing impacts from rising inflation affecting purchasing power nationwide; individuals must adopt strategic measures aimed at alleviating some financial strain associated with increasing expenses. One effective strategy involves reviewing personal budgets regularly ; tracking expenditures helps identify areas where cuts may be possible such as evaluating subscriptions or reducing non-essential purchases while opting instead toward budget-friendly alternatives when dining out or grocery shopping. Moreover; taking advantage seasonal sales along discounts can significantly ease some burdens associated with inflated pricing structures too! A second vital tactic includes prioritizing necessary purchases while exploring bulk-buy options whenever feasible ; focusing primarily upon acquiring vital items ensures preparedness against future spikes while stockpiling non-perishable goods during favorable pricing periods proves prudent! Additionally utilizing comparison websites allows shoppers access best deals available amongst multiple retailers enhancing overall savings potential long-term through loyalty programs designed specifically reward frequent customers ! Conclusion: Navigating uncertain Economic Waters Ahead!The current path taken by UK’s fluctuating rates highlights an intricate economic landscape characterized by widespread increases across diverse sectors including essentials like groceries fuel etc.. As families contend daily challenges posed due elevated living conditions implications stemming from these pressures extend far beyond individual households requiring careful navigation from policymakers who must balance stability needs against growing burdens placed upon citizens alike moving forward into uncertain territory ahead! Staying informed remains paramount both individuals businesses alike throughout this evolving situation ensuring readiness adaptively respond effectively amidst changing circumstances surrounding ongoing battle against persistent high levels seen recently ! |