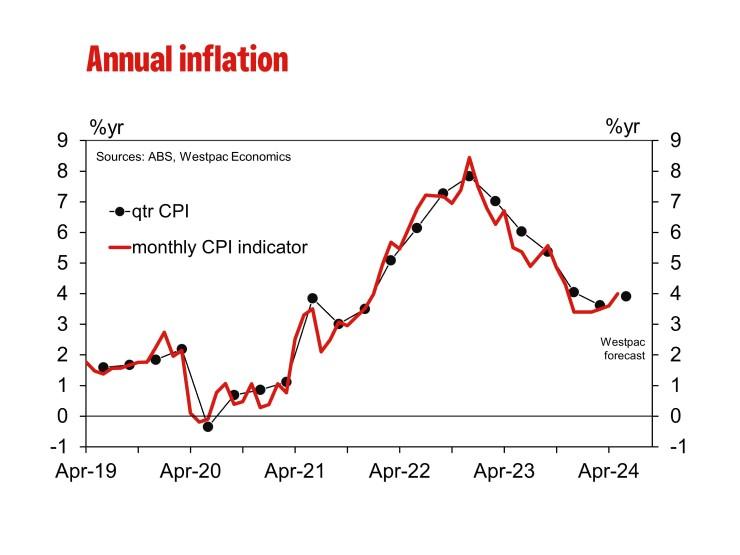

Australia’s consumer price inflation eased more than anticipated in May, offering a welcome sign of cooling price pressures in the world’s 14th-largest economy. Data released on Wednesday showed the Consumer Price Index (CPI) rose at a slower pace compared to previous months, rekindling investor speculation that the Reserve Bank of Australia (RBA) may consider cutting interest rates in the near future to support economic growth. The unexpected moderation in inflation comes amid global concerns over persistent cost increases and adds a new dimension to the nation’s monetary policy outlook.

Australia CPI Inflation Declines Sharply in May Signaling Easing Price Pressures

Australia’s consumer price index (CPI) showed a more pronounced slowdown in May, easing concerns over persistent inflationary pressures. The month-over-month increase fell short of analysts’ expectations, driven mainly by softer housing costs and subdued energy prices. This sharper-than-anticipated deceleration has reinvigorated market speculation around potential Reserve Bank of Australia (RBA) rate cuts in the coming months, as inflationary risks appear to be diminishing.

Key factors contributing to the decline in inflation include:

- Housing and rents: Increased supply and moderated demand tempered price hikes.

- Fuel prices: A downturn in global oil prices alleviated transportation costs.

- Food costs: Stable agricultural outputs helped keep grocery prices in check.

| Month | CPI % Change (MoM) | Inflation Rate (YoY) |

|---|---|---|

| April | 0.6% | 5.1% |

| May | 0.3% | 4.7% |

Market Reacts to Soft Inflation Data with Renewed Optimism for Interest Rate Cuts

The latest figures reveal a surprising easing in Australia’s Consumer Price Index (CPI) for May, signaling a significant cooling in inflationary pressures. This has sparked a wave of renewed optimism among investors and economists alike, as the data suggests that the Reserve Bank of Australia (RBA) may be more inclined to consider interest rate cuts in the near future. Market participants have quickly adjusted their expectations, pricing in lower odds of further tightening measures and raising hopes for a more accommodative monetary policy stance ahead.

Key market reactions include:

- Equities: Australian stocks gained momentum, especially in rate-sensitive sectors like banking and real estate.

- Bond Yields: Government bond yields slipped, reflecting increased demand for fixed income amid expectations of lower interest rates.

- Currency Impact: The Australian dollar weakened slightly against major currencies as traders recalibrated risk outlooks.

| Indicator | Actual | Forecast | Previous |

|---|---|---|---|

| May CPI (YoY) | 4.5% | 4.8% | 5.0% |

| Core Inflation (YoY) | 3.8% | 4.0% | 3.9% |

Analysts Recommend Monitoring Wage Growth and Consumer Spending Trends for Future Policy Moves

Market analysts emphasize the importance of closely tracking wage growth and consumer spending as key indicators for future monetary policy adjustments. While inflation figures have eased more than anticipated, persistent strength in wages could signal underlying inflationary pressures that may deter the Reserve Bank from easing rates too quickly. Conversely, a slowdown in consumer spending might reinforce the case for additional stimulus to support economic momentum.

Key factors to watch include:

- Wage growth trends: Accelerating wages can fuel demand-driven inflation, challenging the inflation cooling observed in the CPI data.

- Consumer spending behavior: Shifts in household expenditures often reflect confidence levels and disposable income, influencing overall economic health.

- Labor market dynamics: Employment rates and job openings provide insight into the pressure on wages and spending capacity.

| Indicator | Current Trend | Implication |

|---|---|---|

| Wage Growth | Moderate uptick | Potential inflation risk |

| Consumer Spending | Slowdown in retail sales | Weaker economic momentum |

| Employment | Stable with slight gains | Steady labor market support |

Closing Remarks

As Australia’s Consumer Price Index inflation cools more than anticipated in May, market expectations for an interest rate cut have strengthened, offering a hopeful signal for investors and policymakers alike. While the central bank remains cautious amid ongoing global economic uncertainties, the latest data injects renewed optimism that monetary easing could be on the horizon. Investors will continue to monitor forthcoming economic indicators and central bank commentary closely, as the trajectory of inflation remains a key factor shaping Australia’s financial landscape in the months ahead.